“Sell your cleverness and buy bewilderment.”

– Rumi

Like the rest of us, I have many characteristics to my personality, some good, some bad. One of the better ones that I am pleased with is a sense of wonder. I am always open to being astonishing. I am always willing to accept the inexplicable as being possible. I recognize, as Saint-Exupéry did, that what is essential is invisible to the eye.

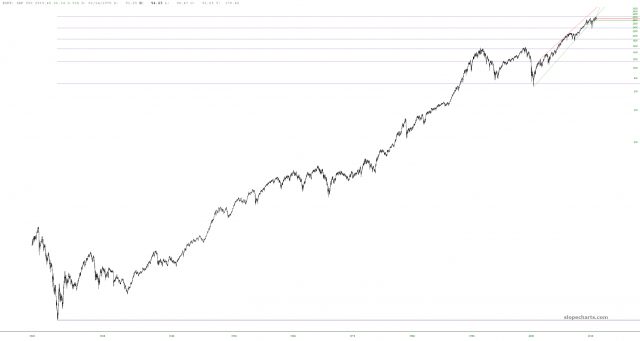

And, thus, with such lofty wisps, I offer the following chart. Although I say it every day, I’ll repeat – – click it for a bigger version, because I use enormous screens, as I personally think people using mobile devices to look at financial charts are psychotic, or at least masochistic. So here we go:

What you see here is an S&P 500 index chart with Fibonacci retracement levels. No big whoop. You’ve seen this chart countless times over the nearly fifteen years Slope has graced the Earth.

But it’s not the same as it was for the past decade, because I moved one of the anchor points. One of them remains the same: June 2, 1932, the lowest point of the Great Depression (when the S&P was literally less than 5 points in value). The peak, however, I’ve moved from the old 2007 housing bubble peak to the recent July 26, 2019 lifetime high.

After I did so, I was knocked off my feet by what I saw. I want to emphasize there are about ninety years (!!!) separating these two anchor points, and obviously the lines that are drawn between those points follow simply mathematical rules for their placement. These aren’t tweaked or fudged in any way.

In short, what amazes me about this setup is how – – and here’s that term I coined years ago – – Fibonacci Friendly the chart is. More specifically, how major zones of support and resistance have been respected through all these decades. Keep in mind, virtually all the human beings around for that first anchor point have long since died!

Here is Exhibit A, which are the major tops of 2000 (Internet Bubble) and 2007 (Housing Bubble). This is the 50% retracement level. Excuse me while I pick my jaw up off the floor.

And look what happened next. The financial crisis caused global mayhem. And yet, with all those trillions of dollars burning up, the market slammed the brakes at the 23.6% level. And then it went exploding higher, thanks to the multi-trillion dollar fraud of the Federal Reserve. In 2014, when it started to become exhausted, it found incredible support at the 61.8% level. From there, it exploded even higher. The most recent severe weakness we had was, of course, the final quarter of 2018. And where did the sell-off stop? You know already…….the 78.6% level!! AEIEEEEEEEE!!!!!!

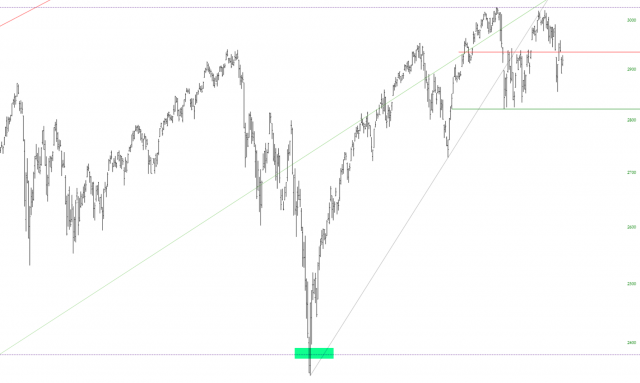

And here is a closer look still.

Anyway, give it a look on your own SlopeCharts. Enjoy!