Grass is green. The Pope is Catholic. Clouds float in the sky. And Barron’s is bullish.

Indeed, I can’t remember any time when Barron’s has called for market reversals. It’s normally chugging along as a classic shill for Wall Street, bested only by the less-esteemed Investor’s Business Daily, which is sort of the Highlights magazine for the investment world.

Thus, I was totally not surprised to see this cover story for Barron’s this week:

And you should comply! Why? Well………..”strategists.’ I mean, they’re experts, right, so they must know what they’re doing.

Helpfully, Barron’s gets very specific uncovering little-known equity opportunities (like Google………….no, seriously) for the year ahead.

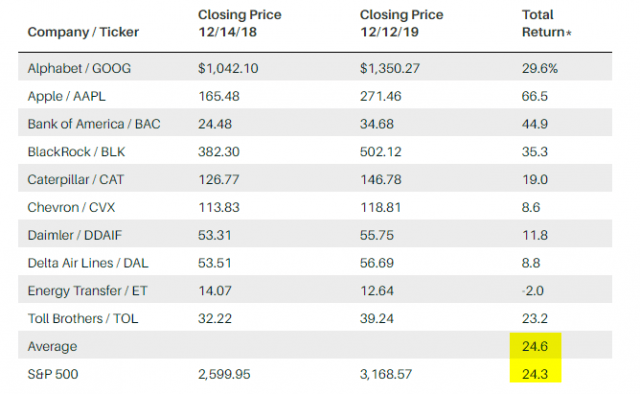

At the same time, they had the forthrightness to show how their picks from last year did. Since a monkey throwing darts at the Wall Street Journal could have picked winning stocks for 2019, their profitable results are not surprising. But, seriously, with all this intellectual firepower, was beating the market by 0.3% really worth all the trouble?

And just to challenge your inability to suspend disbelief, there is an adjacent article declaring that the likes of Netflix is……..a value stock! Benjamin Graham must be twirling in his grave at this point.

And, not to put too fine a point on it, the zeitgeist of Barron’s is, high prices be damned, just keep buying.

Of course, it’s easy to sympathize. Barron’s would look foolish to show any kind of caution in a central-bank-inflated market like this one. But, if I may dig into the Barron’s vault for a moment, allow me to share their own self-reported results from some of their expert picks at the start of 2008. It would seem to me that these “strategists” are able to eke out a tiny advantage during bull markets (see table above), but during downturns, their hot picks get absolutely toasted.