Elon Musk/Bitcoin/Dogecoin meme via Illbe.com.

Betting On The Bubble

In this post, we’ll look at way we can construct a hedged portfolio out of a few crypto names to bet on the bubble while limiting our downside in case it pops on us. Before we get to that, let’s recap a couple of quick points.

The Dot-Com Bubble Analogue

A point we’ve made previously (Partying Like It’s 1929) is that the crypto bubble is similar to the dot-com bubble of the late 1990s for a few of reasons:

- Like the dot-com bubble, the crypto bubble is centered on transformative disintermediating technology. Dot-com had ecommerce eating physical retail; crypto has the blockchain eating centralized finance.

- As with the dot-com bubble, the crypto bubble features crazy valuations and investors buying stuff that will go to zero.

- Just as the dot-com bubble nevertheless spawned future oligopolistic giants, so too will the crypto bubble.

We don’t know when the crypto bubble will pop, though an astute prognosticator we follow (one whose predictions on COVID proved accurate) has said it might pop this year.

With that in mind, let’s look at a way we might be able to make money while the bubble inflates but be protected if it pops within the next six months.

Constructing A Crypto Hedged Portfolio

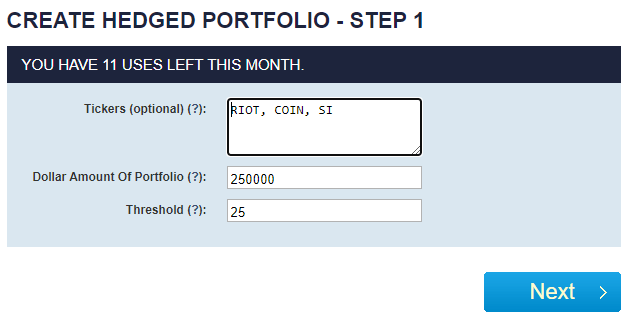

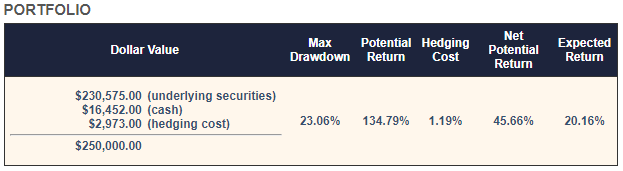

Let’s say you have $250,000 to put to work in crypto names, but you’re not willing to risk a drawdown of more than 25% in the event this doesn’t pan out. We’ll walk through an example using our automated hedged portfolio construction tool.

Step 1.

In the optional Tickers field, we enter the symbols for three crypto names Riot Blockchain (RIOT), the bitcoin miner; Coinbase (COIN), the crypto platform; and Silvergate Capital (SI), the specialty bank catering to the crypto industry.

We then enter the dollar amount of our portfolio in the second field, and the maximum drawdown we’re willing to risk, in the third field.

This and subsequent screen captures via Portfolio Armor.

Step 2.

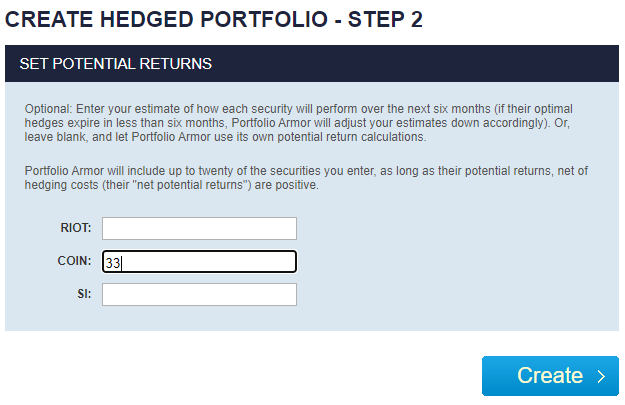

After we click the “Next” button, we’re presented with this screen.

There, we’re given the option to enter our estimates for potential returns of the three crypto stocks over the next six months. For RIOT and SI, I live the fields blank, so the system uses its own potential return estimates for them. For COIN I enter 33%, as that’s half of Wall Street analysts’ 66% consensus 12-month return for Coinbase.

Step 3.

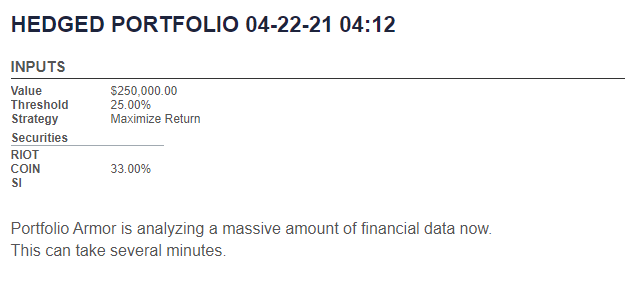

Then we click “Create” and see this screen…

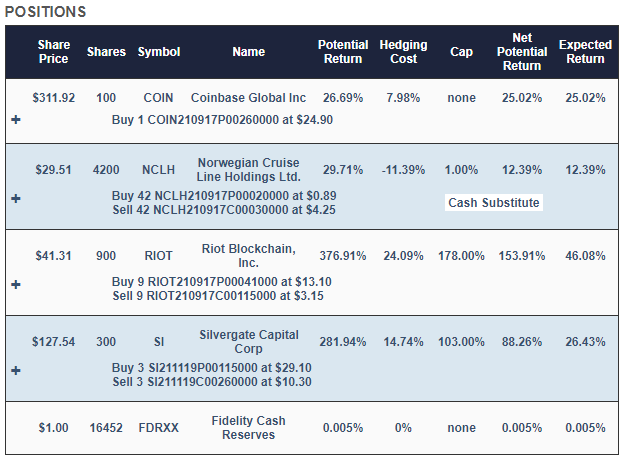

And then a minute or so later, we’re presented with this hedged portfolio:

With this, your maximum drawdown over the next six months – that is, if every underlying security went to zero – will be a decline of 23.06%. Your best case scenario would be a gain of 46%, and your expected return (a more likely scenario) would be a gain of about 20%.

Why Norwegian Cruise Lines?

Our system started with roughly equal dollar amounts allocated to RIOT, SI, and COIN, and then rounded them down to round lots, to reduce hedging costs. It swept up most of the leftover cash from the rounding-down process into a tightly hedged Norwegian Cruise Lines (NCLH) position, to further reduce hedging cost. It used NCLH for that because it had a large negative cost when hedged that way.

Why Those Hedges?

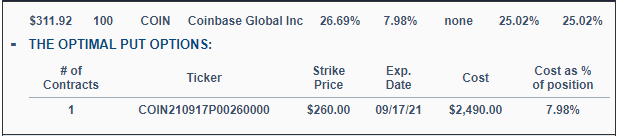

On our website, if you click the plus signs in the portfolio above, the positions expand to give you a better look at the hedges. For example, this is what the COIN position looked like expanded.

COIN was hedged with optimal, or least expensive, put options. The other positions were hedged with optimal collars. Our system estimates returns both ways to determine which type of hedge is best. We elaborated on that process in a previous post: When To Hedge With Puts Versus Collars.

Heads You Win, Tails You Don’t Lose Too Much

We’ll check back in a few months and see how this portfolio is doing, but one thing we already know the most it might be down in a worst-case scenario: that max drawdown of 23%.

Something to consider if you’ve had FOMO (fear of missing out) during the bubble but want to limit your risk.