Since I’ve been understandably distracted the past week, I didn’t really get a chance to take a hard look at charts until well after Friday’s close. To some degree, I was shocked at just how persistently strong things remain. This is not across the board, however, so I wanted to break some representative ETFs up into some appropriate groups, going from strength to weakness.

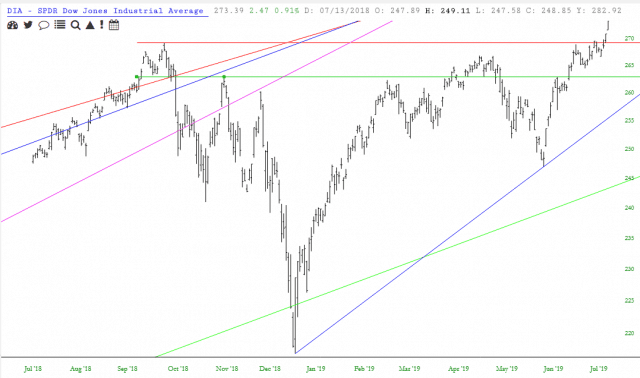

The most “bears might as well give up forever” chart I see is the Industrials, that is the DIA “diamonds”. This is a breakout, no two ways about it. Not only is it a breakout, but it is one from a formidable base. Scary.

Also strong, but not to the same degree, is the homebuilders. This isn’t at lifetime highs like the S&P 500 or the Dow 30, but it is a clean breakout from a very lengthy base. Who would have thought in 2009 that the place to put your money would have been homebuilders?

One area of strength I continue to cheer is the world of precious metals. Here we see the miners building strength upon strength ever since last September.

Now we begin to move into a more questionable area. Of special interest to me is the small caps, that is the Russell 2000 represented by IWM. Not only is this nowhere near lifetime highs, but its behavior has been nothing short of anemic. Simply stated, it seems these days that weak markets make for very weak small caps, whereas strong markets make for small caps treading water or maybe going up a little.

The transports, via IYT, still are in a legitimate head and shoulders topping pattern, but only barely. A breakout Monday would snuff this out.

While I wouldn’t consider the S&P 500 “weak” by any stretch (the lifetime high would make that assertion laughable), I at least want to point out how close we are getting to a trendline which, for the past couple of years, has been a reversal point.

Another “iffy’ area is the banks, represented here by KBE. Again, we have a lot of overhead supply remaining, and it has not broken out of its bearish patten.

Crude oil has been generally strong for the past couple of months, but we are getting close to a major price gap, which I have highlighted in the USO chart below to the penny.

The retail chart, XRT, isn’t a very clean pattern, but a long series of lower highs remains intact, and that red horizontal, unless violated, continues to suggest much lower prices in store.

Lastly, and considering its size, quite interesting, is the emerging markets. These are miles away from any kind of lifetime highs, and considering they only managed a meager gain of seven-hundredths of a single percent on an otherwise explosive Friday session, you can surmise how prone this group is to a selloff.