As traders we are told to check our emotions at the door and just trade what we see. The faster we conquer fear, greed, and all the other destructive emotions that befall our fragile human condition the better traders we will be. And normally I fully agree with that sentiment. However, there are the very rare instances where emotion is the best indicator above all other market signals.

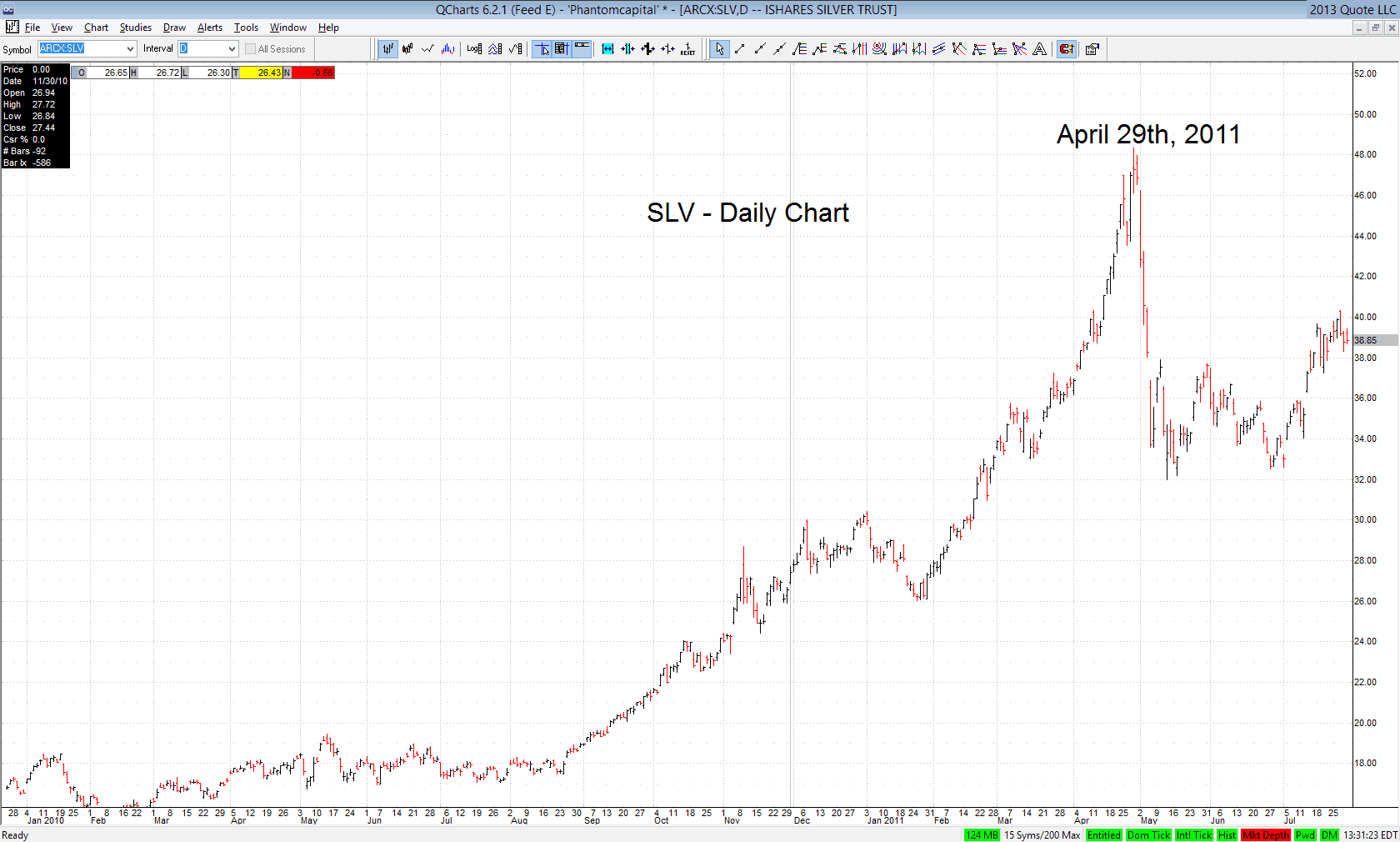

I’d like to tell a personal story. Two years ago to the month I went to war with silver. I had been watching silver go up EVERY SINGLE DAY and it was driving me nuts. To make matters worse my neighbor at the time ran a precious metal business and was borderline unbearable as shiny things marched higher and higher. The concept of precious metals ever going down again was unfathomable. I nibbled short and got hit several times. Come the end of April 2011, I was absolutely FURIOUS with the silver market. Shorting silver now became personal on many levels. I remember very few specific trading days of my career but I vividly remember April 29th, 2011.

April 29th, 2011 was a Friday and after the market closed I went for a run on the beach. Halfway into my run I realized that I couldn’t live with myself if I wasn’t short silver as it neared $50/oz. I literally sprinted home and bought as much ZSL after hours as I could possibly carry. I had suffered over a month of psychological torture thinking I was the only idiot that saw a bubble in silver. Bottom line, I hit the point that I’d rather lose money shorting silver again than miss out on a potential huge drop. The next week silver dropped 25%.

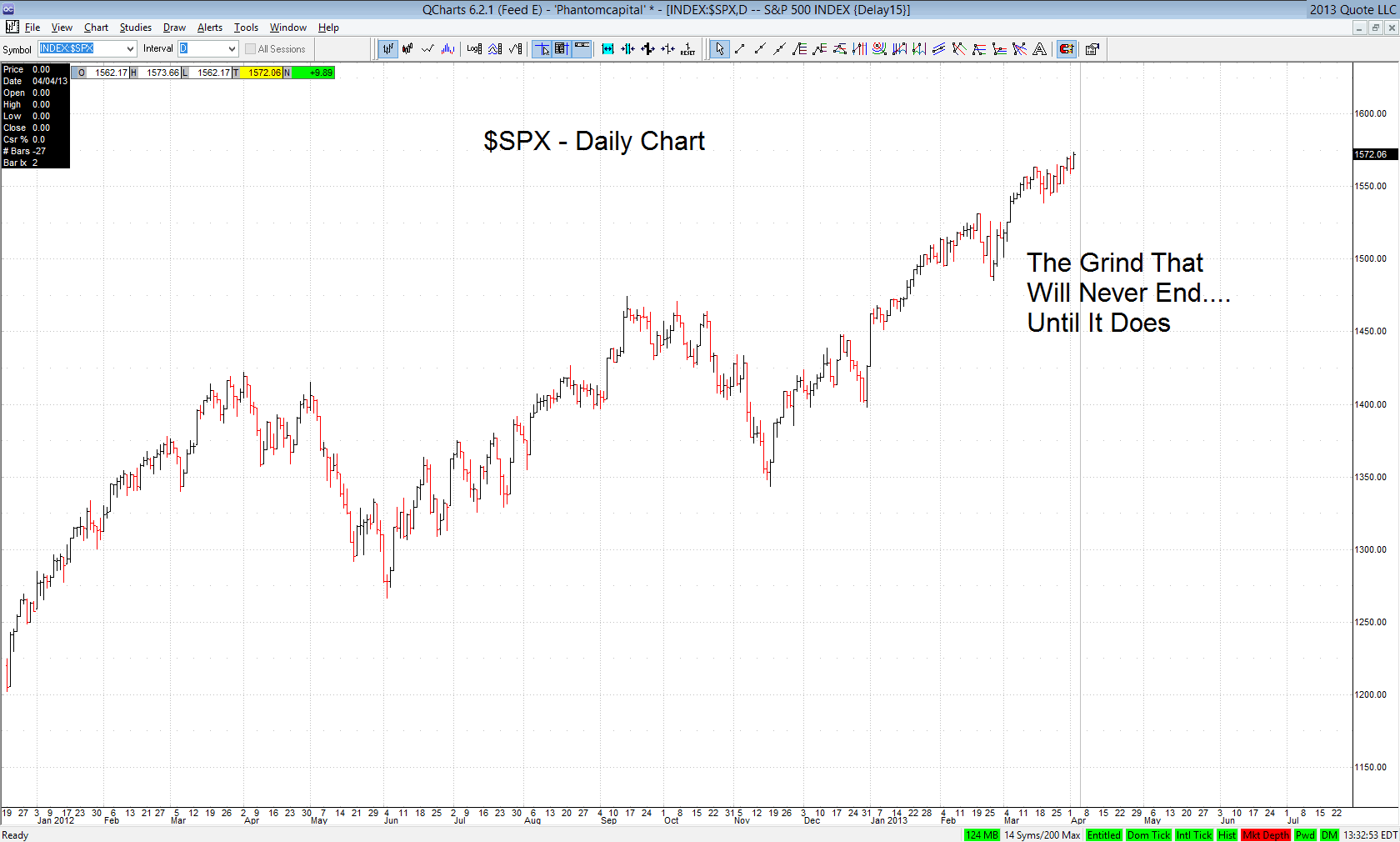

So now we are faced with the S&P never going down. Sure, its been doing this for now three full months. But for the first time in two years I’m absolutely furious with the market. Shorting the S&P is now personal to me. And again I’ve hit the point where I’d rather lose money than not be short and miss out on a major drop. I’ve done my analysis (not even worth sharing as it will just be shouted down) and I’m short via May SPY puts. And I’m not selling the position no matter how much it hurts as the bulls grind it higher. Markets drop significantly faster than they climb, I bought time, and I want to have a front row seat to the bloodbath.

So that’s how emotion can be helpful to a trader. Sometimes the pain is so great when dealing with a one way market that its actually the best indicator to fade the direction. Call it being fearful when others are greedy, call it being an idiot, call it what you want. I’m short and will remain so. Period. Respectfully, phantomcapital.