One of my many shorts right now is Micron Technology. It has a squeaky clean price gap at 45.91 so my stop-loss order is just above that level.

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

A Dreadful Denouement

You’ve probably heard the news that Bill Cosby, who is in his eighties, is going to get thrown into state prison. When I heard this, I instantly thought of my childhood, because I grew up with the Fat Albert and the Cosby Kids. Every Saturday morning, I would watch kids’ programming from 8 a.m. until 11 a.m. (which is when the uninteresting stuff like Soul Train came on……….), and one of my favorite shows was this one:

It was, for me and a lot of the kids in suburban Louisiana, a very positive exposure to a world we knew nothing about (notwithstanding the fact that the clubhouse in the show was nestled in a giant mountain of garbage and human waste). Anyway, it’s just sad for everyone involved……….and brings a whole new meaning to “Bill’s gonna show you a thing or two.” We live in very strange times, my friends.

The Idealized Path

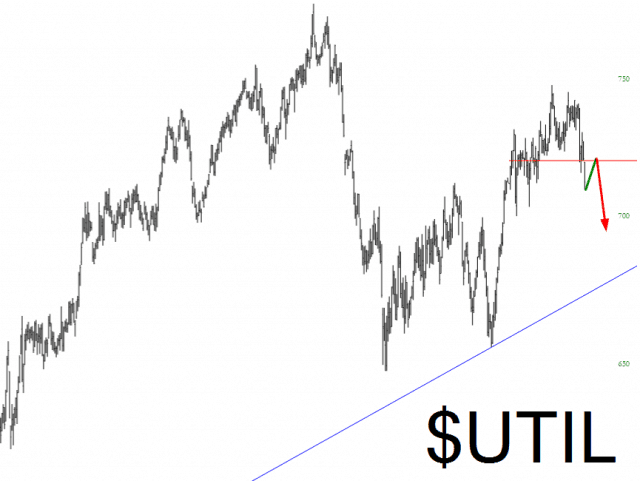

I am admittedly talking my book here (or, more specifically, my lack of book, since I am out of my XLU puts and want to get in at a better price), but I’ve speculated below as to some idealized paths for the utility index and bonds (TLT) for the balance of the week. Tomorrow, Wednesday, is “Fed Day”, and that’s bound to thrown some shock waves around.

Babble Book Write-Up

It was nice to see a write-up about my newest book in the latest issue of Technical Analysis magazine. You can click here to learn more about it.

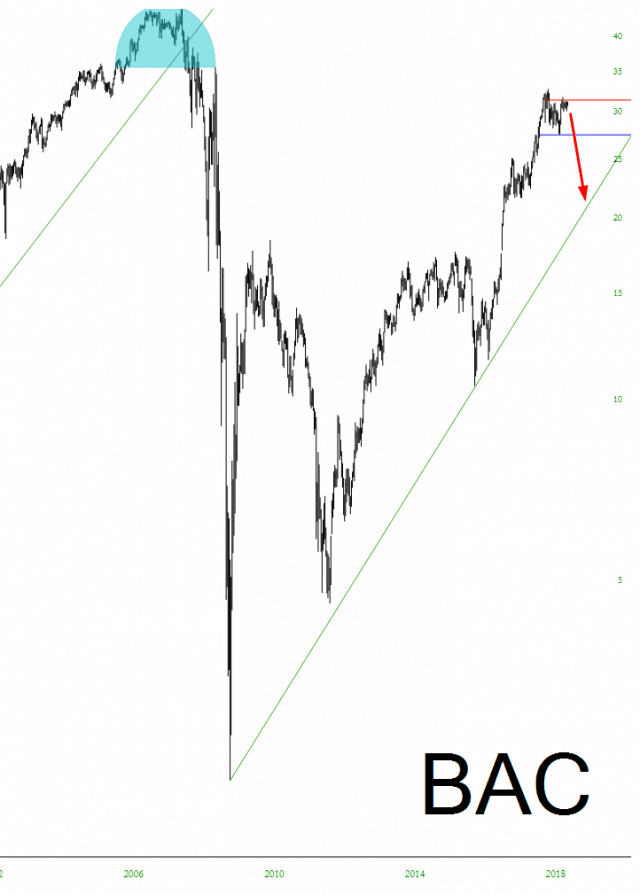

Three Big “B” Banks

It’s been a fairly mellow day so far (how excited can one get about an ES which is down 0.02%?) But I’m pleased with my short positions. Here are three financial stocks, all beginning with the letter “B” (which is an even more effective method than using Elliott Wave) and some suggested paths.