Well, it’s been a great morning so far. I had a really sad “one that got away” however – – the Dow Utilities fund, symbol XLU. It look absolutely juicy for a massive put position. The bid/ask was 4.45 by 5.00, and I figured I could get in at, let’s say, 4.60 or so. Nope. The market moved quickly, and the whole thing got away from me. Oh, well.

My energy bearishness is serving me well, though. Out of eight billion people on this planet, just two of them – – Mr. T.N. Revolution and Mr. Timothy Knight – – were energy bears, and it’s just been one failed breakout after another. It’s hilarious that there’s still articles out there – from this very weekend! – talking about $380 oil. Come on, people. Oil is heading into the drop zone. The peak has long passed.

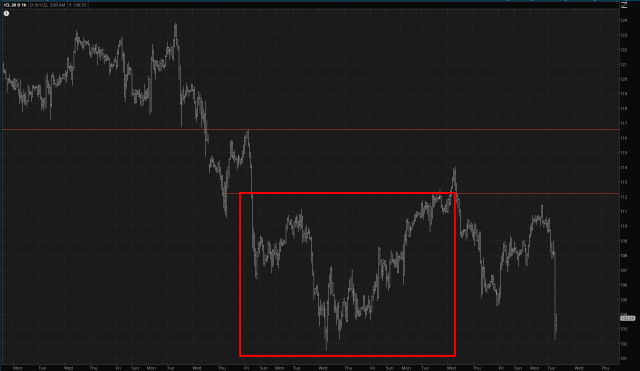

Even recently, crude oil tried its best to break out. It completed a semi-decent pattern, but honest to God, every time I’ve seen one of these, I think to myself “it won’t last” And it never does.

This is going to sound like a humblebrag, but honestly, I don’t mean this to sound as douchey as it does – – but the problem is I’ve got WAY too much money. More specifically, I am NOT willing to put huge bets on. I am neck-deep in cash, and I moved a buttload of it into my brokerage account on Friday……….and it’s sitting there, collecting dust.

This is thirteen years of trauma rearing its head. After all the bullshit the Fed has shoved down my throat since 2008, I just can’t bring myself to really push my chips forward, so I’ve got a Himalayan Mountain Range of buying power that I simply don’t want to deploy.

Feh. I’m going to go through my Bear Pen and see if I can find a few more entries I’m willing to make. I am simply not feeling the mojo that I should be feeling after waiting for this opportunity.