I wanted to toot my own horn a bit – – God knows none of my subscribers are going to do it for me – – and reflect upon my recent Oh-my-God-accurate Tesla predictions to illustrate good old charting in action.

Let’s start off with this premium post that I did on November 5th. Pure and simple, I called a top. I didn’t hem and haw like some Elliott Wave goon. I didn’t say maybe it’ll go up, maybe it’ll go down, time will tell. I said it’s topped out. Not only that, I did so in the midst of the stock raging to levels never seen before. In retrospect, I called the top within literally a few trading hours from its absolutely top tick.

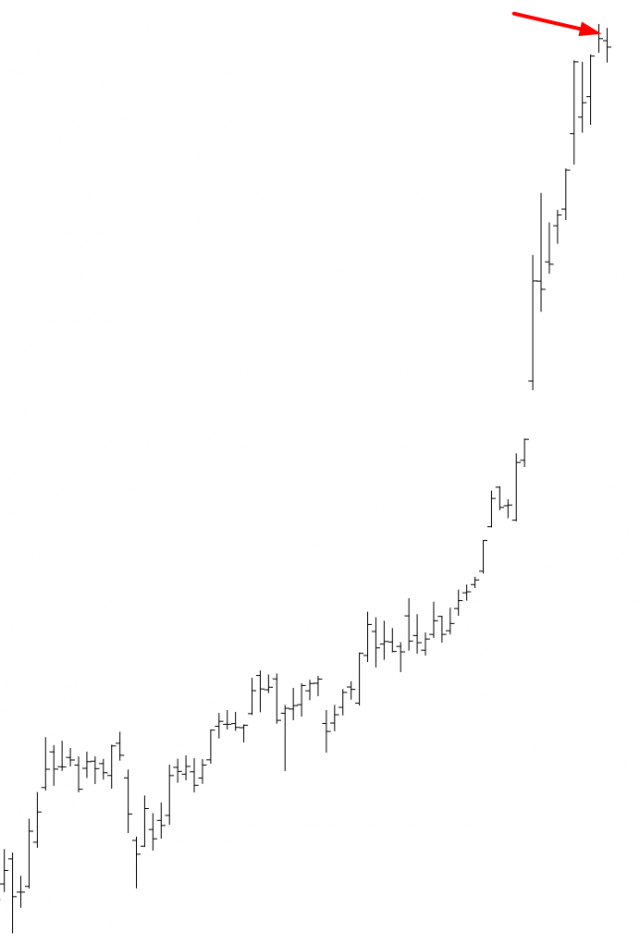

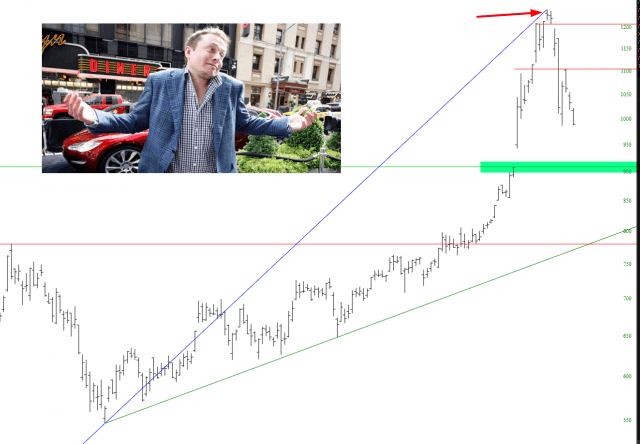

Just to show how bold – – some may say reckless – – this call was, I present to you the chart at the time. I challenge you to find anyone else on this planet on 7 billion people who made such a call. Just me. Just here on Slope. I called the top when everyone else was embracing the “base case” of TSLA going to $1800.

We all know what happened next.

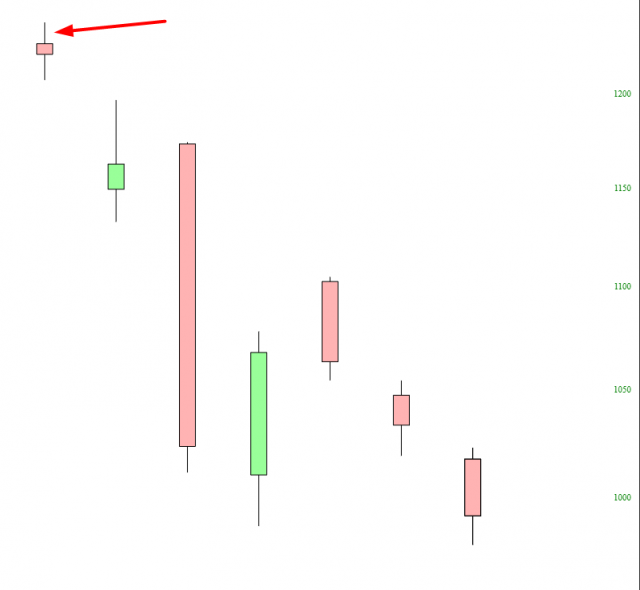

But there’s more to it. I didn’t stop there. During the free fall, I decided once again to stroll in front of freeway traffic On November 9th, I wrote another premium post plainly titled How High Will TSLA Bounce? Once again, I didn’t hem and haw Elliott Wave style and lay out eighty-seven different possibilities.

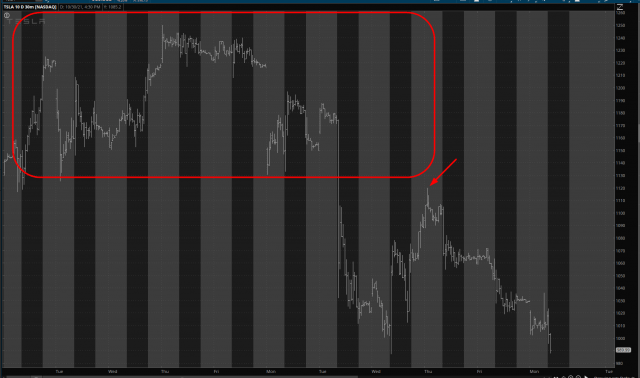

I called for it to rise to “$1135 or so” followed by “a resumption of the downdraft” and that would be followed by a fall to “its price gap at $910.” So there were actually three predictions rolled into one: a target price, a change in direction, and another target.

The stock did indeed rise to $1120 (certainly close to “$1132 or so”) and, as God intended, started falling again. As I am typing these words, TSLA is well below the psychologically-important $1,000 level. I say again – – although no one here agrees with me – – TSLA will never witness the highs we saw earlier this month.

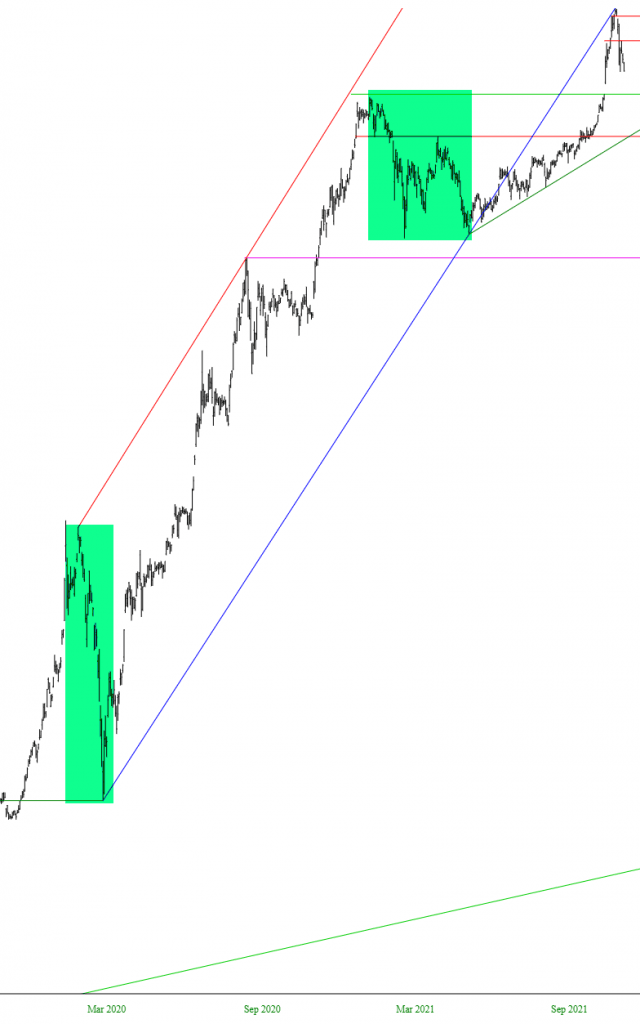

For perspective, here was my top call and the action which followed.

So I’ve made a total of 4 predictions, the first 3 of which transpired precisely as predicted, and the 4th is rapidly coming. Batting 1,000. Perfect calls. And in the throes of all this Nostradamus action, the feedback is has been along these lines………..

………and, regarding my second post idea………

Indeed, one premium subscriber wrote me this weekend to tell me what premium members REALLY wanted was actionable trading ideas.

AIEEEEEEEEEEEEEEEE!!!!!!!!

In any case, I’m actually kind of sad about TSLA’s demise, and Elon’s increasingly-bizarre and 7th-grade-mentality tweets.

You see, one of my beloved children owns a jaw-dropping sum of TSLA, and I certainly want his fortune to thrive and prosper. So at no time was I “talking my book” (or my boy’s book, more precisely) but instead was speaking as a pure-hearted chartist.

This is not the first time TSLA has had a wipeout in its stock price, of course. And I’m sure long-term Tesla bulls will be quick to point out that each of these wipeouts was merely followed by new lifetime highs.

I’m not so sure. The company’s whisper-thin profits are nothing more than carbon credit transfers mandated by the government. Were it not for federally-required payments to the company, it would have gone bankrupt years ago. I’d say 95% of the value of the company is in the form of Elon Musk, who has become the replacement for Steve Jobs. As his increasingly bizarre behavior continues, I think people are going to get really turned off by him. More importantly, as an entire planet full of very sophisticated car makers wanders in with their own EV offerings, it’s going to create an environment that TSLA hasn’t had to deal with before.

As for the stock price, I’ve only got one prediction standing, which is the path to $910. If I had strong feelings about what was coming after that, I’d express this (probably just to my paying members, not here). The “froth” has definitely been blown off the top of this beer mug, and with Elon’s fortune hit by more than 20%, he isn’t quite the shiny pebble on the beach that he was only two weeks ago.

Suffice it to say that when I feel strongly about an opportunity, I’ll lay it out for my premium members. This is not a market I trust. I think it’s utterly corrupt and contrived. Which is why, person-who-wrote-me-this-weekend, I haven’t been a firehose of trading ideas recently. I need to feel fairly confident that, in spite of this utterly laughable fraud of a market, that the risk/reward ratio is highly appealing. In TSLA’s case, it was. And I genuinely hope some of my premium members took the opportunity and profited from it.