Things have changed very swiftly. Just seven days ago, it looked like this market would just go to 100,000 on the Dow without interruption, and all hope would be lost. As it is now, I think the price action forthcoming is going to make Tom Lee’s mascara run. It’s delicious.

We are really getting deep into the earnings season, and it’s starting to occur to folks that going $36 trillion in debt just to create 2% growth in the GDP maybe isn’t a great idea. The nation’s finances are on an unstoppable journey to disaster, and once the numbskulls “trading” out there realize how utterly screwed we all are, the selling is going to get absolutely manic (until the next criminal scheme by Yellen, of course).

For the moment, I’d say the /NQ looks splendidly vulnerable to a hard fall. Every single bearish position I’ve got is deeply profitable, with some having crossed into triple-digit-gain territory.

I continue to be bearish semiconductors, since my view is that this AI scam has been one of the greatest hoodwinks in financial history, beating even the crypto scam. I continue to hold puts against SMH, MU, and NVDA.

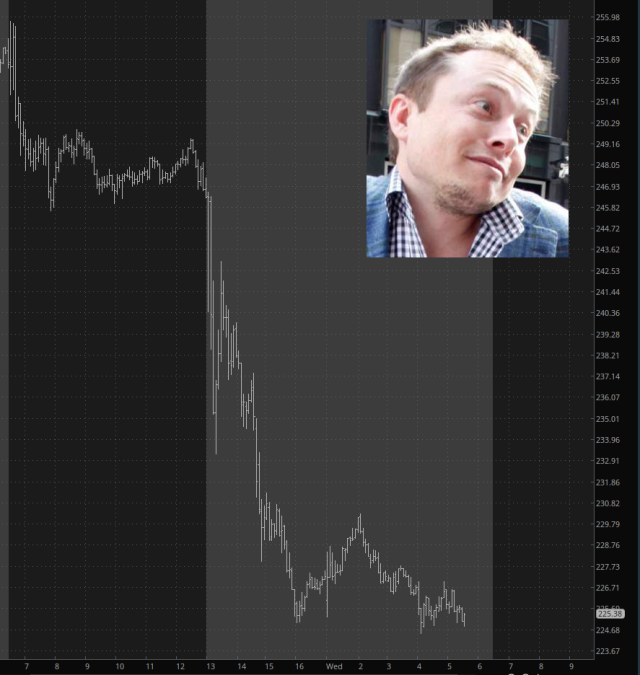

As for TSLA, it’s doing precisely what I thought, which is exhaust itself at the triple Fibonaccis and head toward its gap at $213. Beyond my charting, an intuition yesterday compelled me to instruct a certain beloved son into dumping a certain shitload of stock before earnings. And why? Because a certain richest man in the world had acted like a total dink over the weekend, and I figured something was up. I was right.

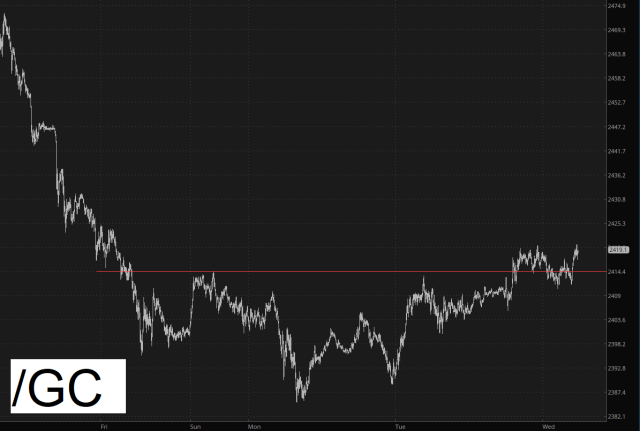

The only twinkle in my eye I’ve got on the long side, not that it needs repeating, is precious metals. My entire strategy is Long Precious/Short Stocks. That’s it. That’s the whole schmear.