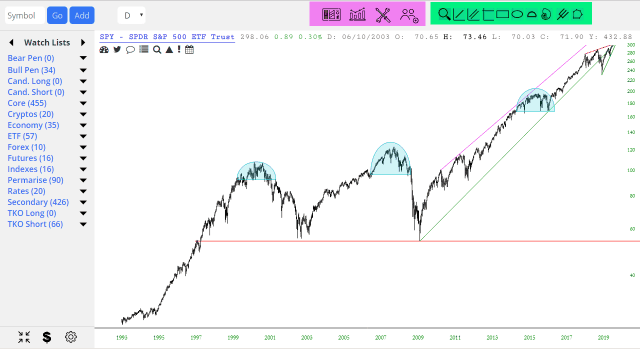

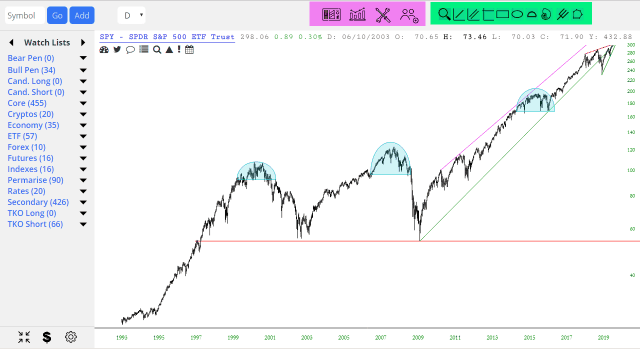

There is an important improvement to SlopeCharts I want to tell you about. To get started, here’s what SlopeCharts looked like until a few minutes ago:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

There is an important improvement to SlopeCharts I want to tell you about. To get started, here’s what SlopeCharts looked like until a few minutes ago:

I like shorting stuff, but there’s one item I wouldn’t short with a ten-foot pole made entirely of tofu, and that is Beyond Meat:

I’ve had a good day. 100% of my existing shorts are in the green. As much as I hate to rock the boat with new positions, I have done so. I shorted 19 more. Nine are shown below, and the other ten are in a members-only post.

Good morning from Tim Knight, “the Dan Bilzerian of technical analysis”, as we enter another exciting week of charting.

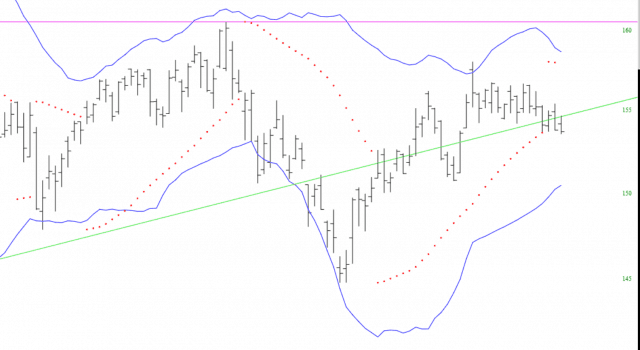

Below is a close-up of the IWM (the small caps) with the PSAR and Bollinger Bands. Of note is that the PSAR has “flipped” bearish (note the red dots above the price levels).

While we were prepared for last week’s run in silver in our service on ElliottWaveTrader.net, many are only now suggesting to buy into the metals after missing the last 10%+ move up in silver. Yes, that is what happens so often in financial markets. Markets go higher and people want to buy more the higher it goes. Yet I was getting a lot of pushback when I was suggesting people use price levels below 15 to accumulate silver holdings.

What strikes me as odd is that in every other aspect of your life, you are in search of “the deal.” If you want to make any other type of purchase, you invest a lot of time in finding the best or lowest price you can find out there in the market. Yet, that is not what happens with most investors in the financial markets.

(more…)