Courtesy of Elliott Wave International, and used with permission:

Why We Are Watching 2021

The April Elliott Wave Theorist is a rare video issue on the outlook for three key market sectors – stocks, commodities and interest rates. Editor Robert Prechter delivered this presentation on January 18, 2021. Interest rates have followed the script by rising sharply, and they have more to go. Commodities gained since that time as well. The current price action in the stock market makes now a good time to keep in mind our timing work in that sector.

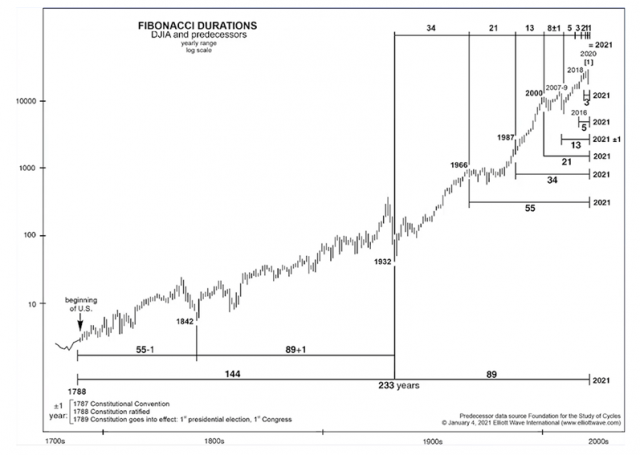

We’re going to look at a 200-plus year chart of U.S. stocks prices. The data is the Dow Industrial Average going back to the 1880s. Prior to that, it’s data from different indexes that newspapers and other sources kept back in the 1800s.

If you look to the bottom left, you’ll see that in 1788 the U.S. Constitution was ratified. In other words, that was the formation of the country. It’s 233 years, which is a Fibonacci number of years, from that year until 2021. Now, that really doesn’t mean very much except that we find it’s really the largest number involved in a whole web of Fibonacci numbers relating to the turning points in the U.S. stock market from its founding.

If you look at the top of the chart, you can see those very same turning years in the market give you a declining sequence from 34 years all the way down to 1. It’s a Fibonacci spiral that’s zeroing in on 2021.

EWI has given me the OK to share the full, 50-minute April Theorist, FREE. Click here and enter the code: SOH. Let me repeat that: it’s going to ask you for a code to look at it. Enter SOH.