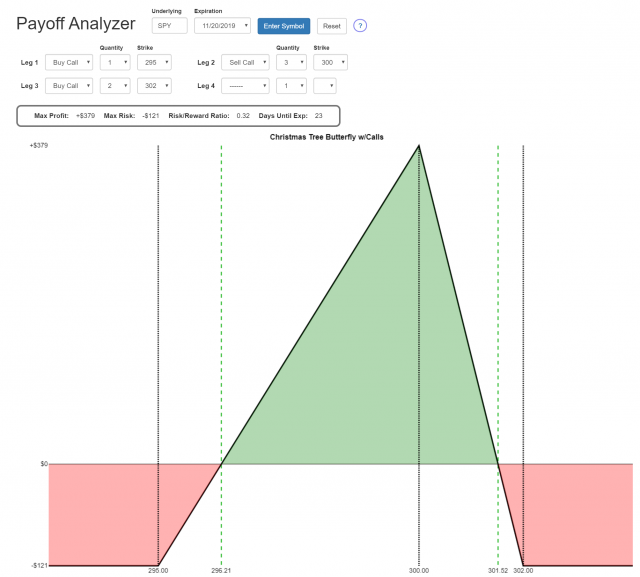

Bang! Got another one done! Our Options Strategy Guide has another complete member, and it is ready to use in SOAP!

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Bang! Got another one done! Our Options Strategy Guide has another complete member, and it is ready to use in SOAP!

Indulge me for a minute – literally a minute – and click on the image below. Allow it to play, which takes, like I said, a minute (if that). There’s no audio, so don’t worry about disturbing anyone.

Beyond Meat released earnings a few moments ago, and at the moment, it’s ugly (I have to add all these caveats, because in this insane market, BYND could be up 100% in the morning for all I know).

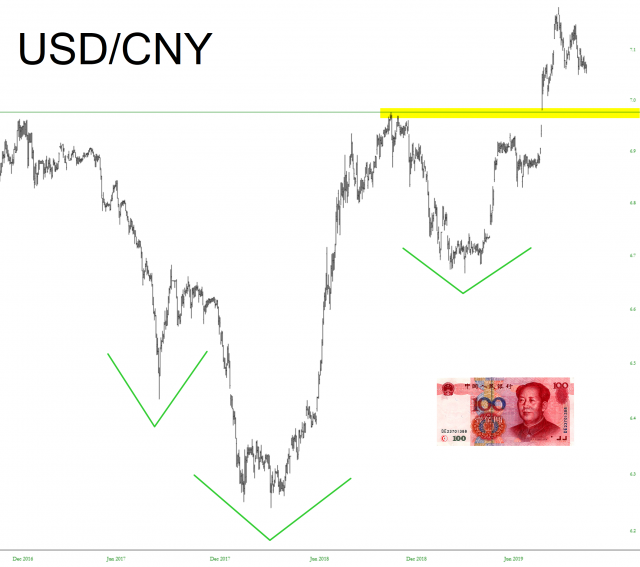

We haven’t looked at the US dollar relationship with the Chinese Yuan in a while. As I mentioned during the trade war (remember that?), the stronger this cross-rate is, the weaker our equities will be, and vice versa. This thing peaked on September 3rd and has been trending lower ever since then (thus, equities have been strong). It’s a relationship that merits monitoring.

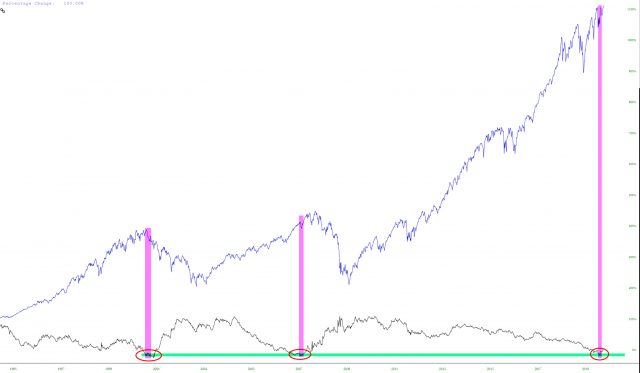

Below is an interesting chart showing, in blue, the S&P 500, and in black, the FR:T10Y2Y (10 year interest rates minus the two year). We’re only dealing with a sample size of three here, but I at least wanted to illustrate what happened in prior instances at these levels where the rate spread got to a certain depth. I’ll also point out that in 2007, it took a few months for any kind of bear market to take hold, even after the signal (if it IS a signal):