Happy New Week, everyone. Although the values of futures pre-market have become rather meaningless lately, I’ll mention as of this composition that the ES and RTY are green and the NQ is red. Nothing dramatic is happening, and the only scheduled event of any consequence this week is the CPI report pre-market on Friday.

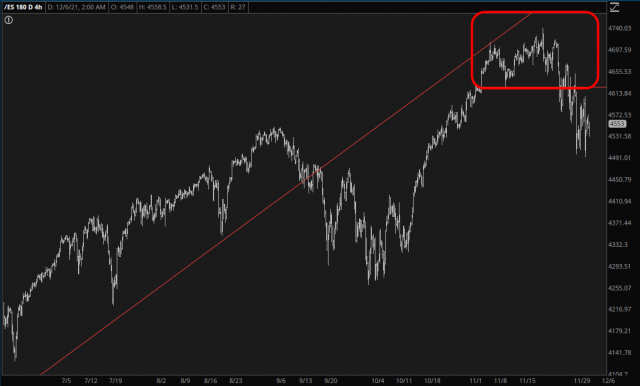

So the ES is indeed green, but for the past week, the market has been following a series of lower lows and lower highs. More importantly, it also completed a tidy little topping pattern which also just happens to be constructed beneath a broken uptrend. In other words, things are looking fairly well-positioned for the bears, in spite of these daily little exercises in green-i-tude from our bullish friends.

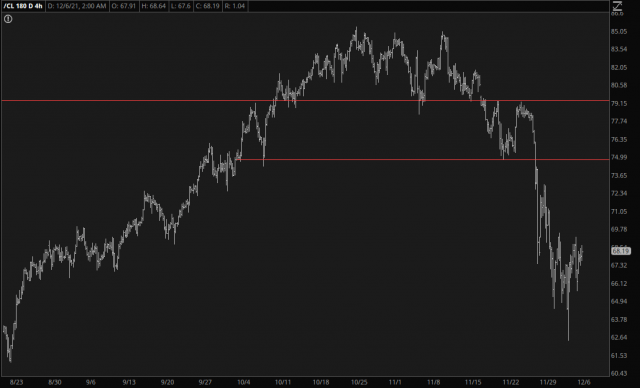

The energy bulls are getting some happiness, as the badly-oversold crude oil futures get bid up (they’re up over 3% as I’m typing this). This isn’t a surprise, although I hardly think this is the start of something bigger. On the contrary, this is a counter-trend rally – – the proverbial dead cat bounce – – in the context of a much more fundamental failure in the price. This will wear itself out soon enough and, I believe, take out recent lows in short order.

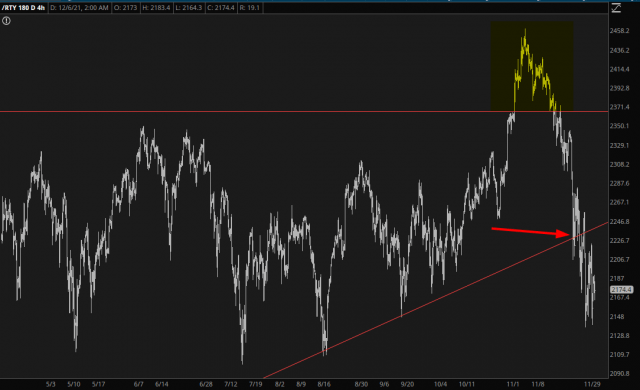

A few weeks ago, the small caps (Russell 2000, represented by the /RTY futures here) scared the bejesus out of me, but no longer. The hearty bullish breakout failed utterly (yellow tint) and was soon followed by a shattering of the uptrend (arrow). As with the market in general, a steady drumbeat of lower lows and lower highs has been thumping away.

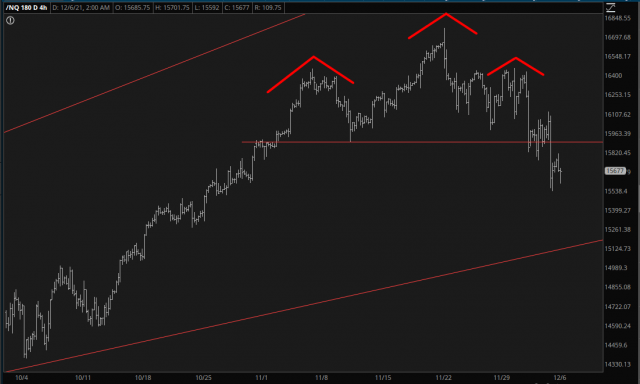

The chart I find especially engaging right now is the NASDAQ (NQ futures shown here). That’s a pretty spiffy little H&S topping pattern. The funny thing is that the market is only a few percent off its lifetime highs and is still insanely and madly overvalued. In the midst of that, everyone is scurrying around congratulating themselves on surviving this “bear market” and is preparing for new assaults to lifetime highs, principally compelled by Goldman Sachs’ endless calls for an end-of-year market meltup. I’m not so sure.