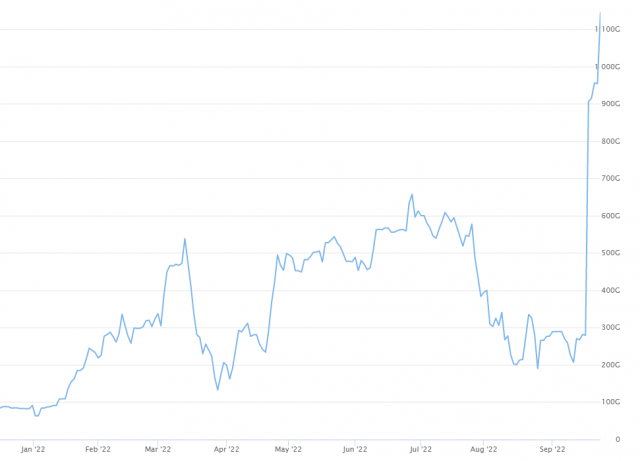

I am delighted to announce that I am at a new portfolio high for the year. This has been a brutal struggle. My last “peak” was early in July, and I subsequently saw my profits get utterly and totally vaporized. I cannot tell you what that feels like, but it sucks. Thus, through sheer tyranny of will, and great charting, I have climbed to the peak of the mountain again. I was filled with so much shame about my fumble this year that I didn’t even talk about it, except privately with Baby Bear. Now the truth is out.

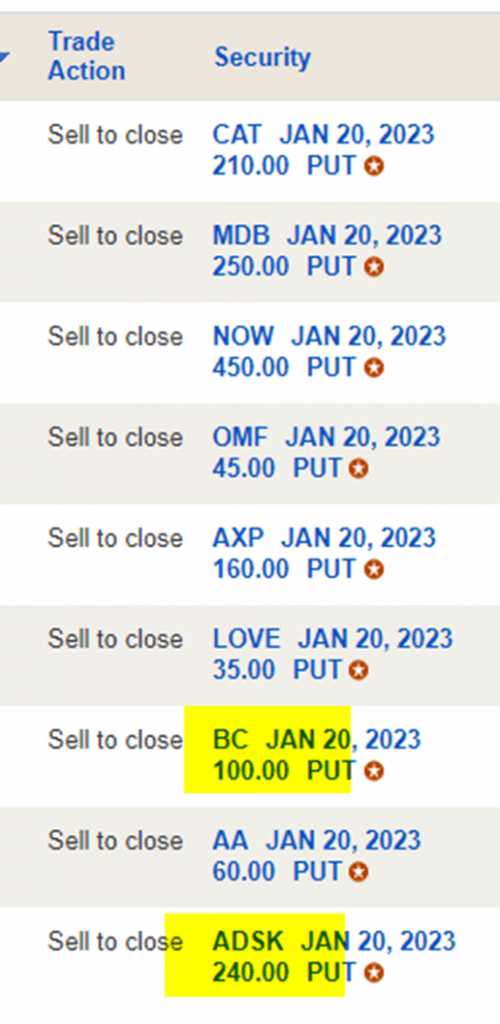

Although it defies every instinct I’ve got, I have forced myself, kicking and screaming, to ease back some. Cash is boring, but at least it doesn’t get vaporized (well, let’s not go there). Here are the executions (I’ve tinted items where I am TOTALLY out; the rest are just trims).

And, hey, my virtual portfolio is at about $1.3 trillion, so I’m just going to take care of the national debt all by myself!

As of this moment, my portfolio is as follows:

- 34 positions, all bearish;

- 32 of them January 2023 puts; 1 of them March 2023 puts (CBRL); 1 of them November 2022 (XLP);

- 100% of them deeply profitable and deeply in the money;

- 15.2% cash, which I would be delighted to deploy if we ever get a bounce.

I have extremely mixed emotions right now. I shall thank the trading gods above, and Slopers around the world, for allowing this victory to take place.