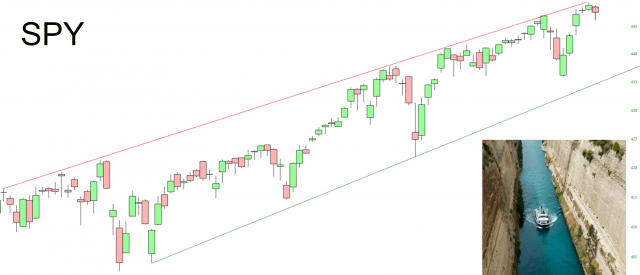

Stock market is at high risk, but…

The ‘but’ is the old saying “markets can remain [seemingly] irrational longer than you can remain solvent” if you fight a trend that is intact at any given point. Since March, 2020 that trend has been up.

Structurally Over-bullish

Below is a chart showing the 10 week exponential moving average of the Equity Put/Call ratio (CPCE) that we review periodically in NFTRH for a view of the structural over-bullish situation in stocks. I write structural because it has extended much longer than extremes in the CPCE have done at previous ‘bull killer’ danger points, after which risk was realized in the form of moderate to severe corrections.

The trend began logically enough at a ‘bear killer’ reading in the midst of max pandemic fear. We noted at the time that market participants were not just bearish, not just risk averse, but absolutely terrified. So the recipe is this: take 1 lump of terrified investors, add a heaping helping of the Fed’s money printing and voila, enjoy the taste of a slingshot rally that is very filling despite its inflationary odor.

(more…)