The market has been going pretty much vertical since Friday, and today’s rally is a little mysterious. As far as I can tell, there’s no news – – none – – to explain the push higher (unless one thinks that President’s declaration that he’d be OK doing away with “spring forward/fall back” every year is bullish).

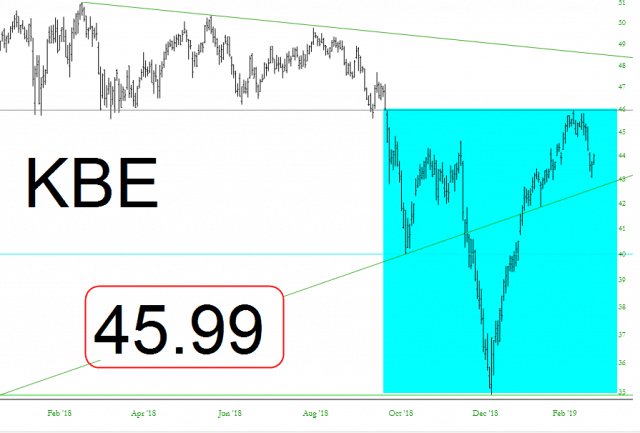

I think it’s useful to maintain a bit of paranoia about what could happen. Let’s focus on financials. I’d say there are two important lines in the sand to watch with the ETFs below. The first, the S&P bank ETF symbol KBE, has a neckline at 45.99 (if you’re having any trouble making out the tiny digits I’ve put on the chart below). That neckline constitutes the completion of an inverted H&S pattern which, in that instance, would send the price flying toward the green trendline.

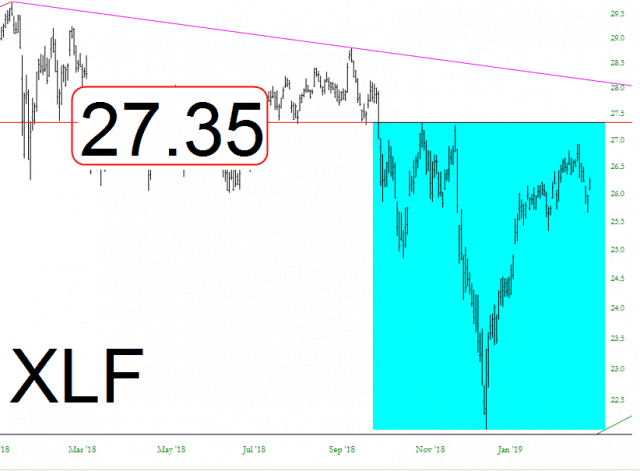

The other level is 27.35 on the big XLF fund. Personally, I think this bounce is going to run out of steam before even last week’s highs are taken out, but like I said before, it’s useful to stay a bit paranoid about prospective sea-changes.