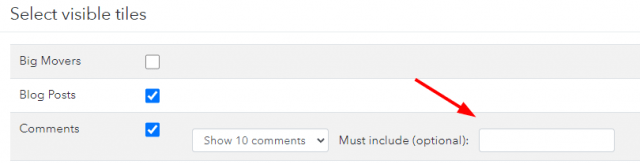

We introduced the Slope Tiles page a little earlier this month, and we’ve already given it a bevy of improvements. The latest is one directly from a suggestion that TNRevolution made. It was regarding the comments tile, and Rev said he’d want to be able to enter a search string (which could be a ticker symbol or just regular words) so that, optionally, the comments tile would display only comments that included whatever was typed. Well, voila, we’ve done it! You can optionally enter whatever search string you want via the Edit Tiles dialog box.