Credit to Oliver Renick for the clever “laser eyes” bear meme, more on which below.

Laser-Eyed Tom Brady

The symbol of Bitcoin bulls has been adding “laser eyes” to their social media profile pics. In hindsight, perhaps it was an inauspicious sign when Tampa Bay Buccaneers quarterback Tom Brady added them to his Twitter profile last week.

When the NFL great posted that last Monday, Bitcoin traded at over $59,000. As we type this, its price is hovering near $39,000. Three market technicians see further downside. Let’s start with the one who looks to have called a top in Bitcoin. We’ll close with a potential bright spot in the crypto complex.

Technicians See More Trouble For Bitcoin

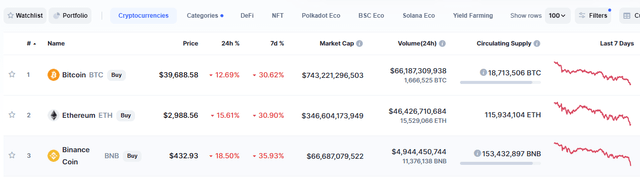

In a post last week (Shades Of 2000 And 2008), we mentioned TD Ameritrade lead anchor Oliver Renick’s prediction that if Bitcoin didn’t stop crabbing and start rallying on inflation news, it could sell off, tanking the whole crypto sector. So far, it looks like Renick called a top. As we type this, Bitcoin is down more than 30% over the last 7 days, with the next two largest cryptocurrencies by market cap, Ethereum and Binance Coin, down a bit more.

Screen capture via Coin Market Cap.

Oliver Renick offered a follow-up post early Wednesday (Bitcoin Is On The Verge Of Implosion). In it, he first reiterates his bearish argument that Bitcoin’s use case as “digital gold” has failed this year as it didn’t respond to inflation heating up:

[I]t’s going in the opposite direction of gold just when inflation is becoming the primary concern for investors. This is the biggest thing happening. The most popular story for owning bitcoin — digital gold — is failing at precisely the wrong moment. It doesn’t matter what bitcoin did relative to gold year-to-date, the past year, or since inception. What matters is what bitcoin does compared to gold when inflation is actually a concern, and for the first time in more than a decade, inflation is the top concern among investors.

A second point Renick makes in this post is that Bitcoin also has failed to live up to its promise of being a noncorrelated asset, as Bitcoin has declined this year as tech stocks have slipped. The third point he makes is more technical, the stock-to-flow model of price projection:

The model says bitcoin should be trading between $80,000 and $85,000 by year-end. By my math, bitcoin’s never fallen more than 65% below the stock-to-flow estimate, which means a drop below $30,000 right now would be unprecedented.

Another market technician we’ve mentioned in previous posts is Hong Kong-based investor Puru Saxena. Last time, we mentioned his prediction that Bitcoin could bottom at its exponential moving average, which at the time was $15,500. Now he sees the possibility of it dropping below $13,000.

A third market technician, our esteemed host Tim Knight, offered a pithier prediction Tuesday.

A Potential Bright Spot In The Crypto Orbit

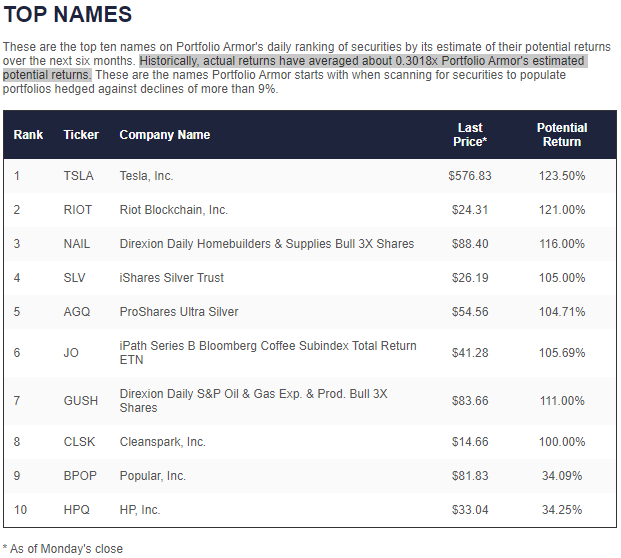

In our previous post (Too Much Crypto, Not Enough Stuff), we posted our top ten names from Monday.

Screen capture via Portfolio Armor on 5/17/2021.

Our focus in that post was the coffee ETN (JO), which we suggested was a way to play the commodity rally. JO closed up 5.3% on Tuesday, but another of our top names from Monday, Cleanspark (CLSK), was up about 5.6% on the day. Cleanspark sells software to manage energy microgrids, but the company also mines Bitcoin using, reportedly, 95% clean energy, which is notable, given Elon Musk’s recent complaints about the amount of coal burned to mine Bitcoin. It might be worth keeping an eye on if you think crypto will bottom out soon.

In Case That Bright Spot Goes Dark

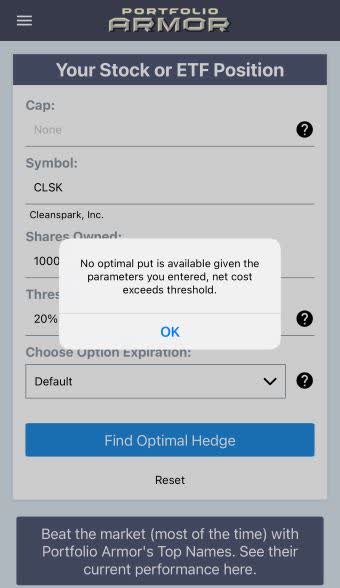

If you do buy Cleanspark, consider hedging it. As of Tuesday’s close, it was too expensive to hedge against a greater-than-20% decline over the next several months using optimal put options…

This and the subsequent screen captures are via the Portfolio Armor iPhone app.

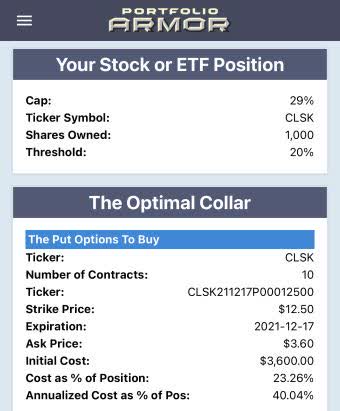

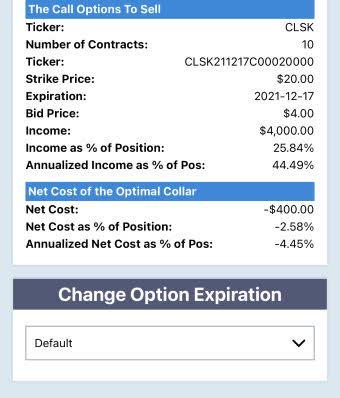

But it was possible to hedge CLSK against the same decline using an optimal collar, if you were willing to cap your possible upside at 29%.

There, the net cost was negative, meaning you would have collected a net credit of $400, or 2.58% of position value when opening that hedge. That’s assuming, to be conservative, that you placed both trades — buying the puts and selling the calls — at the worst ends of their respective spreads.

We used our default time to expiration there, which scans options expiring closest to six months out, but you could also try different times to expiration to see if you find a more attractive hedge.