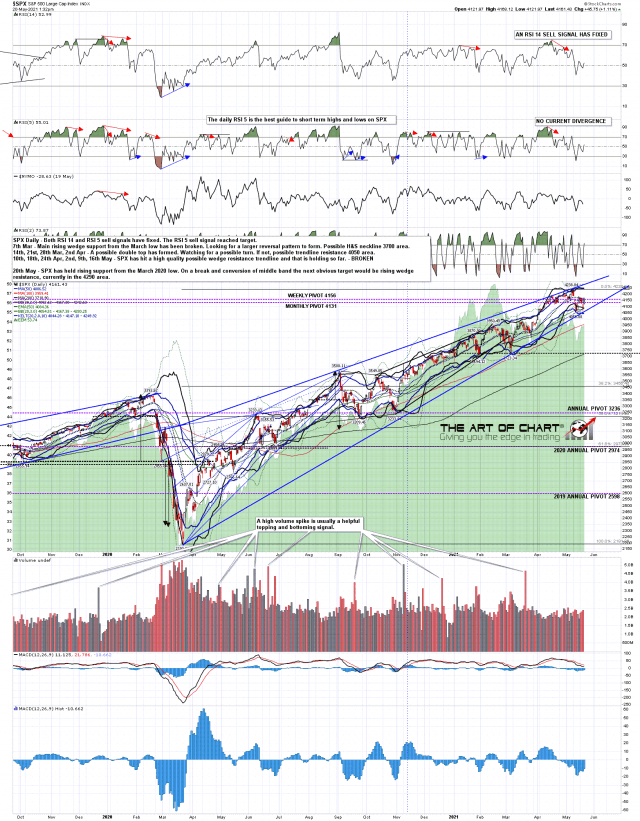

In my last post on Tuesday I listed the three obvious targets for the current retracement from the all time high on SPX. The highest was the rising support trendline from the March 2020 low and that target was hit at the low yesterday. So far that has delivered a large rally and may well be the retracement low.

If so, then that confirms a rising wedge from the March 2020 low and delivers a clear target for the move of that low at rising wedge resistance, currently in the 3287 area, but rising of course. Possible resistance at the current all time high, but no particularly obvious reason to think that resistance would be found there.

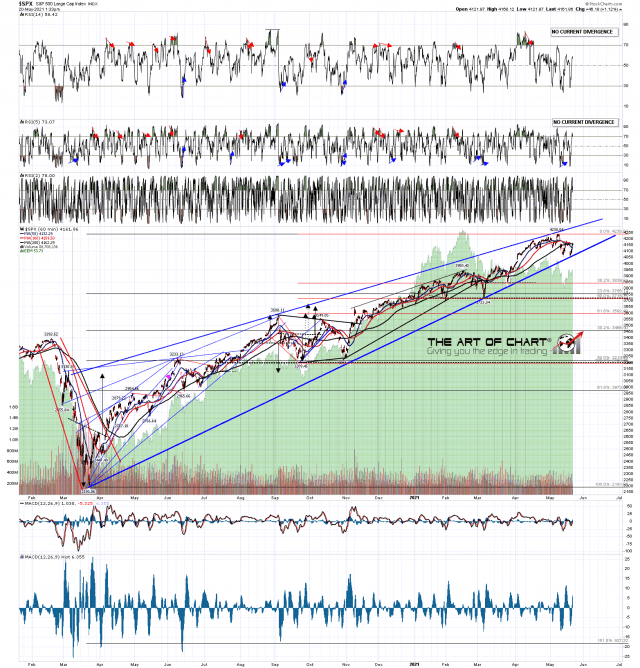

SPX 60min 16Mo chart:

In the short term declining resistance from the all time high has been broken, SPX has broken back over the 50 hour moving average, 5dma and weekly pivot and is consolidating before a likely move higher.

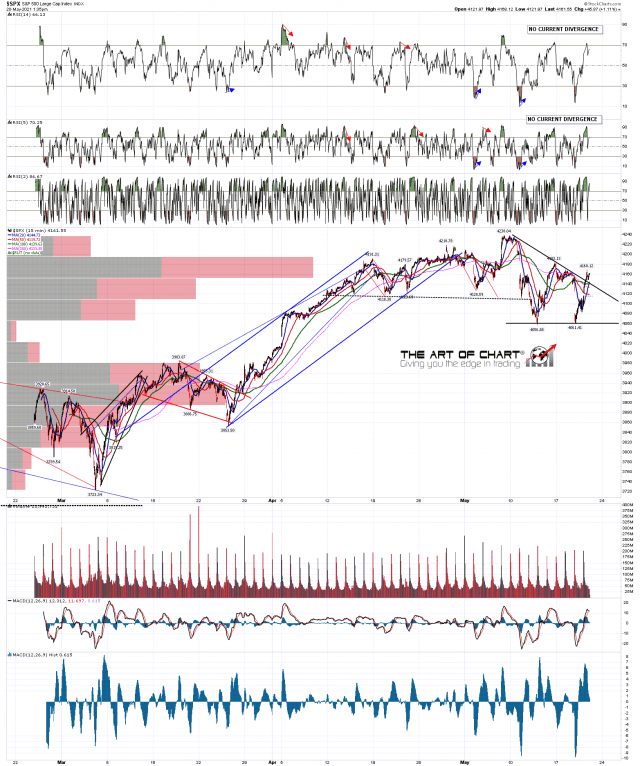

SPX 15min chart:

There is still one strong resistance level that still needs to be broken to clear the way for a retest of the all time high, and that is the daily middle band, tested at the high so far today and holding so far, even though it seems likely to be broken.

If that doesn’t break today then tomorrow is a Friday, and Friday’s have been very bullish in recent months. Some exceptions to that but not many. Ideally for bulls SPX would close above the daily middle band today, currently at 4167 SPX, and then confirm the break back above with another close above it tomorrow.

SPX daily chart:

I’ve never been much for looking back at nice calls made in the past, as it seems like boasting, but I understand that it is actually called marketing and that I should try to do it regularly.

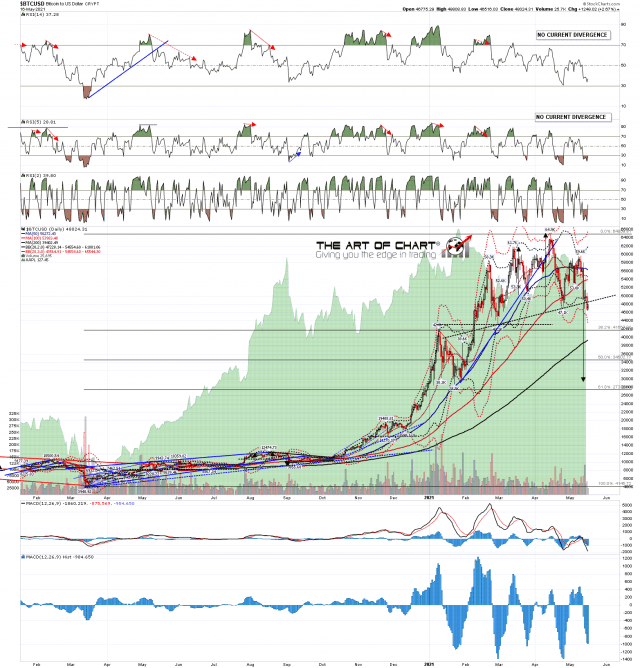

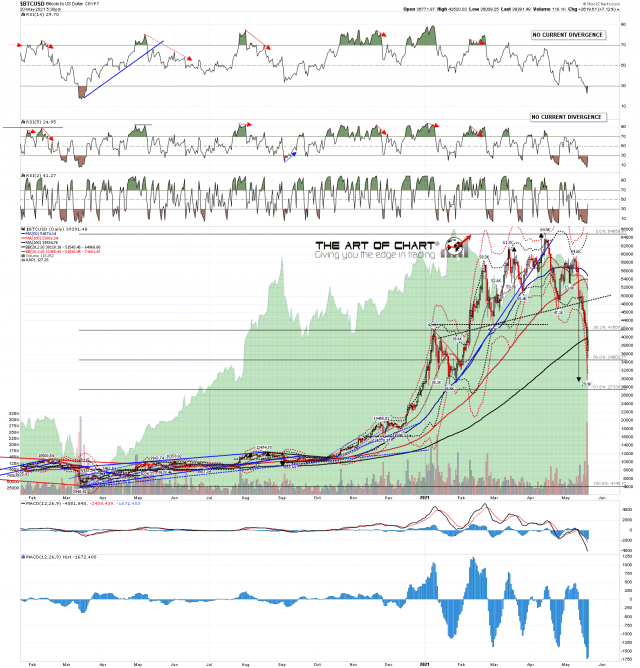

That being the case this is a lovely Bitcoin/USD daily chart I was talking about in the Chart Chat last Sunday at theartofchart.net. I noted the H&S that had just broken down and had the target marked in just under 30,000.

Bitcoin Daily chart (16th May):

The low yesterday on BTCUSD was 29,925, just a little shy of the target marked but very close, and a strong rally started there. Definitely the sweetest call of the week, though I’m pretty happy with the SPX trendline hit yesterday as well of course.

Bitcoin Daily chart:

There are two free public webinars at theartofchart.net this week and the first is our ‘Big 5 – FAANG Stocks and Key Sectors’ webinar an hour after the RTH close today, and our ‘Trading Commodities – Setups and Approaches’ webinar an hour after the close tomorrow. If you’d like to attend either or both you can sign up for those here and here respectively.