There are a lot of things I like about ZeroHedge (I read it multiple times a day), but I’ve got a few gripes. First, their comments section, as some of you know, is a brutal cesspool. Second, on occasions when there are data spikes in a feed (thus producing a corresponding huge spike in a chart), they will write up a “WTF??” article about it as if it was real, even though it isn’t.

But perhaps what bugs me most of all is this kind of thing:

Those two articles appeared this morning in quick succession. To the untrained eye, it would seem that crude oil and the Dow were both in a bloody free fall (hint: they are not).

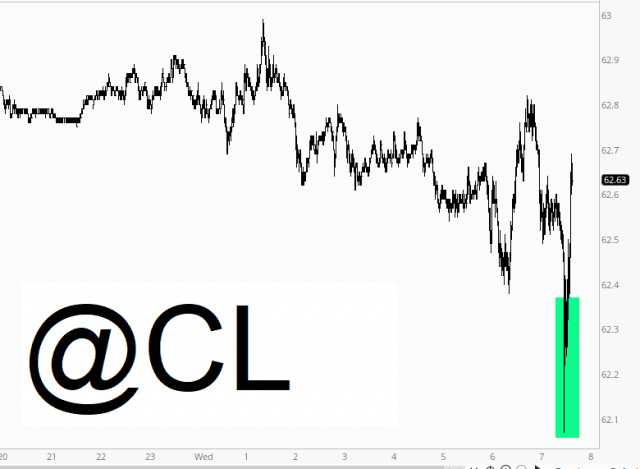

Here’s crude oil, for instance. Yeah, it was down for a few moments, but if the chaps at ZH would take time to grab a cup of tea and then return to their keyboard, they would see that there’s really no “key support’ failure to write about. It was just a minute or two blip. Nothing more.

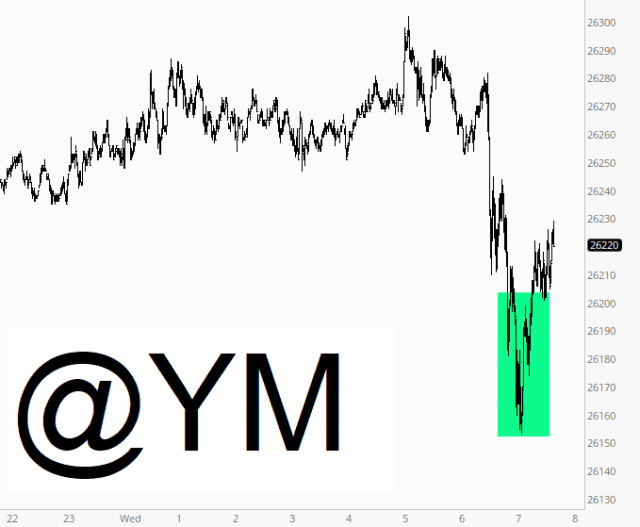

The same can be said for equities, but even moreso. As I am typing this, the Dow is up triple digits. And yet, based on a quick drop down and nothing more, ZH writes up a “dump into red” and how it “erases trade hype ramp”.

This sort of thing happens all too regularly. I mean, listen, I, of all people, know how desperate one might be to latch on to some kind of bad news and say, “See? See? I told you so!” But if the ES is up 20 and then for a few moments is only up 15, there’s seriously nothing to crow about.