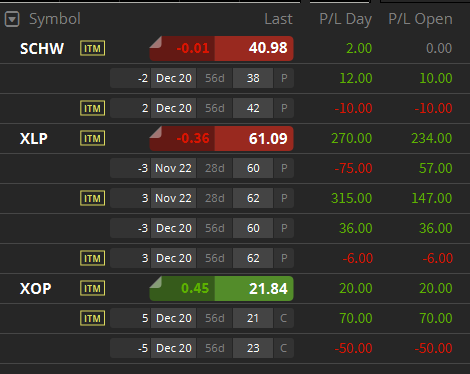

My new adventure in options spreads continues. I am doing this in multiple accounts, but the one I enjoy the most is tastyworks, where I’ve got a teeny little balance and three teeny little positions (again, I’m in learning mode). At the moment, two of them have a small profit and one of them is flat.

Let’s walk through each of them. First up is Schwab, where I’ve got a 38/42 put spread expiring December 20th. Here’s the chart.

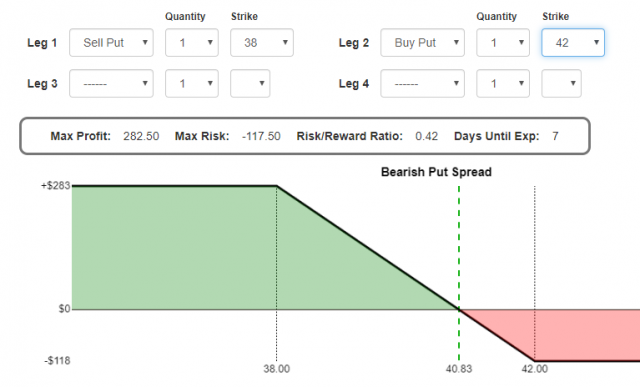

And here’s what the payoff chart looks like in SOAP.

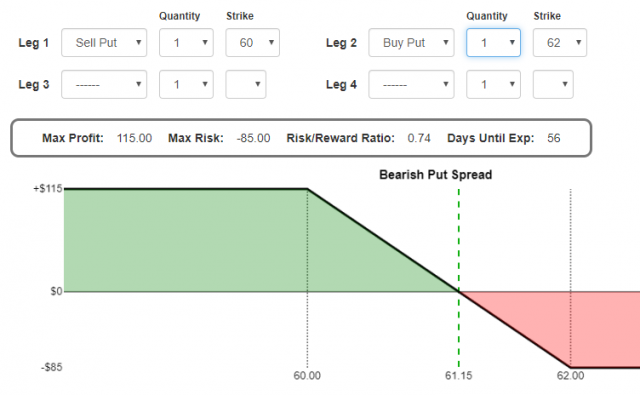

Next up is consumer staples fund XLP, which is in a wedge formation. It hasn’t broken the wedge yet. It actually managed to slip lower on Friday, in spite of everything else on the planet being green.

And here’s SOAP for XLP. I’ve actually got two positions, identical 60/62 put spreads except for differing expiration dates.

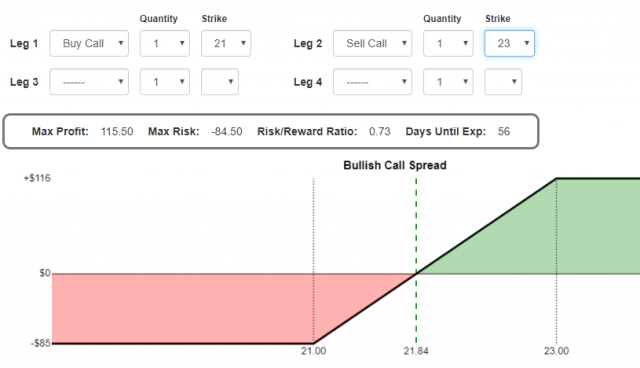

Lastly is the oil explorers fund XOP, where I’ve got a 21/23 call spread.

And here’s the payoff from SOAP:

Pretty cool stuff, eh? SOAP has become a total resource black hole, but like I keep saying, I’m hoping it’ll all be worth the investment in the end. Bang on it and try to break it! I want to know any problems!