Of the many lines one can place on a chart, the objective is to help determine price movement – what is most likely to happen next – in an effort to execute a profitable trade.

Trend lines can be placed on a chart to show an uptrend or downtrend.

Horizontal lines can be placed based on high and low prices, on fibonacci retracement levels, and to note price gaps. Chart patterns, such as triangles, wedges and pennants, can be drawn by the chartist. All of these lines drawn are meant to offer support and resistance levels.

Whatever annotations we place on a chart they are an effort to assess the probabilities of a directional move in price. Assessing price action is based on maintaining or breaking support or resistance. Breaking support or resistance lines may well indicate a change of price direction [false breakouts notwithstanding].

Where chart lines are found is in the eye of the beholder. There are an infinite number of ways lines can be drawn. Charting is subjective.

The following charts illustrate the use trend lines, and for me, the magic of SlopeCharts makes charting a joy. The design of the system – how SlopeCharts can isolate a trend line – is unparalleled.

Say, no, to Bias.

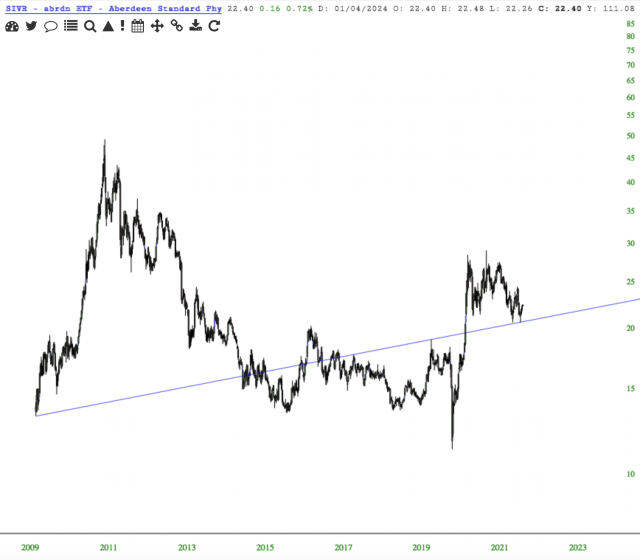

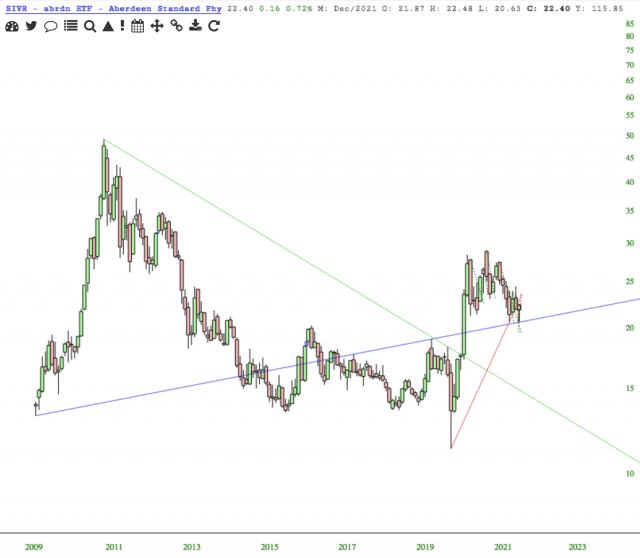

Using SIVR as sample, the first line drawn is linear regression. Regardless of which way one wants price to move, one best not argue with this line. Long term – bullish above, bearish below.

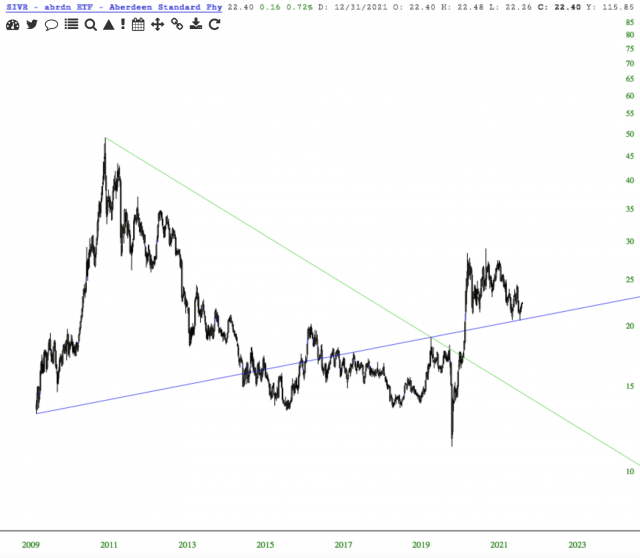

Charting the same symbol, the next line added shows a break in the down trend, offering an objective long entry.

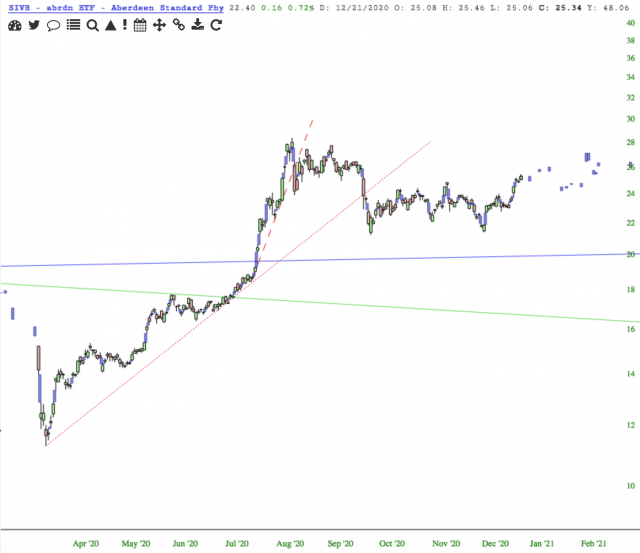

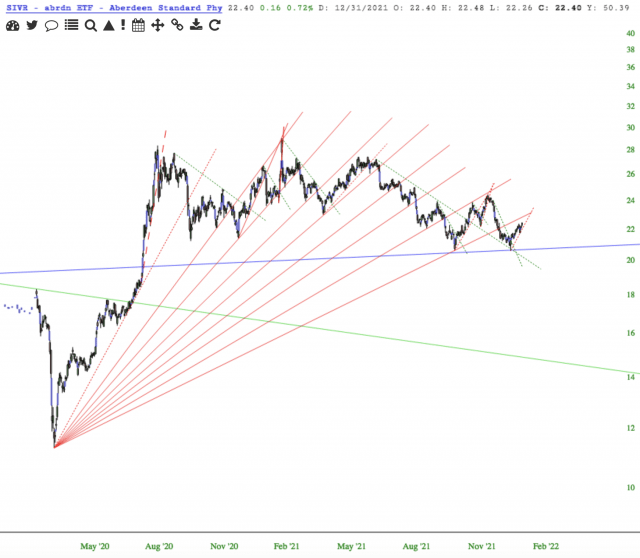

The next lines drawn seek to find where that long entry may fail. Dissecting price action on the shorter term.

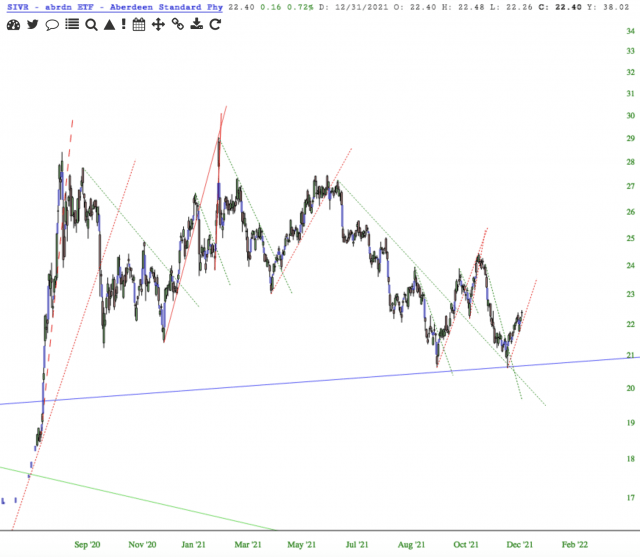

To further dissect price action, one can isolate many trend changes. Up.Down.Up.Down.Up.

This chart adds support lines all coming off of the 2020 low. The trend lines in the previous chart are more precise, but these trend lines could be used on their own, and moreover, give confirmation of the shorter term trend line breaks.

Looking again at the longer term picture, only the most recent short term support line remains plotted. Here’s the monthly.

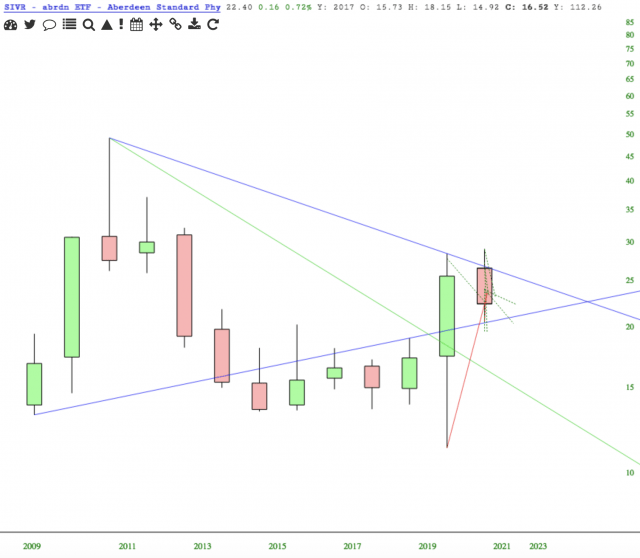

…then skipping to the yearly […with addition of the top down trend line.]

It’s a very interesting time for charting in that it is the end of the month, end of the quarter, and end of the year.

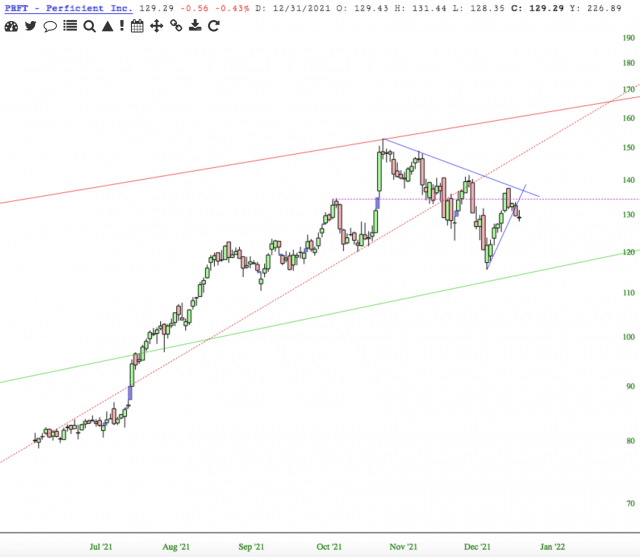

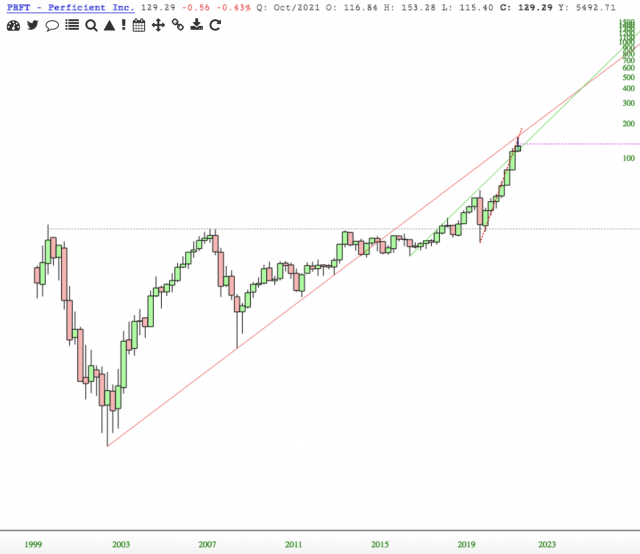

Here is the symbol PRFT to further illustrate charting my way. Looking first at the recent daily price action, it failed at the high and has had lower highs since.

Jumping to the quarterly chart, I’d warrant that the same three trend lines [as shown above], keep one in-the-know of price action.

Charting is a passion of mine and I have great fun with it. Have fun charting your way to profits.

Happy New Year ~ Happy Charting !