Good morning, everyone. I breathe another sigh of relief that I got out of my Friday October 15th puts yesterday morning. The rise in asset prices across the board over the past 22 hours has been steady.

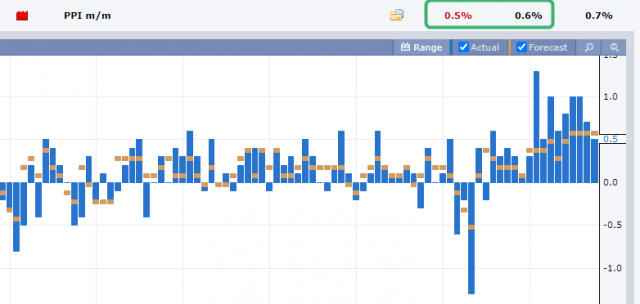

The hot report this morning was the PPI, and it actually came in a little softer than feared. A tenth of a percentage point isn’t going to make all inflation fears vanish, but it certainly doesn’t provide new fodder for the Inflation Is Raging crowd either.

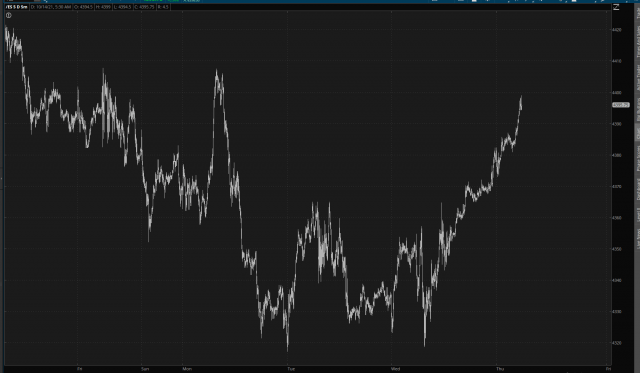

Let’s get back to that hearty rise in the /ES and, as we do, give it some context. There’s no doubt the past 24 hours have belonged to the briefly-beleaguered bulls. Looking at the 5 minute chart, instead of the 1 minute chart shown above, you can see this isn’t the first time we’ve had a powerful bounce, and for the moment, all we’ve done is craft another “lower high” (although it wouldn’t take much more strength to bust that series).

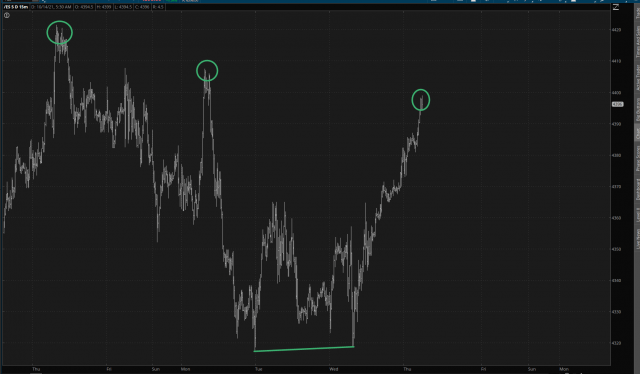

Here is a 15 minute bar chart to show that better. The lower highs are circled, which shows the bears still have a fighting chance. In the bulls’ favor I’ve pound out the “higher low” at the bottom, showing that even at the worst point of yesterday, it couldn’t even get below the prior day’s low, As I’m typing this, the results of the PPI seem to be not moving the needle at all. The ES was up about 42 before the report, and that’s about where it is at right now.

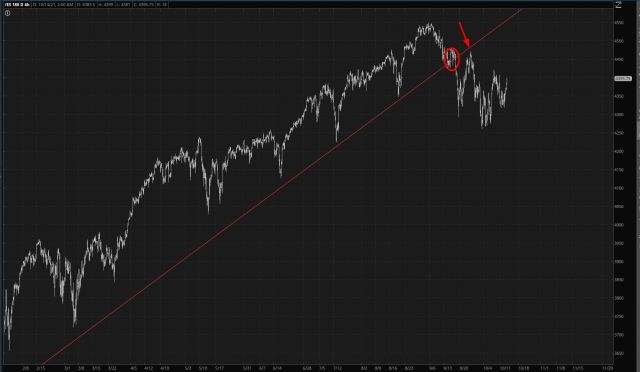

Stepping way, way back, however, you can see while not all hope is lost for the few ursine souls left out there. The trendline break (circled) is plain as day, and that trendline’s importance was affirmed at the nearly perfect touch-point that the big bounce established (arrow). It’s been an epic struggle since then. Over the next three weeks, there is going to be the usual tidal wave of earnings, which even in this wildly distorted market will at least have some influence over the market’s direction. And, of course, the persistent risk of exogeneous market surprises that seem to ebb and flow on an hourly basis lately.