You would think it had all caused me harm, what with all the fuss I made about the market’s rise. It’s just the insanity of it all, though. And I’m not trying to be a drama queen. Or king. Or any kind of emotional royalty. This has simply been insane. And that is a word I freely use, even having lived through the mayhem of 1999/2000.

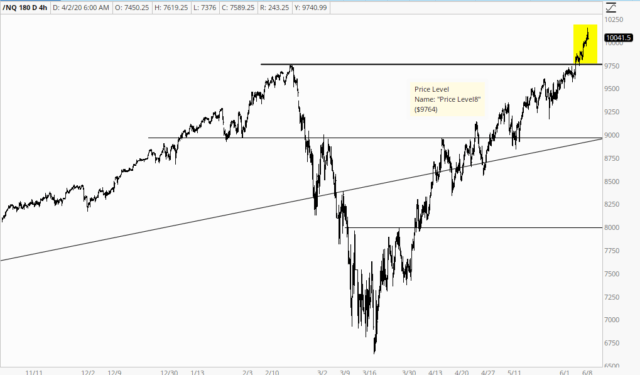

The NASDAQ, of course, slipped right over the Big Round Number of 10,000, and the permabulls couldn’t be happier. Sort of like the effect the Big Round Number of 5,000 had back in March 2000, just before the 83% collapse.

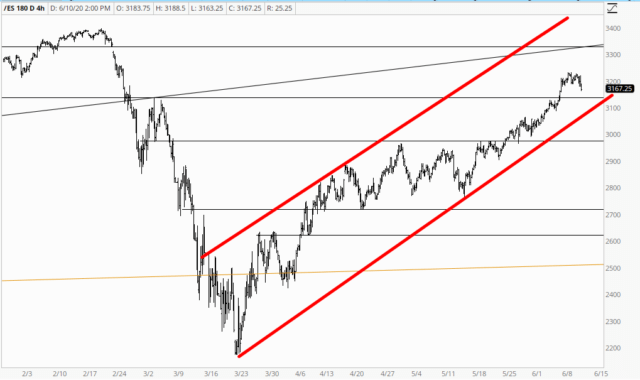

The ascent since March 23rd has been merciless, with the Fed large and in charge. That channel must be broken in order for even a scintilla of humility to return to the vacuous new “traders” out there.

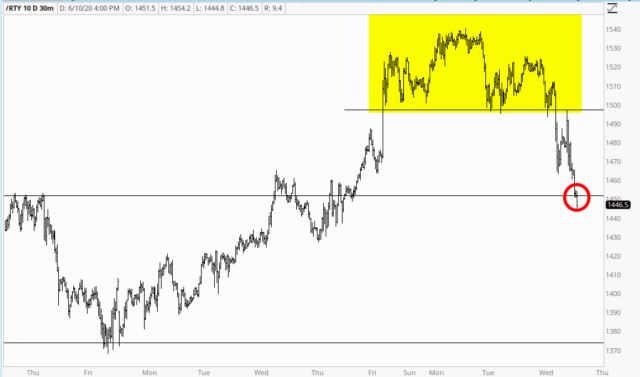

When I retired for the day on Tuesday evening, I had my eye on the pattern highlighted in yellow below. At the time, however, about 30% of the pattern didn’t even exist, so it was largely conjectural. Happily, though, what I perceived to be happening did, in fact, fully transpire. One day does not a trend break, but it’s a good thing on a small scale, at the very least.

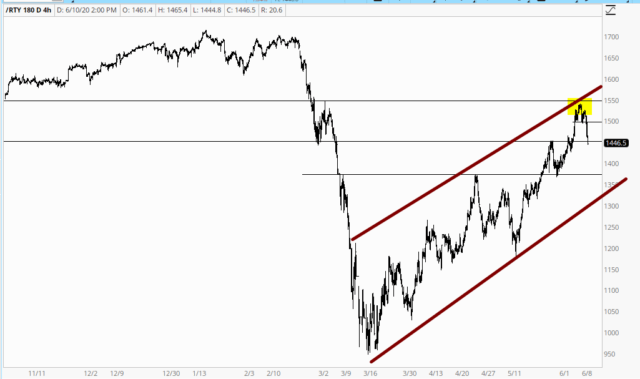

Viewed in a larger context, however, the head and shoulders on the small caps doesn’t amount to a hill of beans. As with the ES above, the monster ascending channel needs to be shattered first.

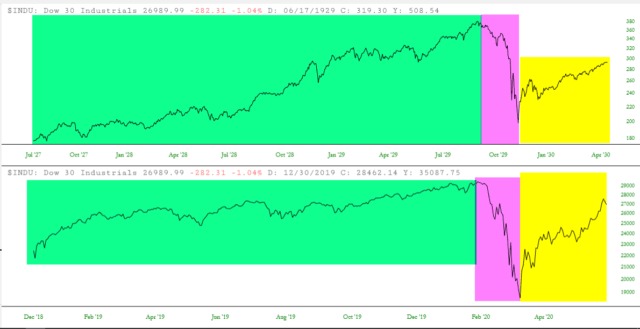

As a market historian, what I’ve been asking myself is if the monster rise in equities in such a short space of time is unprecedented. The answer: no. There is, in fact, a very clear antecedent, and it took place in late 1929/early 1930.

By way of SlopeCharts, I have lined up this analog below, with the yellow zone showing, in both 1929 and 2020, the explosive nearly 50% ascent in equities following a heartstopping collapse.

This is the financial age of idiocy like I never imagined. Once all the dust settles, I seriously need to update my Panic Prosperity book.