Over the long Easter weekend, I wanted to share a few excerpts from my financial history book, Panic, Progress, and Prosperity. Here’s today’s piece:

The growth of the middle class and the availability of the car also created a land boom peculiar to American history – that of Florida. Between 1920 and 1925, the population of the state grew from 968,470 to 1,263,540, and most of this was prompted by an urgent desire to acquire property that was believed to be an almost sure-fire certain investment.

In the end, it would be discovered that Florida was not perfect, and that between the heat, mosquitoes, and hurricanes, Florida had problems just like anywhere else in the country. But to a nation relatively naïve about the potential paradise in the panhandle, the allure of a tropical splendor in the continental U.S. was too much to resist.

In 1921, the frenzy for land acquisition began to gather steam, and by 1922, the Miami Herald was the heaviest newspaper in the country, since it was bulging with advertisements for land that was being sold. Countless stories began dotting newspapers in the rest of the country, recounting tales of quick, easy profits being enjoyed by regular folks who were willing to take the risk.

The towns and cities in Florida sought to grow their own populations (and tax bases) by attracting the newcomers, so bonds were floated at lofty interest rates to raise the money needed to build out the facilities and infrastructure of Florida’s communities. The state, too, understood the benefit of a rapidly-growing population, and in 1924 it eliminated state income tax, inheritance taxes, and took on a pro-construction, pro-business attitude, all of which fit nicely within the spirit of the decade.

The growing army of realtors in Florida off-loaded the task of seeking and signing up sales prospects to “binder boys”, who were typically young men and women that would stand post at any given real estate development, ready to take a deposit on a parcel of land.

This deposit – or “binder” – would let a speculator secure a parcel for which he be required to fully finance thirty days later. In a way, these “binders” acted somewhat like options contracts, since aggressive speculators could secure a property at a given price with a relatively small down payment and, hopefully, sell their rights to purchase the property before the month was over at a handsome profit.

After a few years of steadily advancing prices, the value of properties began to reach absurd levels. One old man had spent his life savings of $1,700 early in the boom on a piece of property in Pinellas county, and his sons, fearing for his mental state, had him committed to a sanitarium. Once the property reached $300,000 in value (over 175 times the purchase price), the man’s lawyer got him released so he could sue his own children.

By early 1925, some members of the press began to question the sanity of their fellow countrymen in bidding up the prices of what was in some cases little better than swampland. Forbes magazine published a deeply-skeptical article about the frenzy, and speculators who had been enjoying a brisk business flipping properties (similar to what their descendents would do in 2004-2006 in certain parts of the United States) suddenly found a dearth of buyers.

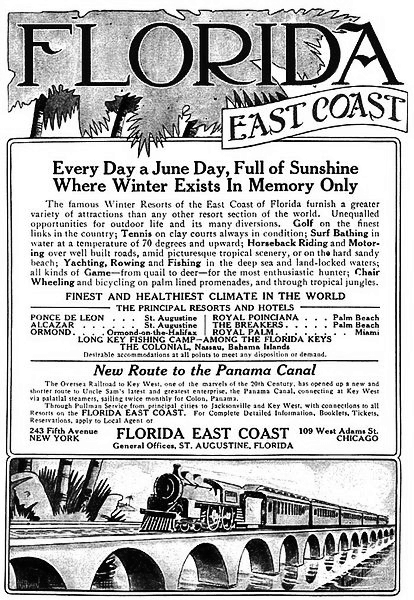

On top of this, the railroads that had been hauling down mountains of construction materials to the rapidly-growing state had grown weary of the bottlenecks and headaches from the ceaseless press of rail traffic into the state, so they formed an embargo. Starting in October 1925, the Seaboard Air Line, Florida East Coast Railway, and Atlantic Coast Railroad would only ship food, fuel, and perishables to the state. The flow of building materials was choked off at once.

The next disaster to befall Florida land speculation was the Prinz Valdemar, a 241-foot boat that sank in the mouth of the Miami harbor, thus blocking access to the one alternative route vendors had to get their wares to the state.

Later the same year, in September, a hurricane hit South Florida with winds over 125 miles per hour. As news reports spread throughout the country of the kinds of natural disasters that could befall residents of the state, the magical allure of Florida fell away, and land prices continued their descent, causing damage to prices that would take decades to repair.

In spite of the boom-and-bust of the Florida real estate frenzy, the urge for quick profits was not gone for the rest of the nation, and a growing interest in the stock market was not hampered by the relatively confined catastrophe of the panhandle state. Much like the Internet boom of 1995, stocks of new technology companies like Radio Corporation of America caught the imagination of the public, and prices were bid up with increasing volume and accelerating prices.

The amount of leverage available to the small speculator was much larger in the 1920s than it is today, with some issues requiring as little as 10% of the purchase price fronted in cash. A more insidious reason for the appreciation in stock prices was the widespread use of the stock “pool”. The way a stock pool would work was similar to how “shills” function at an auction: a body of individuals agrees in advance to target a particular stock. They buy the stock in the open market, purchasing up larger and larger blocks.

As the ownership of the stock in a pool reaches a predetermined size, the members within the pool began buying and selling the stock with each other at higher and higher prices, drawing attention from those outside the pool at the unusual activity of the stock.

Members of the public would notice the surging volume and steadily-rising price of the stock and assume something important and positive was happening beneath the surface and join in the bidding. The rising price would feed on itself, and once the price seemed to be reaching a speculative spike, the pool operators would dump their shares on an unsuspecting public at prices that were, in reality, far out of alignment with intrinsic value.

As constructive as business fundamentals were for most of the 1920s, cracks were beginning to appear in the façade as early as 1928, but those fissures would not be recognized until it was much too late. As we shall see in the next chapter, the country was about to experience a hurricane far worse than those suffered in Florida across its financial landscape. And this disaster would commence when the nation seemed the least vulnerable to any kind of financial worries.