I’m going to start this important post off with three specific things you can do to support Slope and all the hard work and engineering dollars that go into it:

- Don’t block the ads: this costs you nothing. If you’re using an ad blocker, please permit ads to show up on Slope. Do it now. Please. I’ll wait.

- Click the ads: If you see an ad that is even mildly interesting, give it a click. Particularly if you see one of those tastyworks ads and want to try out their brokerage.

- Become a premium member: This is the granddaddy of them all. The vast majority of Slope features are behind the “walled garden” of premium memberships. Our Gold and Diamond members in particular keep the good ship Slope sailing and improving.

Now, on with what I’ve got to say.

Being Bearish Blows.

Sure, there are occasions now and then when it’s cool to be the only one on the planet making money (and doing so really, really fast), but 95% of the time, it’s better to line up with the rest of humanity on All Asset Appreciation, since that’s kind of how the world ticks.

I have been ever-so-slowly morphing Slope from “a bearish blog” to more of a trader’s toolkit. I see this in sort of three phases over time:

- Slope the Blog: this was 2005 through 2016. It was just blog posts. And, naturally, given the editorial nature of the place, we were little more than the same kind of “doom porn” venue that ZeroHedge is to this day. So this is what I would call our “heavy bias” period.

- SlopeCharts: Charts, in and of themselves, are agnostic with respect to market direction. By creating a charting platform and making it such a big focus on the site, I was able to move us away from just “a bearish blog” to something more universal. Over the course of 2017 and 2018, other products and pages were introduced, such as SlopeMatrix, the Reaction Graph, and the earnings calendars. I would call this our “semi-biased” period.

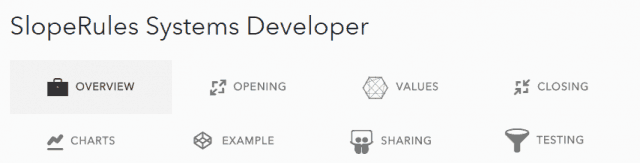

- SlopeRules: Unlike charts – – whose interpretation is in the eye of the beholder – – SlopeRules is more of a cold, calculating, mathematical tool which is not subject to interpretation. The results of a ruleset are either true or false. There is either a trade triggered or there isn’t. At long last, Slope has been able to emerged as a place that can be presented as “bias-free.”

In my private communications with Market Sniper, I shared with him a personal ulterior motive with the creation of SlopeRules was to give me something of my own creation which will tell me in cold, steely-eyed terms about market direction. In other words, to give myself a mechanism to judge the market on more neutral terms as opposed to find-me-something-that-is-falling.

The way I operate here on Slope is pretty straightforward: what you use, I focus on more. If you use SlopeRules and send me ideas, it’s going to get attention and development hours. If you don’t, it won’t.

It’s all too easy for me to just crank out post after post, as I did for most of Slope’s early history. If you would like to see, as I do, Slope to continue to create powerful but bias-free tools, I strongly encourage you to learn them and make use of them so we can continue to move away from our history as a bear’s lair to one meant instead for traders who want to use cutting-edge tools to make profits. The best place to start is right here. Create the rules. Then publish them for others. That’s how we get this rolling.