Good morning, Slopers, one and all. We start the pre-market off a little in the red, with all the stock futures down just a touch (about one-fifth of a percent; whoop-de-freakin’-do). The market continues to feel directionless, still gasping for breath on the heels of its Mag-7-Driven 2023.

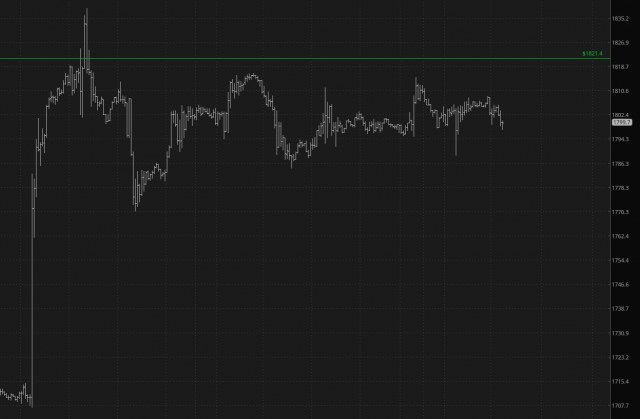

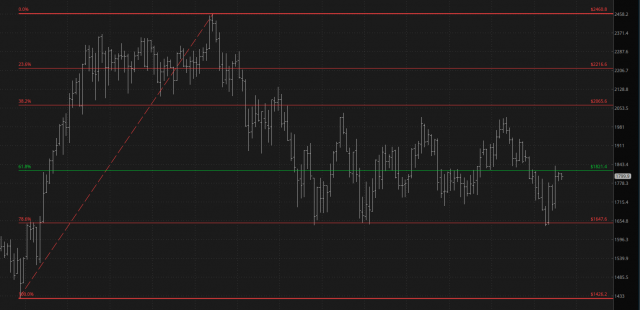

The /RTY has, following its rocket-ship boost to the Fibonacci shown in green, been absolutely pinned there. It’s like a weekend that never ends.

I shouldn’t complain, though. If we can manage to stay below that green line and, by Jove, start slipping, we can break the range-bound pattern that has been in place for literally years. That is to say, we can avoid the 4th, yes, 4th, trip to the next Fib level higher.

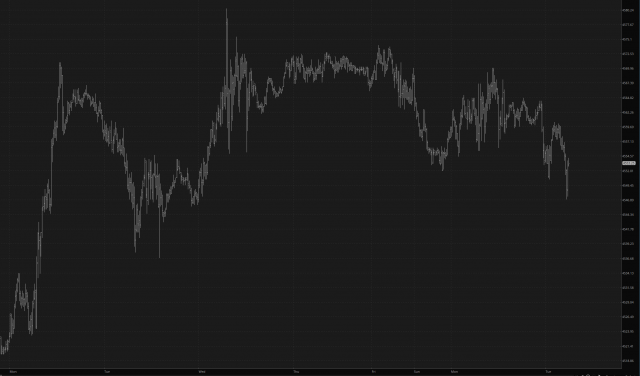

One non-price-chart caught my eye this morning, which illustrates just how zesty, shall we say, the U.S. market has been compared to the rest of the world. At this point, I’m starting to run out of adjectives to describe how preposterous the entire situation is. As I look at this graph, the words, “Because the U.S. is so strong economically and has such a bright future ahead” do not leap to mind, or at least not in that order.

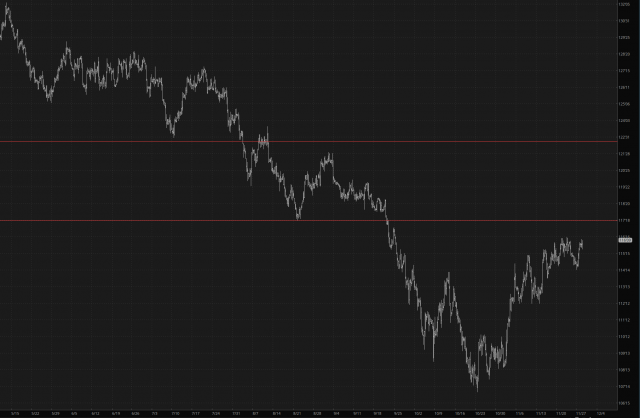

In closing, someone please the bond market a memorandum about turning away from its own resistance point. It’s kind of like we’re all just marking time until the year is over, hanging out at these levels and barely budging. Something has to shake the market loose, and it’s impossible to know just when and what that will be. In the meantime, I’m going to keep slipping the expirations of my positions forward.