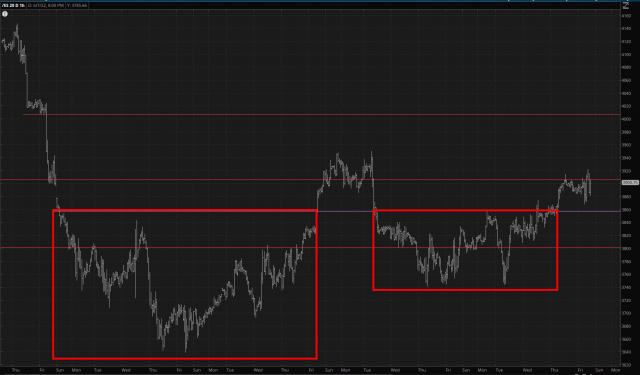

I’m going to briefly set aside my griping about how incredibly annoying today’s market action is and put on my bullish cap for a moment. Let’s take a look at the /ES futures over the past month:

I can say some bullish things about this action.

- There are two bullish base patterns;

- The more recent one is higher than the prior one, which shows improving price strength;

- In spite of ample reasons to go lower, the market stopped falling a full three weeks ago

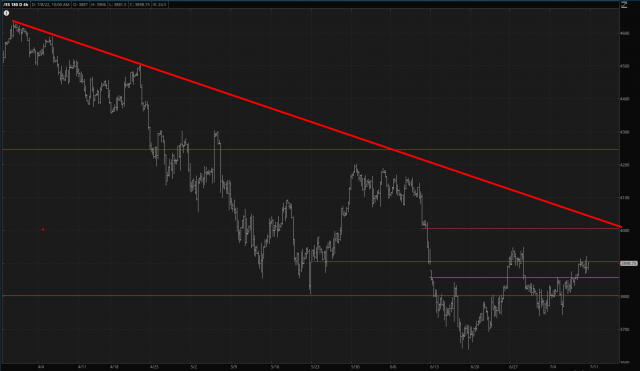

The SPY has a price gap at 401.44 which has never been closed. We have been up EVERY DAY in the market this week, and if this positivity continues, particularly if the market embraces some inflation-isn’t-so-bad news next week, I could easily see the oft-quoted price of 4,000 being achieved. Indeed, we might get as high as the aforementioned gap. Such a move would tag the descending trendline quite nicely.

To be clear, I’d prefer NONE of this happen, but the fact is that neither the assassination of the prime minister of Japan nor a very bearish jobs report have created any sustainable selling (as I’m typing this, the /ES is literally UNCHANGED) so maybe the 99.99999999999% of the public which is steadfastly bullish is getting their gumption back. It’s a big pain in my ass, but that’s where things stand.