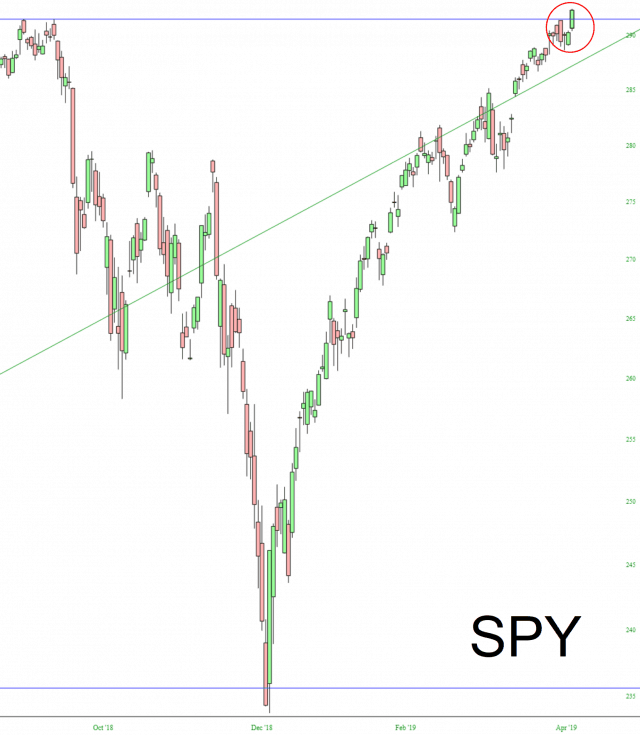

Well, they finally did it. On an adjusted basis (that is, adjusted for dividends, which I think is the only proper way to do it), the SPY has broken out to a lifetime high.

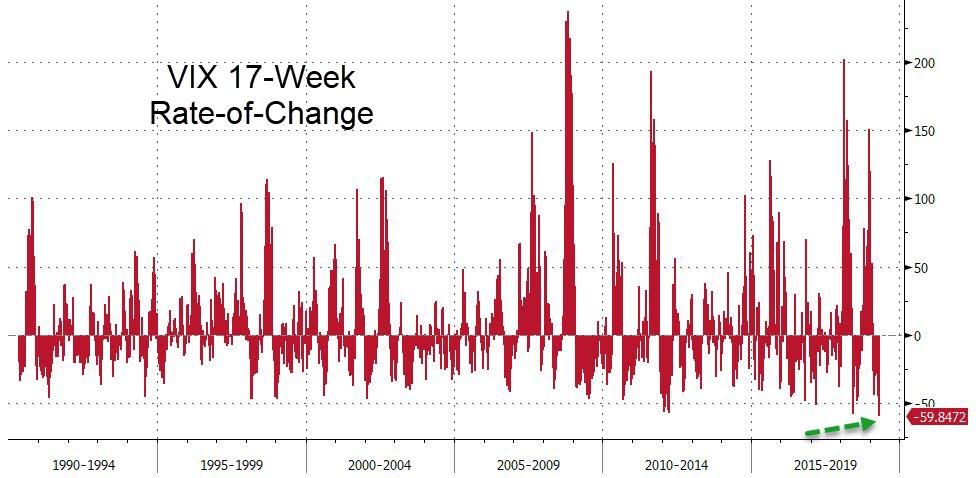

Accompanied, as pointed out by ZeroHedge, with the fastest plunge in volatility in market history.

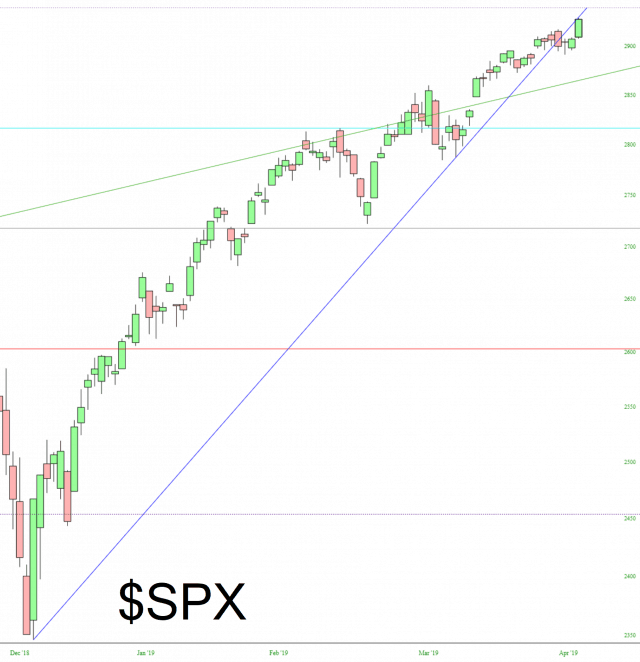

The cash index itself has not (yet) broken to lifetime highs. We’ll certainly see that event slathered all over the press when it does happen. As a side note, the uptrend from December 26th was broken, but I’m not sure at this point if it makes one whit of difference.

The small caps are roaring higher at twice the pace of the S&P, although the damage there is more substantial. I would also point out that, unlike the S&P 500, the small caps are far, far away from their own lifetime highs. A cross above that green tinted zone, however, would ensure many more months of buying.