BEHOLD.

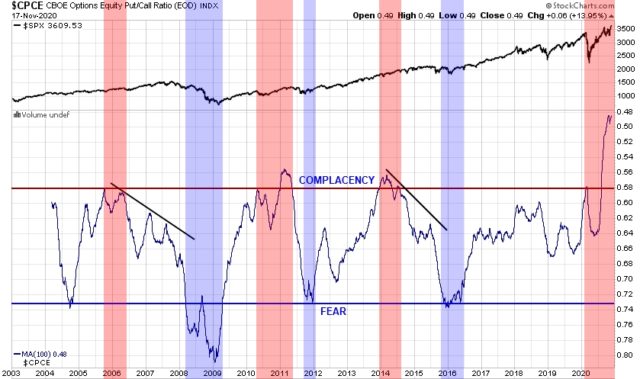

A long-term INVERTED chart of the Equity Put/Call Ratio with a 100SMA slapped on it (raw data invisible). I got curious tonight (the basis of learning IMO) and decided to take a cleaner look back at the Equity Put/Call Ratio over time and suddenly the simplicity of it hit me. This is a beauty of a chart!

IMPORTANT NOTE: This is NOT a timing tool. It is a CONDITION tool. It merely reflects the overall option market sentiment at the time.

Sometimes sentiment changed slowly, other times, it changed rather quickly.

It is interesting and perhaps helpful to see the PCR back off from the complacency level after mid-2006 (which is I believe when foreclosures started to pick up), but trying to short then would have you in the poor house in no time as the market just kept on marching higher anyways. I suggest finding and using other tools (MA’s might be a good start) to determine when the indices are rolling over.

Other retreats from complacency reversed much faster and didn’t result in bear markets, but certainly resulted in severe corrections such as in 2011 and 2015.

After the most recent advance to the complacency level, SPY had a prompt 35% correction that took less than a month. You would think that that would have been enough to reset sentiment, but astonishingly, the answer is NO. Now seeing that complacency has apparently reached stratospheric levels, I certainly have my concerns about how this one is going to play out given the fragility of market internal structures as I have been sharing from the @fadingrallies twitter page.

Sure. The eventual reversal of this, shall we say, historic complacency could be a very scary thing for some, but it also spells opportunity for those with the knowledge and rules to benefit from it.

If you treat a bear the right way, you might even find yourself a friend. And with that, I’ll leave with this…