I am very pleased to let you know of some important improvements to SlopeRules. A few of them are important, but cosmetic, changes, whereas one is kind of a big deal.

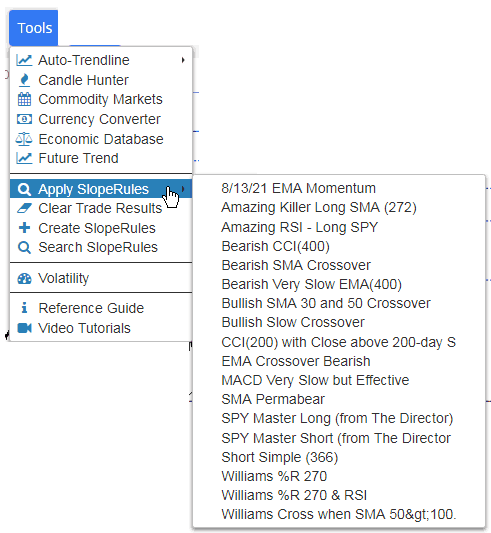

First of all, I have sought to make SlopeRules‘ presence in SlopeCharts more visible, so I’ve moved the menu items up a level so they aren’t quite so “buried”.

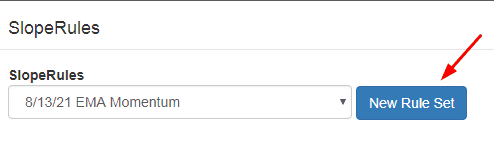

It always bugged me that we put the creation of a New Rule Set into the dropdown. It was just……….weird. And wrong. And it irked me every time. So we’ve redeemed ourselves by busting it out of the dropdown and putting this function into a button, as God originally intended.

Likewise, the insertion of New Value into a dropdown was just plain dumb. Thus, you’ll see a new hyperlink called Define New Value which does the same thing. In short, I’m much happier with the interface now, because it’s more sensible and intuitive.

So let’s turn our attention to the “big deal” part of this announcement.

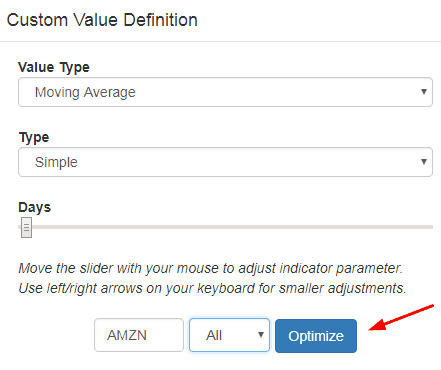

When you create a new value – – that is, a “rule” – – for SlopeRules, you may or may not have an idea what parameter to use. For instance, when you go to create a moving average parameter, you probably do like most people and use some nice, round number that you’ve seen before, like 50, 100, or 200. If you’re anything like me, what you’re doing is basically taking a wild guess.

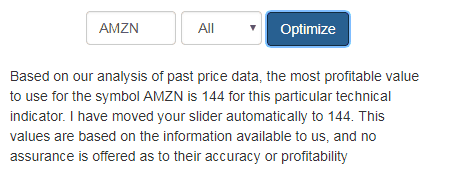

We’ve brought something new to this by doing the “thinking” for you in advance. We’re starting off with a baby step, but it’s an important one: now you can get the optimal value for a simple moving average or an exponential moving average just by clicking the Optimize button.

To be clear, the data set now is confined to the symbols of the S&P 100, but in short order we’ll be expanding that to……….everything. But we wanted to get this out there and see how people reacted in case there were any “course corrections” we wanted to take.

Although the symbol entry will default to whatever symbol is on your chart, you can change the symbol used for optimization to be anything. For instance, I’ve changed it to AMZN (from SPY, since that is not a part of the S&P 100 for purposes of this example). The default dropdown is “All”, which means both long and short trades. After I click it, I am told that the optimal value to use for this moving average is 144 (which, let’s face it, I would have never guessed).

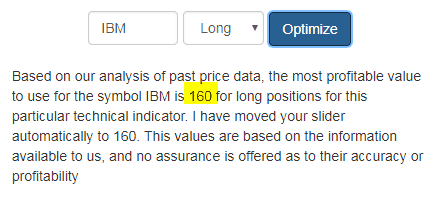

Changing the symbol to IBM and the type of trade to a Long……..

………I get a different result……..

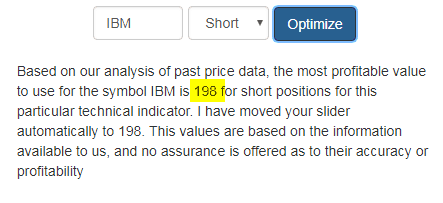

And optimizing it for short sales changes it once more.

Assuming people like this new feature, we’re going to be building it out across two obvious dimensions:

- All the equity symbols, not just the S&P 100;

- More technical indicators, not just moving averages.

So please dive into SlopeRules, try out Optimize, and tell me what you think!