When you write about Coinbase before it drops another 9%.

Bad Timing On That

In our last post (Betting On The Crypto Bubble), we presented a portfolio that included Coinbase (COIN) along with a couple of other crypto names, Silvergate Capital (SI) and Riot Blockchain (RIOT). Coinbase promptly dropped another 9%, as cryptocurrency prices wobbled in the wake of Biden’s proposal to raise the capital gains tax rate.

That’s why we hedge.

Still Bullish On Crypto Names

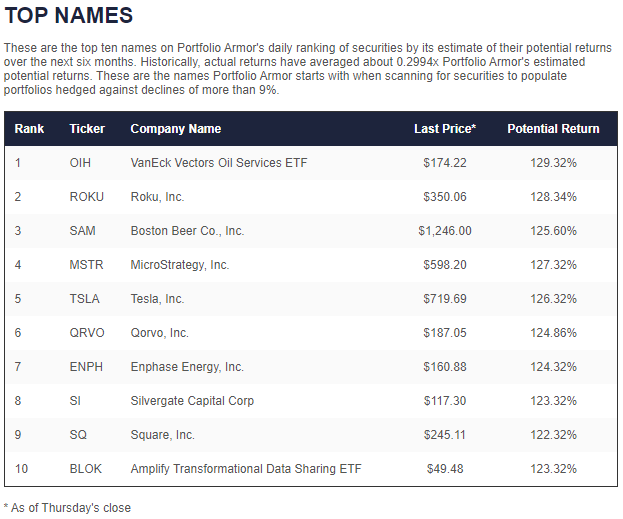

As we mentioned in our previous post, our system won’t start estimating potential returns for Coinbase until the stock has been trading for six months. It was still bullish on other crypto names after cryptocurrency prices dropped though. Its top ten names as of Thursday’s close included crypto names Microstrategy (MSTR), Silvergate Capital, Square (SQ), and the blockchain-focused Amplify Transformational Data Sharing ETF (BLOK), which has Square and Microstrategy among its top holdings.

Screen capture via Portfolio Armor as of 4/22/2021.

Top Names Performance Update

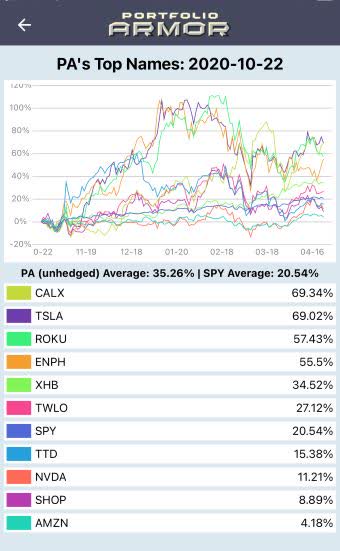

Our system looks at total returns and forward-looking options market sentiment to come up with its top ten names cohorts such as the one above. We then track their performance over the next six months. Here’s how the one from 10/22/2020 did:

Since we updated our security selection process on May 28th of last year, that was the 18th weekly top names cohort out of the last 22 to beat SPY.

Update On The Dot-Com Analog

As we’ve written before crypto/DeFi (decentralized finance) is both a bubble and transformational technology, and as such, is similar to the dot-com bubble of the late 1990s. Entrepreneur and venture capitalist Balaji Srinivasan echoed the transformational tech aspect of the analog on Friday.

Meanwhile, Citicorp’s chief equities strategist Tobias Levkovich compared the current equity market to 1999, echoing the bubble aspect of our analog.

What If It’s Not 1999 But 1997?

If we knew for certain that the current moment in this bubble was analogous to December, 1999, we’d suggest shorting the market. Of course, we don’t know that, and neither does Tobias Levkovich. If it ends up that April 2021 is more akin to, say, January 1997, then shorting the market will lead to some real pain.

Our Approach To Uncertainty

Since we don’t know when the bubble is going to burst, our approach remains this: identify names that we estimate are likely to perform well over the next six months, and are also relatively inexpensive to hedge. Then buy and hedge a handful of them and repeat the process.

To smooth out returns, we can slice up our money into two or three tranches, and buy and hedge a few different handful of securities with start dates staggered by two or three months. That way, when the bubble bursts, we’ll always have cash freed up from one of the maturing portfolios to reinvest. And since our universe includes bullish and bearish exchange traded products covering every asset class, we may be able to make some money on the way down.

Packaging This Approach

We’ve had some interest in packaging our approach as a fund, where this would all be done automatically for investors. If that general idea is of interest to you, you can let us know your specific preferences about it here: Potential Investor Survey.