For reasons that will eventually be self-evident, I’ve taken quite an interest in artificial intelligence (AI) lately. In particular, I’ve been doing a deep dive into the intersection of finance and AI, since there are a gazillion companies pursuing the (misguided) notion that the right code can make them billions.

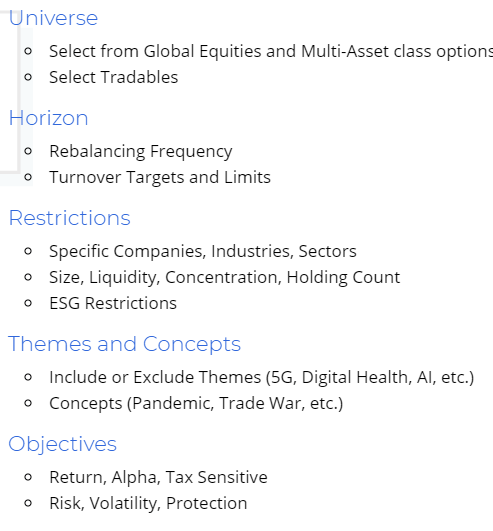

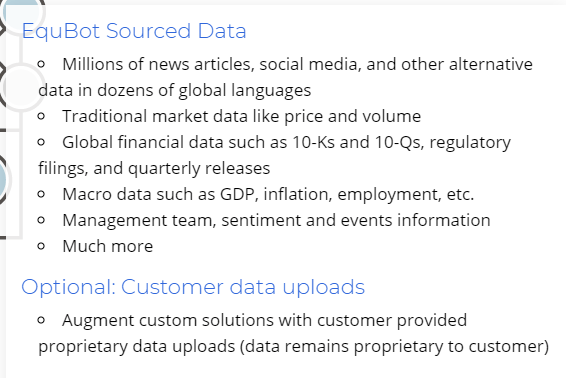

One such firm is located in San Francisco, and its name is Equbot. Their website goes to great lengths to show the sheer volume of data they are processing, the techniques they are employing, and the speed they are handling multiple spigots of information:

The breadth and depth of data is stunning……..

…….as is the sheer quantity (“millions”) of data points they take into account every day, in languages from all over the world.

This company has received no small amount of attention; hell, they even got to open up the NYSE:

Not surprisingly, this organization has provided the world a couple of ETFs powered by the aforementioned technology. There is a U.S. equity one, as well as one for international equities.

So with all this firepower, how much did AIEQ outperform the humdrum bench of the SPY? 20% better? 50%? 100%? More?

Errr, no. They move in lockstep. If you get out your electron microscope, I think maybe all that AI power produced a tiny, tiny bit of a superior return, but it’s truly negligible.

The international fund, on the other hand, underperformed the SPY substantially. These funds are not new either, by the way. They’ve been running for years and have had plenty of time for improvement. I am simply showing the last two years since it makes for a clean comparison and incorporates some big market moves.

I’m not impressed. How many PhDs and tens of millions went into producing these results? I don’t really blame them, though. In an actual “market”, this AI stuff might be amazing. As it is now, anyone with cash might as well just put the money into Alphabet (GOOGL) and call it a day.