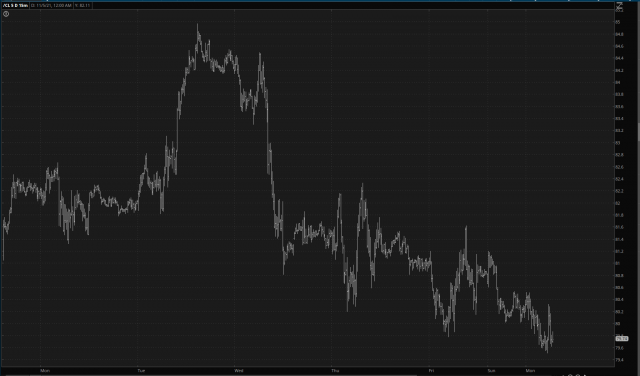

As we head toward a new week, it’s the Same Old, Same Old: green ES, green NQ, green RTY. My fixation remains on energy, however, which I believe has the most intriguing bearish prospects, and crude oil, bless it, is actually managing to be down 1.2% as I’m typing this, which in this environment is practically catastrophic:

Short-term, my view is that oil will continue to weaken, as represented here by USO, until it tags its supporting, ascending trendline. In other words, we’ve got a ways to go.

Long-term, I think prices are poised to move substantially lower. Only recently did we tag a major line of resistance, and although I cannot guess how long crude will go, the long-term trend certainly suggests that these overheated prices (which are yielding about $6/gallon signs at gas stations where I live) are going to crumble.