Allow me to share a two-word euphemism that is appearing with alarming frequency in the many real estate ads where I live: New Price.

It was only a couple of years ago that the idea of such a thing (that is, ads begging for buyers at increasingly-lower prices) would be laughable. During the peak of 2016-2017, dozens of people would line up just to make a bid on a property. On top of that, all-cash Chinese buyers would swoop in and gobble up real estate at just about any price asked.

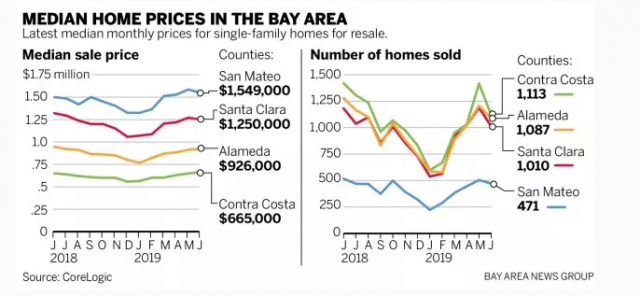

Even though the perpetually-propped-up equity market shows no sign of ever turning down in our lifetimes, other assets that aren’t so easily manipulated, such as residential real estate, are feeling the heat. Here’s the headline from the local paper:

Accompanied by a pair of graphs (which, in typical newspaper style, does a lousy job with the scaling, but the general idea gets across):

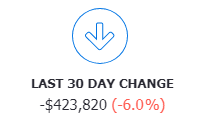

For me, the weakness in prices hits home (literally) as our own property has dropped over a million bucks. In fact, glancing at Zillow, here’s this encouraging little tidbit about my house:

I’ve written about local real estate before, and invariably people will ask me, “Why not just sell your house now, take those huge profits, and buy a five-acre estate in Bumblefuck, Kentucky, where I am, and live like a king?” Well, I don’t want to live in Bumblefuck. My family is already established here. And we bought so cheap that I frankly don’t care that it isn’t at its high price. It’s just………….a house.

Plenty of people aren’t in that position, though. They plunked down their 20% down payment, locked in this super-high property taxes based on the peak price, and merrily went on their way, only to discover that most of their down payment is gone forever, since their house has already dropped in price.

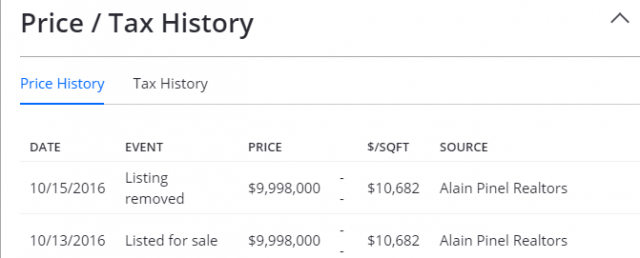

Just around the corner from me, for example, is a place that a Chinese buyer bought for $10 million. Below is the tax history. You may wonder if the $10,682 per square foot is a typo. It isn’t. The reason is because the house on the lot isn’t even 1,000 square feet.

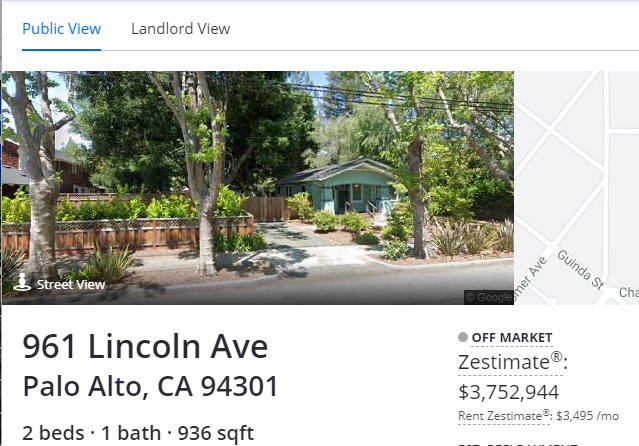

Below is an image of this grand $10 million estate. I sure hope the Chinese buyer was in dangerous of losing his money, because this strikes me as an awfully pricey “safe harbor” for your cash.

All I can say is that there are certainly tens of thousands of families out there who bought in this vicinity during the 2016-2017 peak who are probably too afraid to see what the place is really worth now. And the dips we’ve seen so far have taken place in the most insanely accommodative environment (with lifetime high stock prices) in history. God help these top-tickers when the economy begins to truly sour. It’ll make 2008 look like a garden party.