Two Approaches To Handling Volatility

In the hedged portfolios constructed by the Portfolio Armor website, each security is hedged; the core strategy we’re using on our Substack is designed for smaller accounts, where hedging each security may not be practical, so we’re using trailing stops on individual positions while hedging market risk. Here’s a look at how hedging worked with one volatile asset class: natural gas.

Long And Short Natural Gas

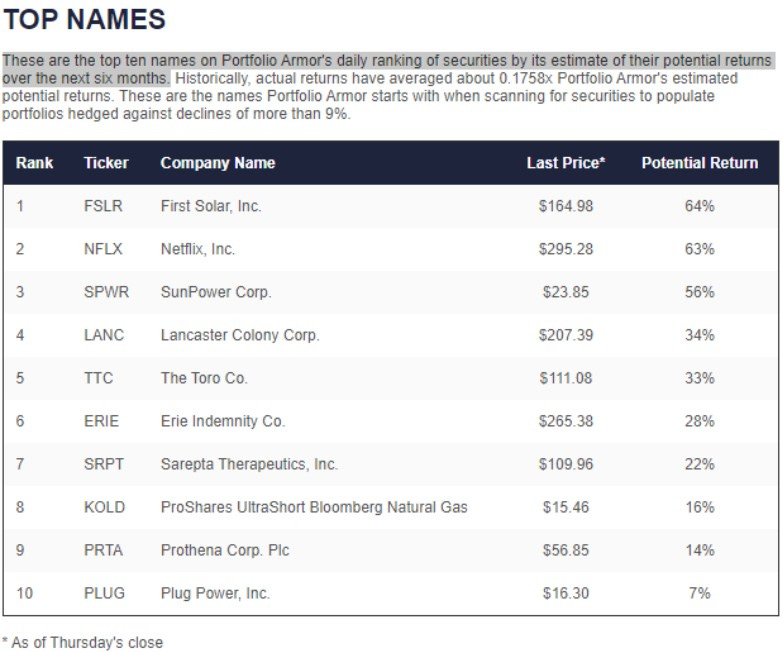

Both long and short natural gas ETFs have appeared in our top names over the last several months. The ProShares UltraShort Bloomberg Natural Gas ETF (KOLD) was one of our top ten names in mid-November.

Screen capture via Portfolio Armor on 11/17/2022.

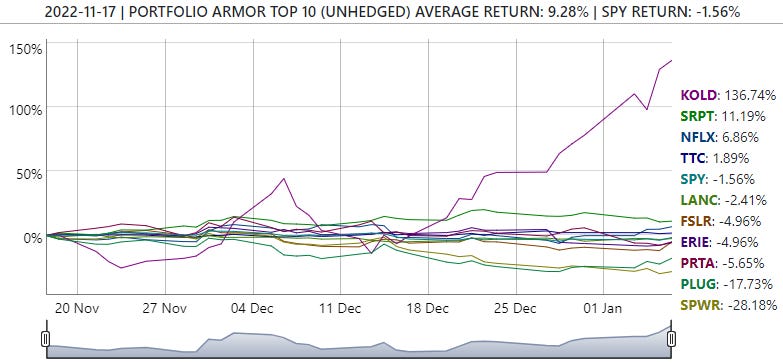

Since then, KOLD is up more than 136% as of Friday’s close.

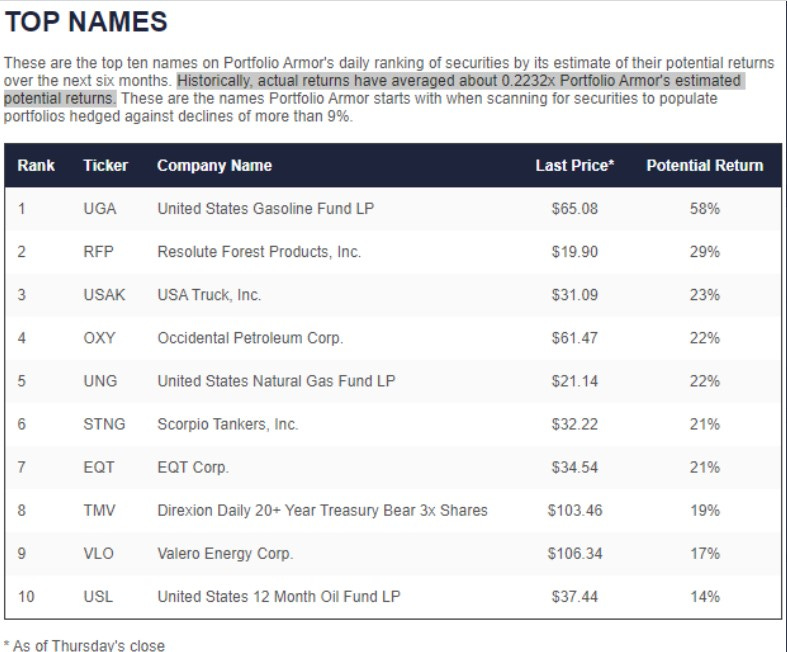

But the long ETF United States Natural Gas Fund (UNG) was one of our top ten names a few months earlier, on July 7th.

Since then, UNG is down nearly 44%.

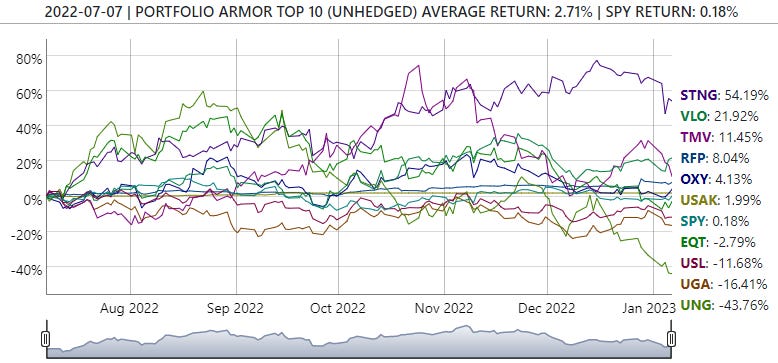

On average, those top ten names from July 7th are down 2.71%, but as you’ll see below, a hedged portfolio constructed from several of those names, including UNG, generated better returns.

How Hedging Can Improve Returns

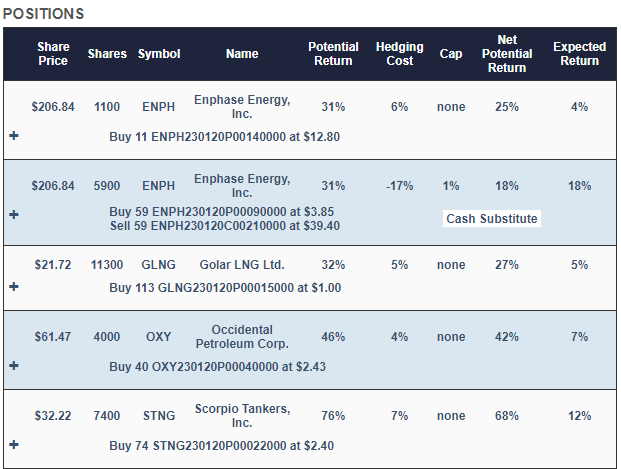

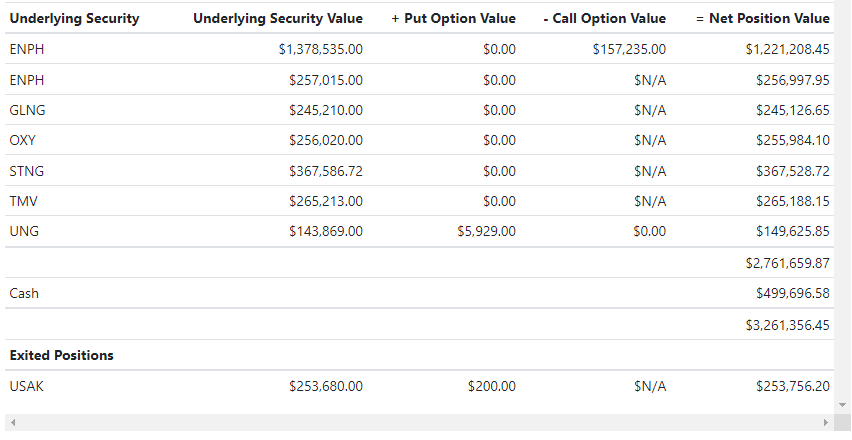

This was an aggressive hedged portfolio created by our site on July 7th, starting with our top names on that date.

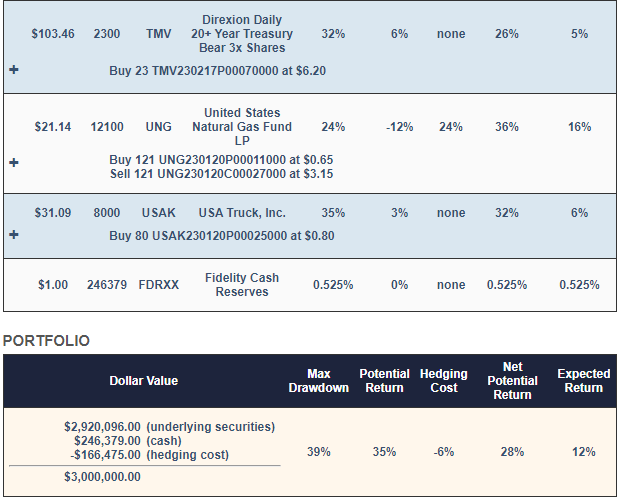

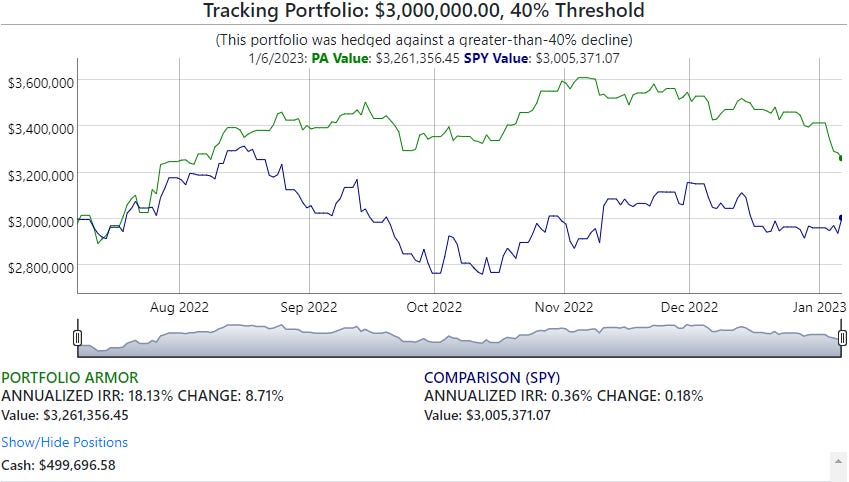

And here’s how that hedged portfolio performed as of Friday’s close: up 8.71%, net of hedging and trading costs, while the market-tracking SPDR S&P 500 Trust ETF (SPY) was essentially flat (up 0.18%).

By clipping off the left hand tail negative returns, hedging enabled the portfolio to generate a decent return despite natural gas tanking while it held UNG.