I’m pleased to let you know of another entry into the SlopeCharts technical indicators library, which is the Average True Range (ATR).

The average true range (ATR) indicator appears in a pane of its own and indicates increasing or decreasing dynamism in a security’s price. Unlike some indicators, its ascent and descent have nothing to do with strengthening or weakening prices, but instead illustrates volatility.

The reason for this is the calculation for ATR is based on its dollar price range (either the difference between a day’s high and low or, when appropriate, the difference between the day’s high and prior close or the day’s low and prior close). The average of these values is the basis for the line chart drawn, and the default value of 14 days is the suggested value of the original creator of the study, Welles Wilder.

You will find this study in the Technical Studies dialog box, and it has two parameters: the number of days used in the calculation (which you can manually enter or adjust via the slider bar) and the color.

If you use the slider bar, you can witness how different day settings affect the resulting chart.

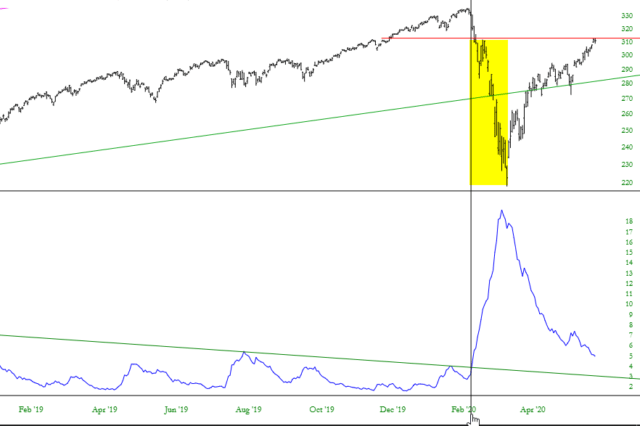

Below is one interesting example of ATR with the SPY. The trendline in the ATR window had been declining for years. When the ATR finally pushed through the descending trendline (marked below with a vertical line), the market begin a severe downward move.

Again, it was not the direction that was important (since this does correspond to the prospect of prices going up or down), but the fact that the ATR broke its downtrend that suggest an important change in volatility was happening.

Slope’s own TNRevolution put together this helpful video about how he uses the ATR (he filmed it using a platform other than SlopeCharts, since at the time ATR was not available).