Once again, after a tiny, tiny dip in the market, everybody’s talking about a push higher. S&P 3000 is offered as a foregone conclusion. Indeed, even to this poor old bear, I can see an argument to be made for a bounce at current levels:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

BABA Follows Negative Technical Path

On August 22, when BABA reported strong earnings, I noted to members that “lousy technical price action” saw the initial 4% gain in reaction to the news give way to a 5% downside reversal.

I wrote: “The interesting aspect of the downside reversal is that the intraday high smacked into key resistance at the June-Aug resistance line AND the horizontal 200 DMA, both in the vicinity of 186.60. This is very negative technical action, and indicates to me that all of the action in BABA from the 8/15 low at 165.39 to today’s high at 186.50 represents a completed recovery bounce, and the initiation of a new downleg that should break the 165.39 low, which could unleash a very powerful decline towards 130-125. Last is 174.35/50.”

Fast-forward to Monday and today (September 10 and 11), and we see on my big-picture chart of BABA that it has broken down to a new reaction low at 152.85 so far, continuing last week’s decline that sliced below a MAJOR year-long support zone at 164.25 to 166.60 (indicated in our 8/22 discussion). (more…)

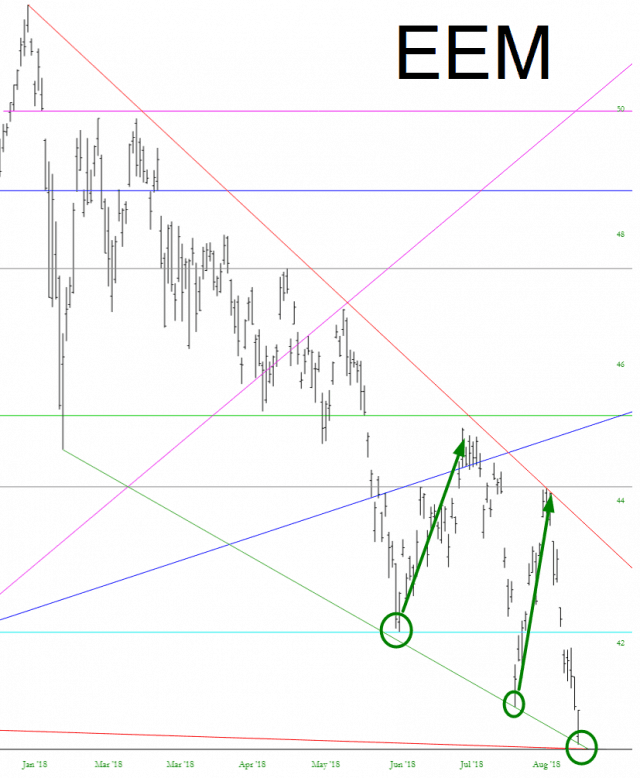

Looking For A Retracement Low

Since I was writing on Friday the bull flag megaphone has broken up, a rising wedge formed on ES into yesterday’s high and then that wedge broke down with the obvious target at a retest of the retracement low. So far however this has delivered higher lows on SPX and ES, and ES is again testing key resistance at the weekly pivot at 2884. On a break and conversion of WP the obvious read would be that the next leg up has started, although ………

Partial Premarket Video from theartofchart.net – Update on ES, NQ:

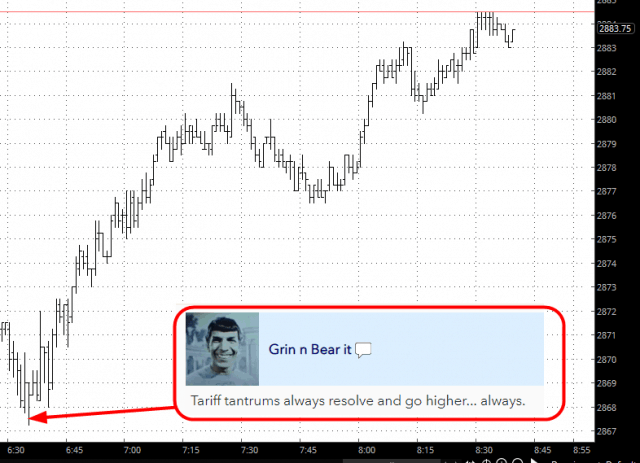

Grinning and Bearing

Looks like our man Spock was spot-on!

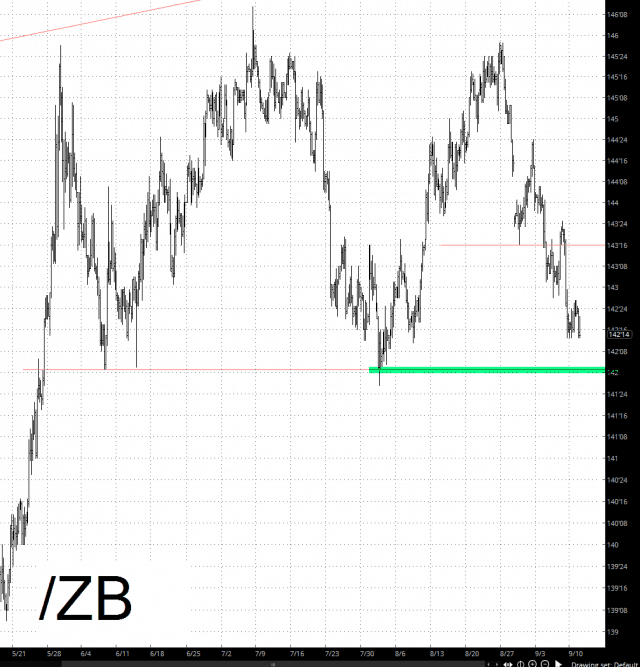

The 42 That Matters

The number “42” had resonance in the financial world a month ago when Elon “I think I’ll ruin one of the world’s greatest reputations” Musk declared that Tesla was going private at $420. Multiple lawsuits and one SEC investigation later, such chatter has of course vanished. Four Two Zero is moot.

For me, the far more important figure is ONE Four Two. Specifically, the support level of bonds (How’s that for a segue?) Break it, and the world is our oyster.