Another little thought experiment – – and I welcome corrections or new insights on this.

The Fed has made it clear they want inflation. They want it at 2% or above, and they’re willing to let it go decently above that level for a while before they consider raising rates. They’ve said so repeatedly.

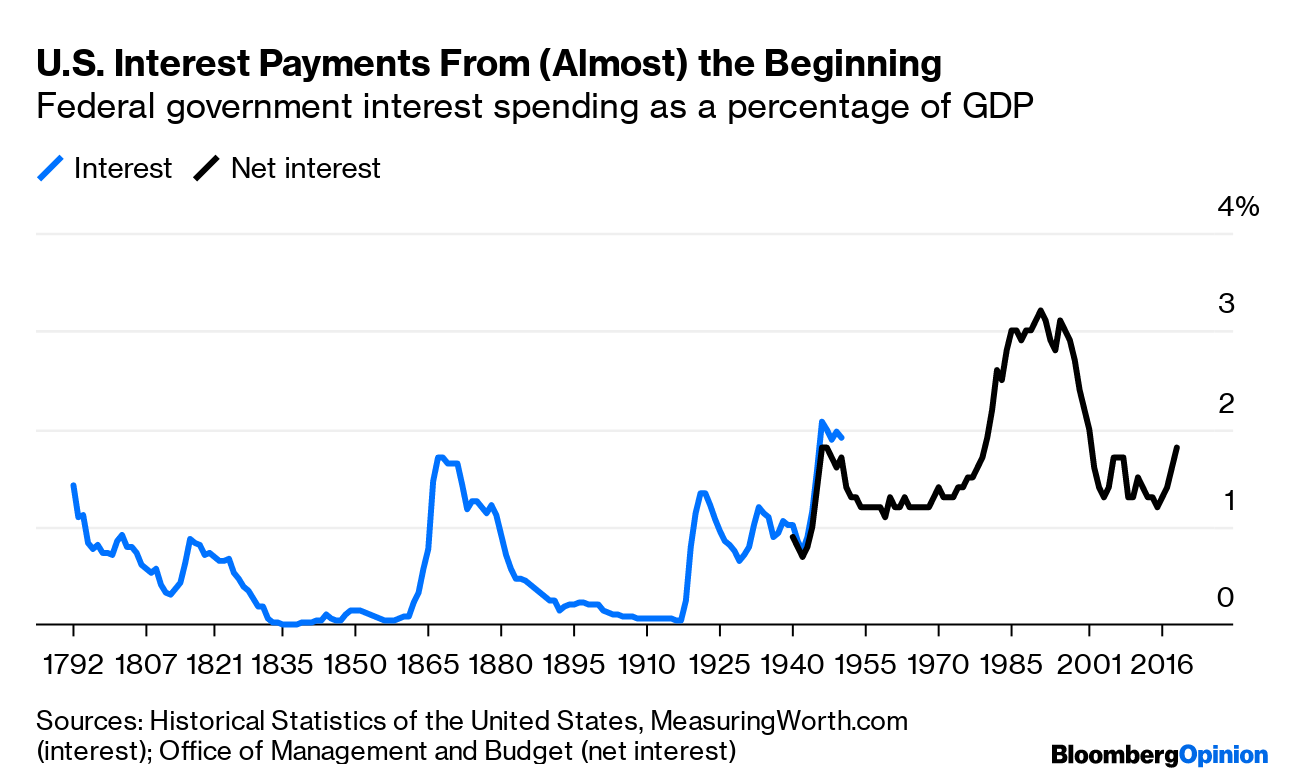

At the same time, trillions and trillions of new dollars are floating around out there. Adjunct to this, the world has never been so in debt. It hasn’t stung too much, because interest rates are so historically low that the burden of interest rate expense today isn’t much different in nominal terms than it was twenty years ago, even though we are dramatically deeper in debt. So the government is a bit spoiled by near-zero rates.

But let’s say something like this happened………….

- Thanks to all the help from the Fed, inflation does indeed start to heat up. Across the board, things start to get more expensive.

- After a while, the Fed starts to get too concerned at too much of a good thing. There’s really only one cure for inflation – – – tamp down demand by increasing interest rates. So they start to bump up rates.

- Naturally, government start sinking in value as interest rates increase. The interest rate expenditure of the government begins to ramp up.

- As multi-trillion dollar deficits continue, the government must keep selling bonds endlessly to fund all these losses, further depressing bond prices and warming up rates.

- And we return to step #3, as the cycle continues and interest rate expenditures go through the roof.

So we start to get something more like this……….

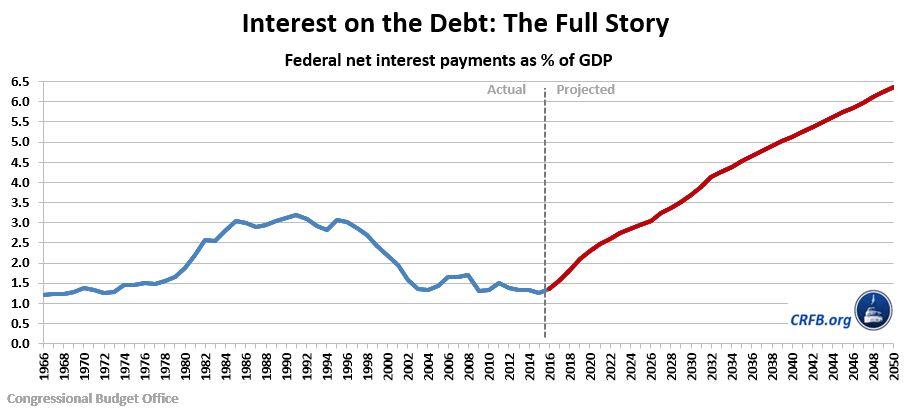

One more chart to think about……..