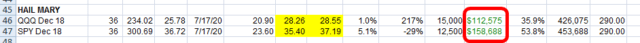

Let’s check in with my “Devil May Care” spreadsheets, since they continue to weave a fascinating story. First we have the “throwing all caution to the wind” Shorts portfolio, which as of Thursday’s close had 45 winners, 80 losers, and a loss of 3.28% overall.

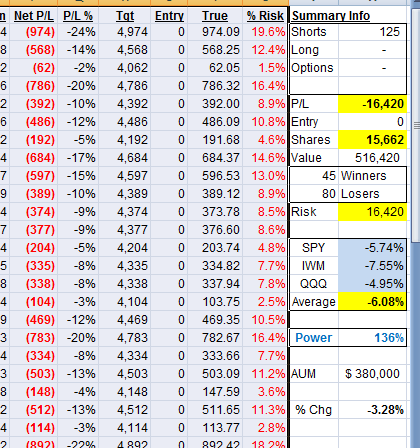

On the opposite side of the spectrum is the pure Bull portfolio, which had 15 winners, 10 losers, and an overall gain of 3.75%.

What I find fascinating is that, only a few days before, the “all shorts” portfolio was getting absolutely massacred, with a loss approaching 20%, while the “all long” portfolio was up, yes, but only about 6%.

In other words, the shorts were falling three times as fast as the longs were gaining. Even more interesting, when the market got blasted on Thursday, the vast majority of losses in the shorts portfolio vanished, going from a nearly 20% loss to less than 4%.

Putting it yet another way, the most appealing bearish charts are extraordinarily volatile, and they seem to recover with even more speed than they spoil, whereas the P/L of the all-longs is relatively plodding and “sticky”, not moving very much in either direction.

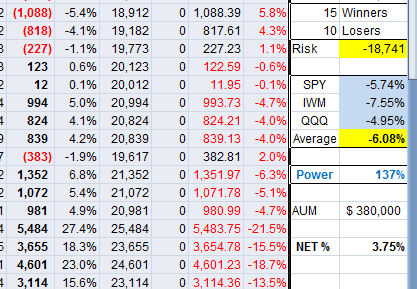

One other risk-free experiment I did was on Wednesday. Just for the hell of it, I entered into a spreadsheet some hypothetical options purchases if I decided to put every single penny into some relatively conservative puts. By “conservative” I mean:

- They were already in-the-money;

- They had a long, long time until expiration (December 2020)

The profits the next day are shown below: about a quarter million dollars in gains based on these very simple SPY and QQQ options. Of course, I never would have actually done something this crazy, but it was pretty cool to see how rapidly those profits amassed.