We live in a very complex word, and it grows more complex by the day. But let’s set aside all the uncertainties, possibilities, relationships, and exogenous outliers. Let’s strip it away and focus on the basics.

It’s quite evident that being simple-minded in 2009 was the way to go. The President said to go out and buy stocks. The Federal Reserve made it absolutely clear they were going to pour everything they had into “saving” the economy. Any member of John Q. Public who naively took them out their word has made out fabulously well to this day. We sit at lifetime highs in equity markets, in spite of a $23 trillion debt which is going to grow $1 trillion per year (at least) as far as the eye can see.

With this in mind, let’s walk through some basic assumptions and consider what is the logical path from here.

Assumption #1: People and institutions are self-interested: Seems like a fairly safe a priori assumption, right? Trump wants what is best for Trump. Mnuchin wants what is best for Mnuchin. Same for Jerome Powell.

Assumption #2: China and the U.S. needs each other: So the updated version of “mutually assured destruction” from the cold war is now “mutually assured financial dependence.” China needs the voracious consumers of the United States, just as the never-quite-satisfied citizens of the U.S. need a place that can manufacture crap at a reasonable cost. So the silly little trade war is going to die down into nothing, as the two sides hammer out Phase 1.01, Phase 1.02, Phase 1.03, into perpetuity.

Assumption #3: The election is all about the stock market: The memories of the financial crisis are far from gone. People are now utterly addicted to an endlessly-ascending stock market. As long as it keeps going up, they wouldn’t care if Genghis Khan was President. If the stock market starts to go down, they will vote Trump out of office in a heartbeat. The election is only about a year away, so the plates have to be kept spinning in the air, no matter what, for him to win. People care way more about their 401-k than they do about some conversation with Ukraine. I guarantee you, over 90% of U.S. citizens couldn’t find that country on a globe if you asked them to.

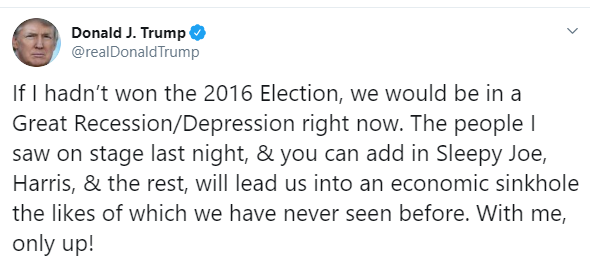

Assumption #4: Trump is going to stop at nothing to win re-election: For lack of a better term, he’s in full extortion mode with respect to the election. He has tweeted and said out loud, repeatedly, that the choice is simple: if a Democrat wins office, there will be a depression and stock market crash the likes of which have never been seen before. If he wins, then things will be just peachy. He will continue to browbeat Jerome Powell to maximize the chances of fealty and compliance from the timorous Fed Chair.

Assumption #5: The government is extremely powerful, but (probably) not omnipotent: It’s quite clear that the central banks of the world have breathtaking power over the financial markets. Hard as it is to believe, however, they are not omnipotent. If they were, 2008 would have never happened, because a lot of powerful people got hit hard during the financial crisis, and I’m quite confident that if they were able to avoid it, they would have.

Now, about that parenthetical “probably” – – I’m going to allow the possibility that the central banks are, in fact, omnipotent, and the only reason that 2008 happened is because the central banks never had the – – let’s call it boldness, although I could think of more colorful terms – – to do, in Mario Draghi’s words, “whatever it takes” to keep asset values high. In other words, I don’t see any stone tablets anywhere that say it’s impossible that the U.S. will be $100 trillion in debt and that the Dow won’t go to 650,000, as recently predicted on CNBC. It certainly seems that no one gives a flying crap about debt anymore. They just keep piling it on, yet everything still seems to be functioning.

Having said all of that, there are probably three reasonable conclusions:

(a) the market will, more or less, keep lumbering higher, egged on by QE4, jawboning by Trump and Kudlow, and the efforts of the world’s central bankers up to the U.S. election about a year from now;

(b) if Trump loses, the market will fall to pieces, and Trump will probably spend the approximately three months he has left in office doing absolutely batshit things that will probably just exacerbate the fall;

(c) ironically, if Trump wins, I also suspect the market will weaken, even if it gets a bump immediately following the election. The reason is, in spite of what I said above, I don’t think the government can keep the plates spinning in the air in perpetuity, and Trump will have lost his motivation to do “whatever it takes” since he’s won already. Thus, some small measure of organic markets will be allowed to creep back into equities, because because the requirement to pull out all the stops will have vanished.

Overall, the only absolute certain thing to say is that the next twelve months are going to be endlessly interesting. And now perhaps my hard left turn to a near-obsession with defined-risk options trading makes more sense.