Reddit “Apes” raise money for apes in Africa.

GameStop Pops After Hitting Our Top Ten

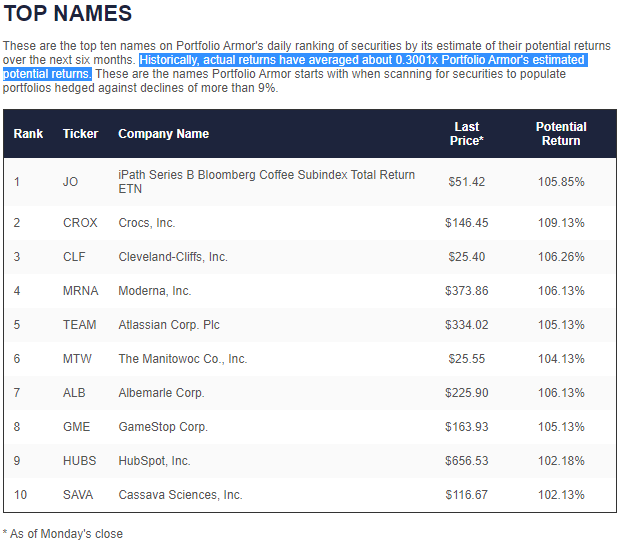

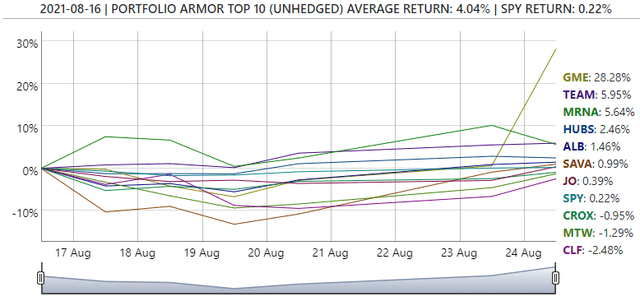

In a post last week (Out Of Afghanistan And Into GameStop) we wrote that GameStop (GME) had finally hit our top ten names, after pulling back 53% from its January peak. After noting how one of our subscribers had seen some overlap between our top names and popular Wall Street Bets stocks last fall, we pointed out that GameStop finally made our top ten on August 16th.

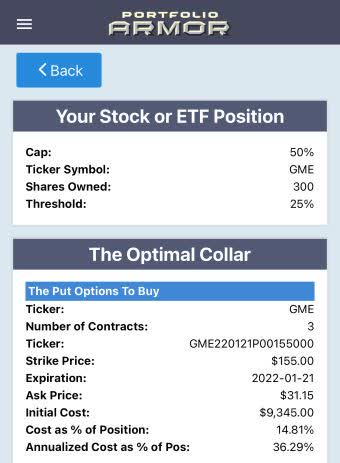

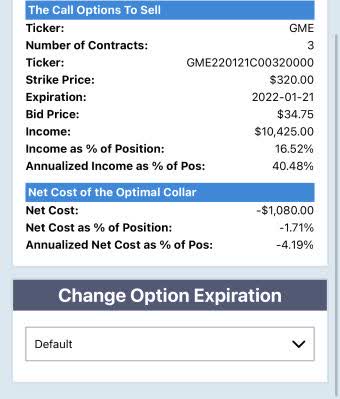

Screen capture via Portfolio Armor on 8/16/2021.

Since then, it was up 28% after Tuesday’s pop.

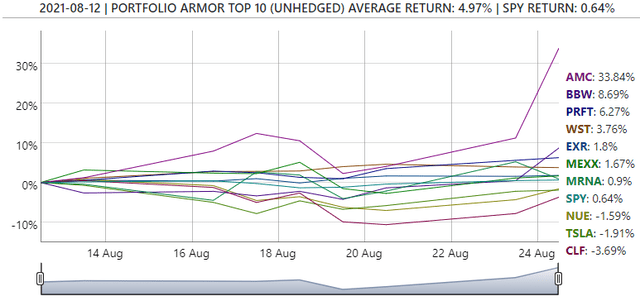

AMC Jumps Too

Another meme stock that made our top ten recently was AMC Entertainment Holdings. It jumped 20% on Tuesday. Since it hit our top names most recently on August 12th, it’s up nearly 34%.

The Meaning Of The Meme Stock Resurgence

We can speculate as to why AMC and GME jumped on Tuesday, but the short squeeze scenario from the beginning of this year likely isn’t as big a factor. AMC is at less than 17% short interest according to the most recent data, and GME is at less than 13%. Perhaps there’s a connection with crypto: maybe more apes had dry powder to buy call options on these stocks after cashing in some coins as Bitcoin got back to $50k earlier this week. For us, it brings to mind the new factor we wrote about recently (Tesla And The Quest For Alpha):

It’s possible that this factor will end up being cyclical; if so, we may be able to identify likely peaks and troughs and start using it near a trough and stop using it near a peak. But this year has been extraordinary in a few respects, from the peak in GameStop (GME) in January, to the peak in Bitcoin in April. Both are relevant to our new factor as it has selected both Bitcoin and meme stocks recently.

The spike in GameStop and AMC on Tuesday suggests that factor may have some alpha left in it. In the event, we’re wrong though, let’s look at a way you can hedge your bets on GameStop.

Hedging Your Bets On GameStop

Say you owned 300 shares of GameStop and wanted to stay long but lock in some gains after Tuesday’s move. This was a way of doing that. This was the optimal collar to hedge against a greater-than-25% drop in GameStop by late January while not capping your possible upside at less than 50% by then.

Screen captures via the Portfolio Armor iPhone App.

Here, the net cost was negative: you would have collected a net credit of $1,080, or 1.71% of position value, when opening this hedge. To be conservative, that was calculated assuming you placed both trades at the worst ends of their respective spreads, buying the puts at the ask, and selling the calls at the bid. In all likelihood, you would have gotten a larger net credit opening this collar on Tuesday.