Since this is Inflation Week (and, in a way, I suspect every week for the next couple of years will be), all eyes were on this morning’s PPI number. As I am typing these words, the actual figures were just released, and it’s a scorcher.

The prior month was 0.8%. The expectation was 1.1%. The actual number (which, let’s please keep in mind, is heavily discounted from reality since the government has a vested interest in keeping it low) is 1.4%, which annualizes out to 16.8%. So, in fact, we’re probably in a 30% inflationary environment right now, thanks to the bumbling, criminal Federal Reserve.

It’s way too early to say what this will mean to equities (I mean, good Lord, look at what happened yesterday). Overnight, the /ES rallied (as usual, for no particular reason) over sixty points, but things got bumpy, and at this very moment, it’s essentially flat.

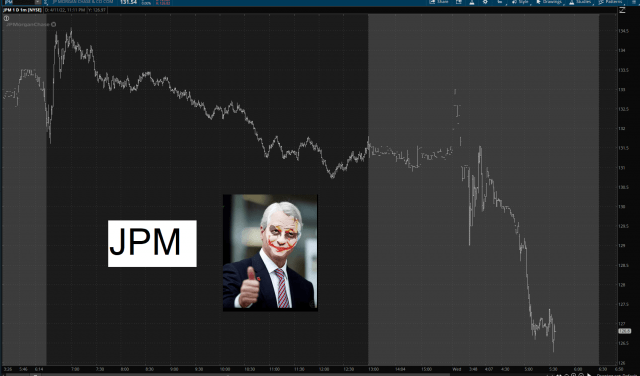

We’re tip-toeing our way into the earnings season, and as usual, the banks are the first to come out with their numbers. JP Morgan is the belle of the ball this morning, and they’re not exactly tearing up the dance floor.

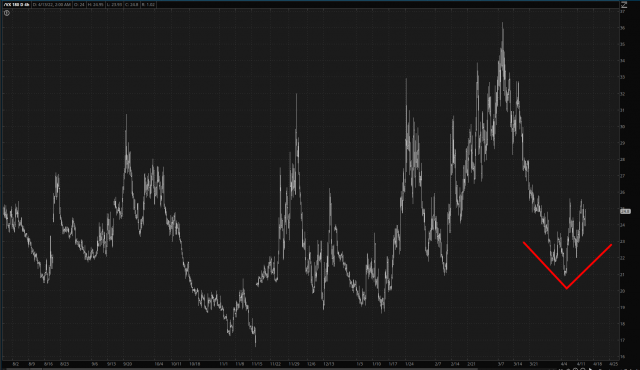

What I find most interesting is the /VX (volatility) futures. Please note the chart below is on a much larger time scale than those above. Even though it feels like things are getting frisky again, we are, in fact, absolutely in the swamp with respect to volatility. Putting it another way, we’re far more poised for a equity wipe-out, and corresponding /VX explosion, than we are a calming of the nerves.

I’m entering the day with some buying power (which is a bit of a misnomer, since it’s just buying-puts power). I’ve got 14% of my portfolio in cash and 27 live positions with an average expiration 105 days from now. Just two trading days left this week, folks, so let’s make ’em count.