Welcome back from the long Thanksgiving break, everyone! The rest of 2023 is simple: four solid weeks of uninterrupted trading, and then a final chunk (26, 27, 28, 29) of what I suspect will be very diminished holiday-style trading. So there’s not much of this not-my-favorite-year left to go.

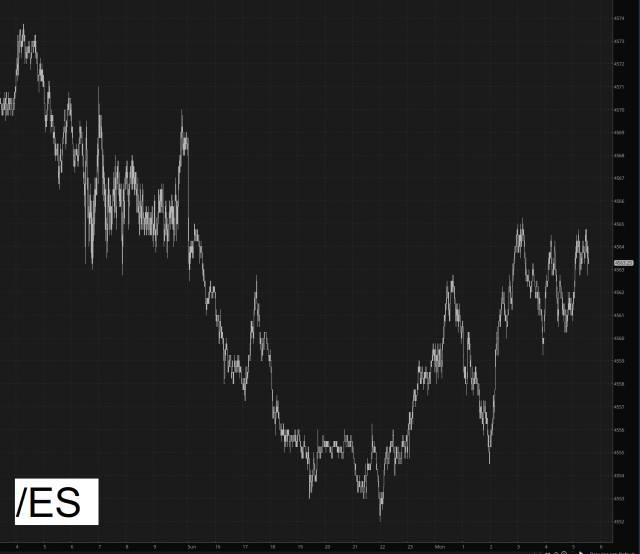

In very 2023 fashion, the markets were all down hard last night and spent the past seven hours climbing back up. Equities are still down, but only a little, so as the /ES, which has inched down a very believable 0.13%.

Crude oil, too, has recovered for No Particular Reason, although it is still managing to be weaker by almost a full percent.

My ingenious plan to go Gartman on Bitcoin worked brilliantly, as the /BTC futures have shaved off $2,000 in just the past few trading days.

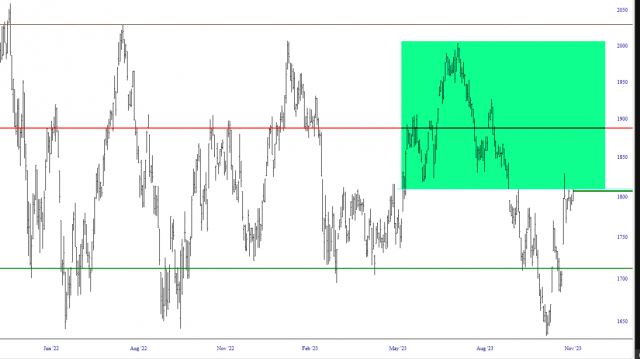

The Russell 2000 cash index illustrates the balance of 2023 quite nicely. Take note of that green tint. It will, I believe, serve one of two possible roles: it will either finally prove to be meaningful resistance in the form of overhead supply, meaning we’re dumb climbing or, as it did the prior two occasions, it will be beckon with a siren song for equities to push to the top of the range before, yet again, yielding to common sense and starting a multi-month sell-off. I’m so cynical about this damned year that I am inclined to believe the latter, but hope springs eternal in the bearish breast.