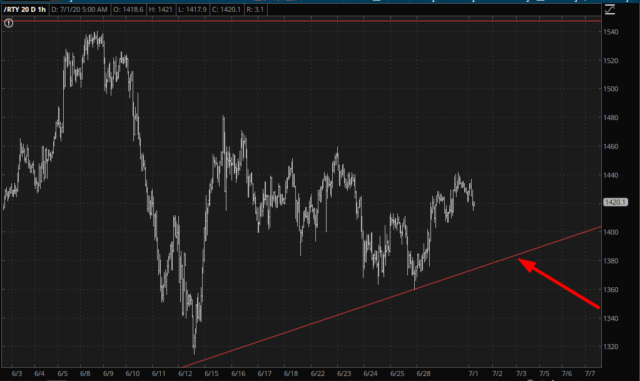

Welcome to Q3 2020! When I woke up this morning, the ES was down good and hard. As I’m typing this, it’s still red, but barely, having shaved about 25 points off its drop. I guess that’s to be expected. What’s important to me is whether over the next week or so the Russell (/RTY) shown below breaks its trendline. That’s fairly key.

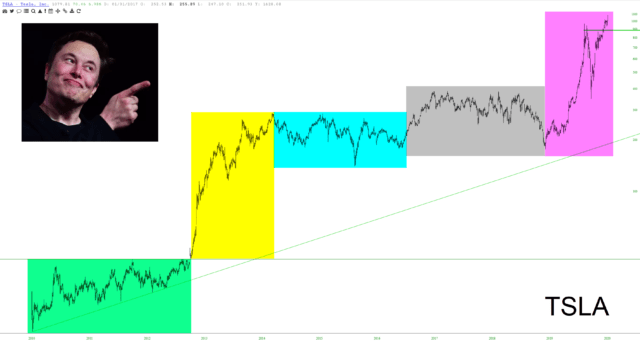

I thought I’d use Tesla’s stock chart as a prop to talk about current market zaniness. Do you remember when Musk tweeted out about how he was thinking of taking the company public at $420 and that he had ‘funding secured’? What was risible about the tweet was what an absurdly high price he was suggesting.

Well………it’s almost three times that much now. In a relatively short amount of time, the public markets are willing to pay almost triple what not long ago seemed like a totally zany takeover price.

Looking at the chart of its entire history (click it for a huge version) I see five phases………

- Green was an honest-to-God beautiful bullish setup, and I said as much at the time (adjunct to my over-the-top praise for my Tesla S). The stock was about $40 back then.

- Yellow was the “launch” phase from that bullish base, when the world really started paying attention to this stock.

- Cyan was the “going nowhere phase part one” portion of the stock’s history. In nominal terms, big price swings, but from end to end, a lot of smoke and not much fire.

- Grey was “going nowhere phase part two”.

- Magenta, most recently, is the manic launch, similar to the yellow one earlier (but stretched far higher on fundamentals).

Folks, what used to be a niche electric market maker is now valued at a fifth of a trillion dollars and is selling at 8 times revenue. What’s astonishing is that only a year ago this stock was $176 (and, let’s face it, the stock wasn’t exactly a secret back then) and now it’s at $1100.

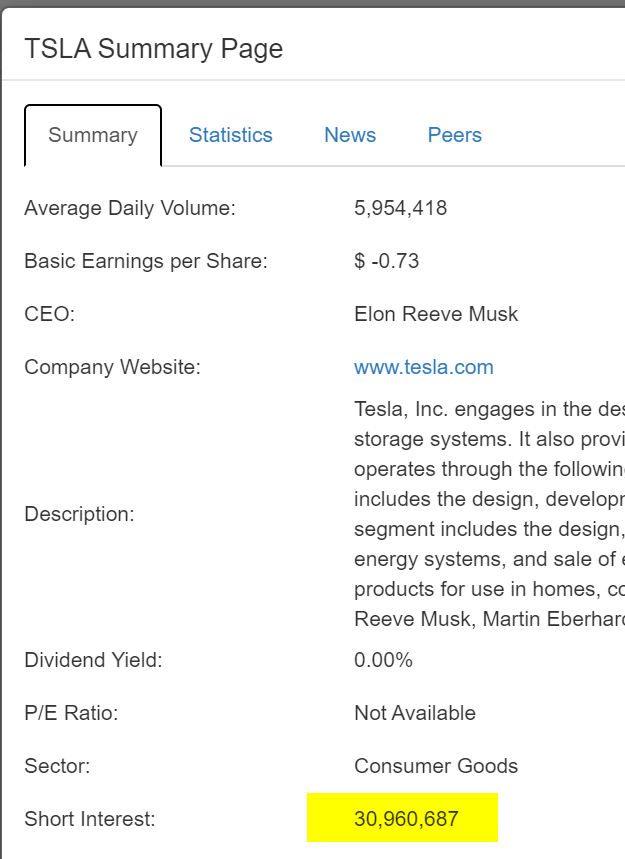

Like Amazon, this is one of those stocks which is so powerful, even Tim the Permabear doesn’t go anywhere near it, even though I think its stock price is lunatic. But, a moment of silence please for those still short this beast. Over $30 billion in short positions (which, incidentally, is greater than Tesla’s annual revenue!)