The force is strong with the bear side.

After a terrific May for team Tim Knight (he’s no longer the last bear standing…), June brings a VERY high probability Summer opening meal for the bears.

And it comes from America’s favorite smartphone maker… Apple.

Yes, the company our beloved bear leader used to work for has an extremely impressive track record when it comes to the sell-side to kick-off June. I wrote about it last year here on Slope.

And here’s the result from 2018

Why you ask? It’s $AAPL Worldwide Developers’ Conference (WWDC), which this year takes place from June 3rd through the 7th. You can click here to get a quick read from Wired about what to expect.

Since 2005, $AAPL closed EVERY WEEK RED except for one. That’s a 13-1 win record for the bears. The only exception took place in 2014 when the seven-for-one stock split took place shortly after WWDC.

Bears should salivate seeing the following stats on WWDC week:

- 2005 (June 6-10)

a. Open: 5.48

b. Close: 5.12

c. Week’s High-to-Low: 5.52-5.07 (Range equals to -8.1% of high of week)

d. Percent change from week’s open to close: -6.57%

- 2006 (August 7-11)

a. Open: 9.68

b. Close: 9.09

c. Week’s High-to-Low: 9.94-8.94 (Range equals -10.06% of high of week)

d. Percent change from week’s open to close: -6.09%

- 2007 (June 11-15)

a. Open: 18.00

b. Close: 17.21

c. Week’s High-to-Low: 18.02-16.49 (Range equals -8.49% of high of week)

d. Percent change from week’s open to close: -4.39%

- 2008 (June 9-13)

a. Open: 26.40

b. Close: 24.62

c. Week’s High-to-Low: 26.68-23.62 (Range equals -11.47% of high of week)

d. Percent change from week’s open to close: -6.74%

- 2009 (June 8-12)

a. Open: 20.55

b. Close: 19.57

c. Week’s High-to-Low: 20.65-19.43 (Range equals -5.91% of high of week)

d. Percent change from week’s open to close: -4.77%

- 2010 (June 7-11)

a. Open: 36.90

b. Close: 36.22

c. Week’s High-to-Low: 37.02-34.60 (Range equals -6.54% of high of week)

d. Percent change from week’s open to close: -1.84%

- 2011 (June 6-10)

a. Open: 49.39

b. Close: 46.56

c. Week’s High-to-Low: 49.58-46.50 (Range equals -6.21% of high of week)

d. Percent change from week’s open to close: -5.73%

- 2012 (June 11-15)

a. Open: 83.96

b. Close: 82.02

c. Week’s High-to-Low: 84.07-80.96 (Range equals -3.70% of high of week)

d. Percent change from week’s open to close: -2.31%

- 2013 (June 10-14)

a. Open: 63.53

b. Close: 61.44

c. Week’s High-to-Low: 64.15-61.21 (Range equals -4.58% of high of week)

d. Percent change from week’s open to close: -3.29%

**10. 2014 (June 2-6)

a. Open: 90.57

b. Close: 92.22

c. Week’s High-to-Low: 93.04-88.93 (Range equals +4.42% of high of week)

d. Percent change from week’s open to close: +1.82%

- 2015 (June 8-12)

a. Open: 128.94

b. Close: 127.17

c. Week’s High-to-Low: 130.18-125.62 (Range equals -3.50% of high of week)

d. Percent change from week’s open to close: -1.37%

- 2016 (June 13-17)

a. Open: 98.69

b. Close: 95.33

c. Week’s High-to-Low: 99.12-95.30 (Range equals -3.85% of high of week)

d. Percent change from week’s open to close: -3.40%

- 2017 (June 5-9)

a. Open: 154.34

b. Close: 148.98

c. Week’s High-to-Low: 155.98-146.02 (Range equals -6.38% of high of week)

d. Percent change from week’s open to close: -3.47%

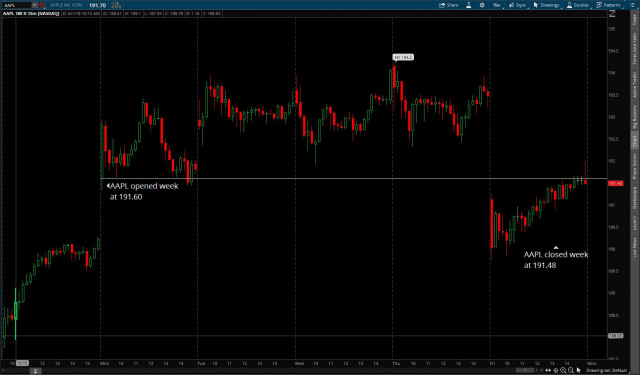

- 2018 (June 4-8)

a. Open: 191.60

b. Close 191.48

c. Week’s High-to-Low: 194.20-189.77 (range equals -2.2% of high of week)

d. Percent change from week’s open to close: Less than -0.1%

For options traders, the plan is simple: Sell the in the money weekly call spread with the sold strike closest to the opening print on Monday.

But there’s another trade set-up as well.

In ten of the past 13 years, $AAPL’s price action made a pronounced bearish move on the Friday of WWDC week. So the highest probability time to short or buy puts/sell call spreads happens on Thursday, usually after the European close.

BONUS: Eight of those ten bear pushes closed at or near their low of the day.

So clean those claws this weekend bears. There’s work to be done next week.

Also, while I have your attention… I’ve got one question for non-Gold and Diamond Slope of Hope members… Do you want to lose less and win more?

Tim created just the tool to help you figure out your true trading numbers… and avoid the misery of guessing when to take profits or cut losses.

It’s called Slope Rules.

Myself, and other Diamond and Gold members here on Slope have already found and shared dozens of profitable trade set-ups with it.

So if you want to break free from the ranks of the 90% of traders who consistently lose money… join the ranks of us who know their numbers before entering a trade.

CLICK HERE to sign up for a Gold or Diamond level membership, and lock-in a current rate to access Slope Rules.

And put a smile on both your face and Tim’s.