Moments ago, I saw that ZH ventured into an area that they normally don’t, which is classic technical analysis (which is, I say selfishly, kinda my thing). They offered up this long-term chart of the Dow:

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Moments ago, I saw that ZH ventured into an area that they normally don’t, which is classic technical analysis (which is, I say selfishly, kinda my thing). They offered up this long-term chart of the Dow:

I just wanted to point out that in my post yesterday about the book I finished, The Wealth Hoarders, I made this observation:

Well, that didn’t take long………….within twelve hours of my post:

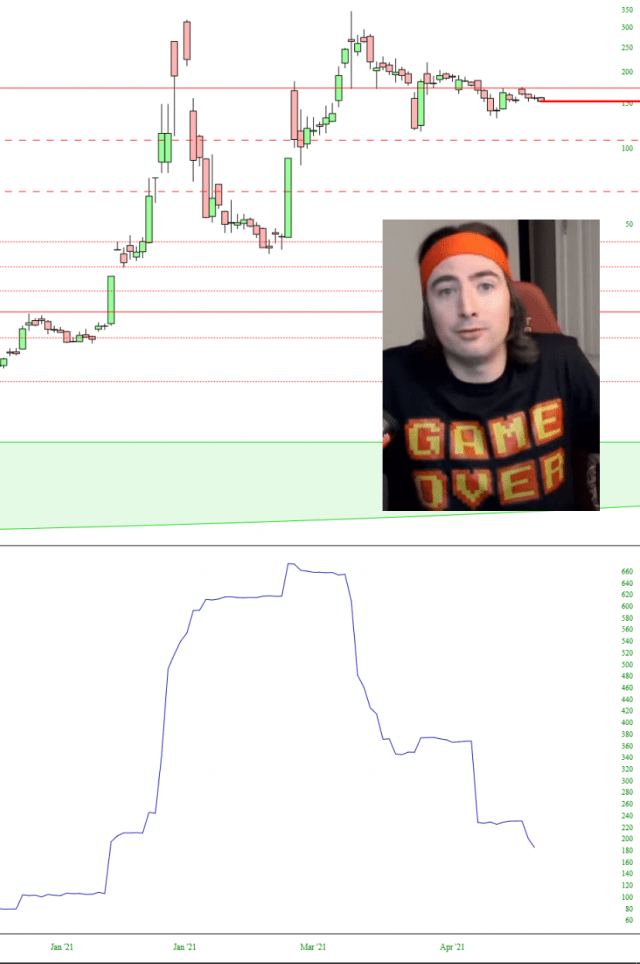

The tidal wave of call-buyers who were inspired by Roaring Kitty have been left holding the bag.

Roaring Kitty (AKA: DFV) has Exited Stage Right, having converted his remaining call options into a normal equity position. At the same time, newcomer “investors” who bought calls must be wondering why the value of their options continues to crumble even though the stock is relatively stable. Well, one chart answers that question………check out the implied volatility (and, thus, the premium value):

OK, you Slope Tiles users, this great product just got better.

First, some background……….

It has been a long-running gag that a lot of us, including me, get all their news from Slope. If you hang out here, it’s just a natural by-product of all the chatter going on.

One guy in particular is a veritable fountain of information, and that is beloved five-star Sloper RNeo. Just minutes before I started this post, he shared this:

Since we’re in the thick of earnings season, I thought it would be an appropriate time to illustrate how much information is on Slope for any one company which is facing an earnings event. Referring to the Calendar of Earnings, I can see that Intel is at the top of the pops today, so we’ll focus on that one.