Good morning, beloved Slopers. And I say good morning since the /ES isn’t up 300 points right now. But, honestly, just think of how much has changed in a single week’s time. Last week, at precisely the moment I am typing these words, the market was in a total free-fall thanks for the white-hot inflation numbers that that had just tumbled out. Since that time, evidently, ALL the problems that had caused market weakness all year long have been totally solved, and Mr. Jason Goepfert (and, come on, let’s face it, Knight is such a better name) declares the following for the world of Wall Street Shills and Permabulls:

In case you’re wondering what the asterisk is for, it’s his C.Y.A. declaration that he might be wrong. I’ve got to say, the criteria he lays out seem AWFULLY specific.

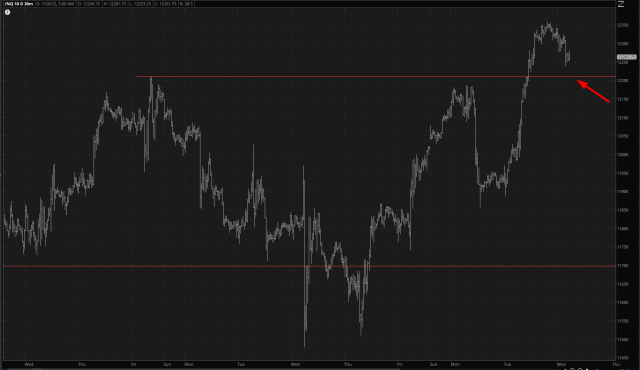

The bulls indeed broke the curse of the “lower highs” yesterday by besting the horizontal drawn below, although at this moment it’s stumbling a bit on the /ES.

The /NQ is holding above its breakout, albeit tenuously. We’ll see.

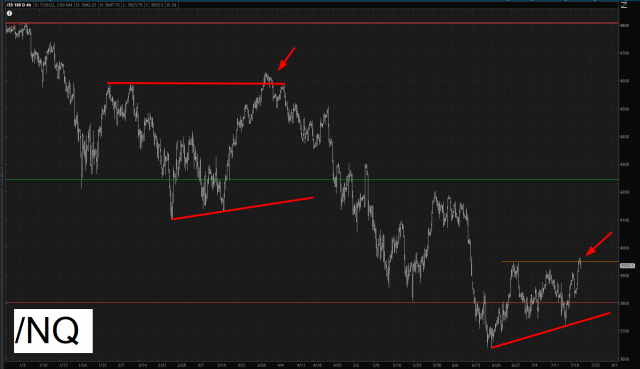

It’s an interesting face-off right now between the bearish reversal pattern (in red) and the larger, more recent bullish right triangle base (green). I’ve never played, or even watched, football, but I think this is called the line of scrimmage.

For the one or two bears still alive out there (and that is probably a high estimate), allow me to offer a couple of flickers of hope. First of all, kindly note of the identical setup on the /NQ based on a shockingly similar pattern earlier this year. It was the same deal: a hearty push higher by the bulls, a breakout, and then barf-o-rama.

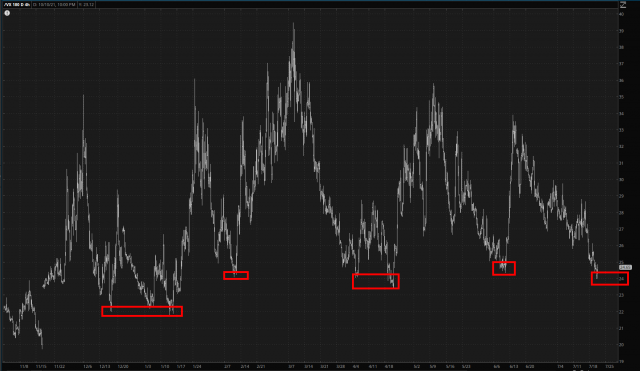

I would also add that, going all the way back to the tippy-tippy-top of the entire market last November, the /VX has been beaten senseless to levels that are typically as low as they go.

And, in defense of Mr. Goepfert (hoo boy……….) he modestly states the following, which is a sentiment to which I certainly must associated myself as well.