My sleep schedule has gone off the rails for a couple of reasons. First, I’m entirely by myself this week, which is intrinsically a peculiar experience. So I wind up in bed reading books at an hour that 80 year old men would say is embarrassing. Second, the markets have been the most insane they’ve been in the past fifteen months.

Thus, I’ve been waking up, ready for action, at about 2:30 in the morning, but with nothing to do. So here I am, sharing a few thoughts with you.

My feelings about this week are a combination of gratitude and regret. Gratitude because I came into this week loaded to the gills with shorts. As I think I mentioned, my broker literally have to cover a few shares of AAPL last Friday just to get my account margin-compliant again. I had shorted with every penny at my disposal. Thus, Monday and Tuesday were sensational.

The regret comes, of course, from Money Left On the Table, which is a lifelong trader’s disease. The amount of abandoned profits , both from covering shorts and selling options, is mind-numbing. I covered everything on Wednesday morning, which made me feel good when the markets were evidently recovering. However, their selloff has decidedly resumed – – exacerbated by the bizarre appointment of the empty suit Pence to head up the Covid-19 battle – – and I’m left standing here with 10 short as opposed to my typical 60 or more.

There are a few hours to go until the market opens, as I’m tying this, but here are a few words on what I’m seeing.

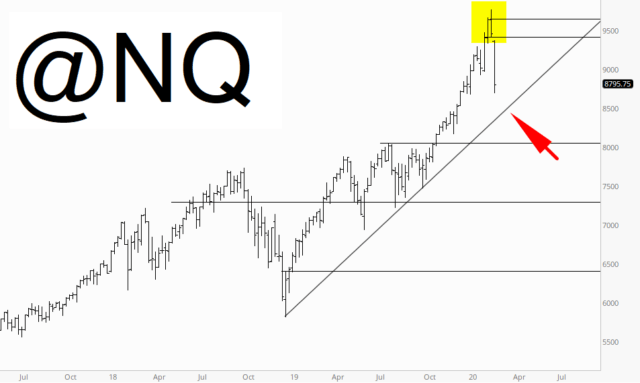

The NASDAQ has been getting a complete ass-pounding, although a major supporting trendline is getting fairly close. My dream scenario – – and I can’t emphasize this enough – – would be a rally back to the topping pattern that I’ve tinted. I have literally 93 stocks I want to short at that level. So, for once, I would be thrilled to pieces of Powell announced something bold and daring to save the day. Do it, you silver-haired demon!

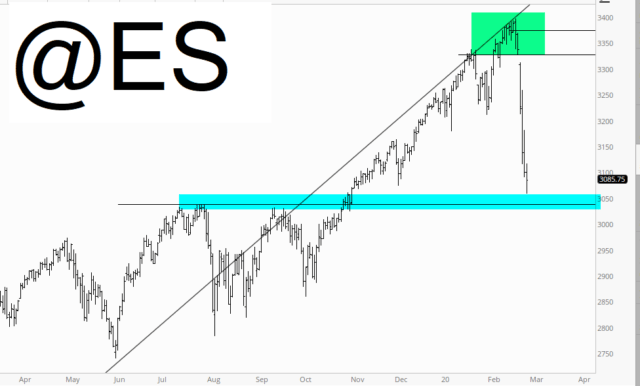

The S&P 500 futures have obviously been plunging as well, but here, too, there seems to be meaningful support on the way.

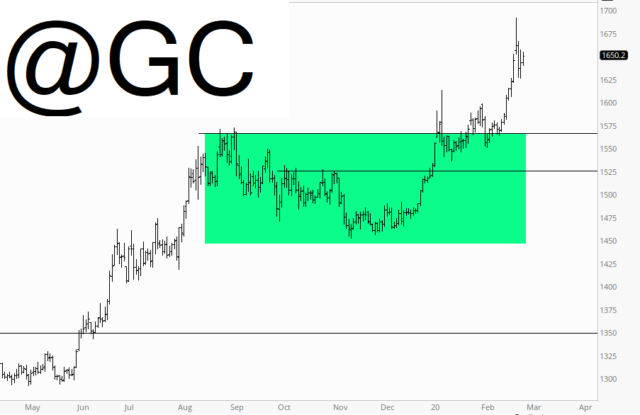

One of the most bizarre things of all is that my two greatest ideas – – maybe ever – – were long plays. Specifically, gold and bonds. I spotted these patterns beautifully, and they have been absolutely on fire. If virus fears abate, gold will probably ease back, but I think its long term future is well above the $2,000 mark.

As for bonds, these are poised for yet more strength. The trendline break was the key signal, and now we’ve topped that sundae off with a cherry by pushing above the horizontal line.

Anyway, my trade brain is fear-based now, rather than opportunity-based, which is a bit of a shame. My ideas have been fantastic. I feel fortunate to have shared them with an audience. My execution has been a B-, and that’s probably a kind estimate. I can only hope some of you have done better with my insights than I have.