As I mentioned in my final post yesterday, the 17 hours spanning Thursday’s close and Friday’s open are going to be HUGE, with

- AAPL earnings;

- META earnings;

- AMZN earnings;

- The unemployment report

So, ironically, Thursday’s trading day is going to be pretty much the act of waiting around and looking at one another.

Following yesterday’s insane spasm, the equity markets have been slowly trying to heal themselves overnight, as required by federal law. Hopefully this is just them catching their breath before they get struck across the skull again.

The longer-term /ES shows the spasm in context, which permitted the completion of a not-at-all-bad short-term topping pattern at the failure point shown. We need to stay below that green line.

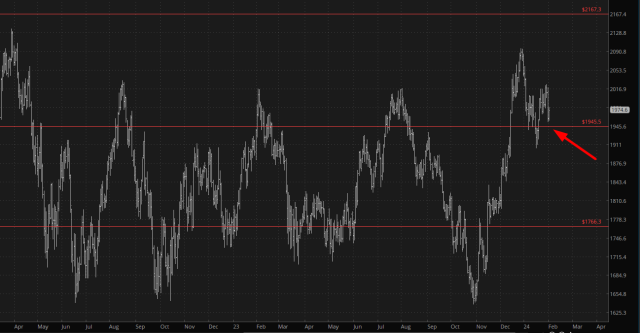

Longer-term still, below is the /RTY, which has spent years grinding around in a fairly predictable cycle. What’s important at this point, for the two remaining bears on the entire Earth, is for the Fibonacci to fail again (red arrow……….obviously). It’ll take something big to make that happen.

I am basically out of dry powder at this point, so I am in place with five positions – – all of them Long Put bearish positions, as follows:

- EEM April $39

- IWM April $200

- XLU Mar $66 puts

- XOP March $140

- XRT April $75